NYU students start applying for Biden loan forgiveness program

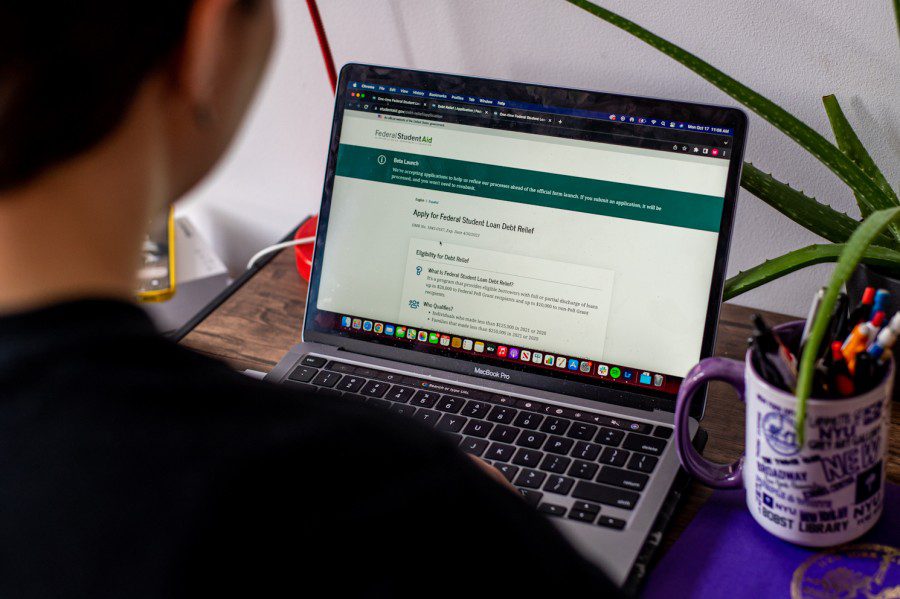

After the application for the program opened on Oct. 17, some students said it would partially or completely pay off their loans.

As next year’s Free Application for Federal Student Aid opens, some NYU students reflect on how the aid they received this year was not sufficient. (Manasa Gudavalli for WSN)

October 21, 2022

Many NYU students who have taken out loans may benefit from President Joe Biden’s student loan forgiveness program, which began accepting applications on Monday, Oct. 17. While some with loans say they will be left debt free, others have found out that they do not qualify for assistance, or believe that up to $20,000 in aid is still not enough.

The student loan forgiveness plan allows individuals with an annual income of less than $125,000 and families that made less than $250,000 in 2021 or 2022 to receive relief of up to $10,000. Pell Grant recipients — need-based federal awards that do not need to be repaid — may be eligible for an additional $10,000 in relief.

NYU undergraduate students leave the university with a median loan amount of $20,500, according to U.S. News. In the fall 2022 semester, 24% of first-year students received Pell Grants.

CAS senior Davianis Cruz, a Pell Grant recipient, said that they have already applied for the program. Because they have scholarships from NYU and New York state financial awards, their full loan balance will be forgiven if their application is accepted.

“A lot of people have to take out huge loans to be able to afford a school like NYU — it’s super fucking expensive,” Cruz said. “Even $20,000 off of how much you have taken out in loans is really helpful. For people who are like me who have less loans in general, it’s perfect. You basically went to school debt free, and that feels really good.”

The application can be completed in less than five minutes and only requires a student’s name, social security number and date of birth. Only current borrowers with federal undergraduate, graduate and Parent PLUS loans — loans that parents can take out for their students — that were distributed before June 30, 2022, are eligible to apply.

Gallatin first-year Nayeli Rodriguez has not yet applied for the program because she does not know if her family’s income would disqualify her.

“I never really thought about it, because sometimes we qualify, but sometimes we don’t — it just depends,” Rodriguez said. “The cost is something that you can’t really ignore at this school. If kids here were able to get that it can definitely be very relieving.”

Although the program aims to reduce student loans, some have said that it will ultimately have a small impact on the loans they will have to pay off due to the high cost of tuition and housing at NYU. Tuition, mandatory fees, and room and board costs for undergraduate students all rose by 3% for the 2022-23 academic year — the same percentage increase as the previous year.

The program will also limit undergraduate student loan payments to 5% of a borrower’s income, amounting to half of the current limit for most borrowers. In March, Biden increased the maximum Pell Grant amount from $6,495 to $6,895 — the largest increase since the 2009-10 academic year.

CAS junior Anna Hildebrand said that while she does not currently qualify for loan forgiveness under the new program, she hopes it will expand to cover more students in the future. She added that she will still benefit from the program because her girlfriend is eligible for loan relief and has already applied.

“I’m on a loan plan of $70,000 a year, and I didn’t get any financial aid whatsoever,” Hildebrand said. “A lot of people that are on aid — it would really, really help them, because that’ll take some of the stress off of them.”

Stern sophomore Sebastian Ubillus said that because he comes from a low-income family, he has taken out several loans. The program will allow him to use the money he makes after graduation to save for his future rather than pay off his debt.

“Most people are postponing their lives just to pay off their loans, which is really unfair given that there’s a lot of other students here who are able to pay their entire tuition and not worry, ” Ubillus said. “If we’re all given the opportunity to study here, then we should all be given the same economic opportunity.”

Contact Carmo Moniz at [email protected].