Opinion: NYU investors must commit to sustainability

From divesting to uplifting clean energy initiatives, NYU’s board of trustees must increase the sustainability and transparency of their investment decisions.

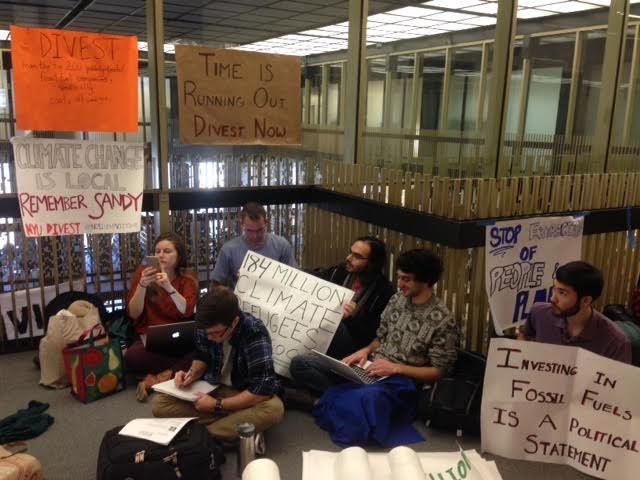

NYU Divest members sit in on the 12th floor of Bobst Library waiting to confront university administrators in 2015. (Photo by Lexi Faunce)

February 2, 2022

In 2015, NYU’s student body led an “NYU Divest” campaign urging the administration and board of trustees to stop investing the university’s endowment in fossil fuels. Prompted by a student group sit-in, the administration met in February of 2016 to discuss divestment. After their meeting, they concluded that removing investments in fossil fuels, or “divesting,” was not the proper action to take, as they “do not support NYU using its endowment as a tool for simply making statements.”

As the vice chair of NYU’s board of trustees Larry Fink, CEO of BlackRock Inc., an investment firm with a value of over $100 billion in oil, gas and coal investments, puts it, “Stakeholder capitalism is not about politics. It’s not ‘woke.’ It is capitalism.”

While it’s true that the activity of the investment does not go away in divestment, that has never been the point. The point is to de-legitimize the fossil fuel sector

By refusing to divest, NYU continues to support firms that emit large quantities of greenhouse gases, and therefore some of the primary contributors to global warming. Even if we have solar panels on our roofs, even if we have electric or hybrid cars, the economy continues to depend on fossil fuels. We know we need to pressure companies such as BlackRock to adopt science-based targets for reducing their greenhouse gas emissions in order for the global temperature rise to stay below 1.5 degrees Celsius. That is going to take time, but the environmental clock is running out.

Several studies agree that there needs to be roughly 80% decarbonization by 2030 and 100% decarbonization of electricity production by 2035 to prevent further environmental catastrophe. If we’re going to stay under a 1.5-degree change, there can be no new fossil fuel development.

While NYU’s strategy to improve sustainability, such as building the cogeneration plant and pursuing their goal of a 50% reduction in greenhouse gas emissions by the end of 2025, is admirable, it is essential to take further action to address the climate impact of current investments as well. Aside from launching the Better Buildings plan, the administration must ensure that it is engaging with the companies that invest NYU’s money, such as BlackRock.

Asset managers, who determine what investments to make, are able to pressure the companies they are shareholders in. They are able to vote and file proposals, which are written documents with business requests that members put before the companies.

With respect to climate change, such proposals may call on companies to adopt climate-based targets, to move faster with their resolutions, or to decarbonize their operations and their power productions more rapidly.

Blackrock, for example, receives many sustainability proposals. Within their Stewardship Expectations report, their analysis found that “companies tend to meet the request made in a shareholder proposal if it receives significant support, regardless of whether or not the proposal passes.”

When asked to comment on whether it is pressuring its asset managers to vote on and submit climate-related proposals, NYU’s Investment Office responded with the board of trustees’ 2016 divestment response.

NYU has not been clear about the extent of its engagement with asset managers. It should be engaging with companies in their investment portfolios to call for a rapid transition away from fossil fuels.

The Investment Office needs to share with the student body how it votes as a shareholder, and whether or not it is submitting sustainable proposals to the companies it invests in to help transition to a clean energy economy.

Divestment is an important call for the pivot towards green energy, and it certainly has the support of the student body. But if NYU decides not to divest, it needs to show its support for climate initiatives through its asset managers, and perhaps join an investor-led group such as the Climate Action 100+. NYU must use all the levers at its disposal to pressure companies to decarbonize.

Contact Clara Scholl at [email protected].