A Two-Pronged Attack on the Student Loan Crisis

February 22, 2016

Last week, a man in Texas was arrested by U.S. Marshals for failing to pay a $1,500 student loan he owed for three decades. With an estimated 40 million Americans who collectively owe $1.2 trillion in student loans, student loan debt has become a pressing national issue. Student loans pose the biggest threat to millennials but affect all Americans, and it is the obligation of both universities and government to attack this national crisis.

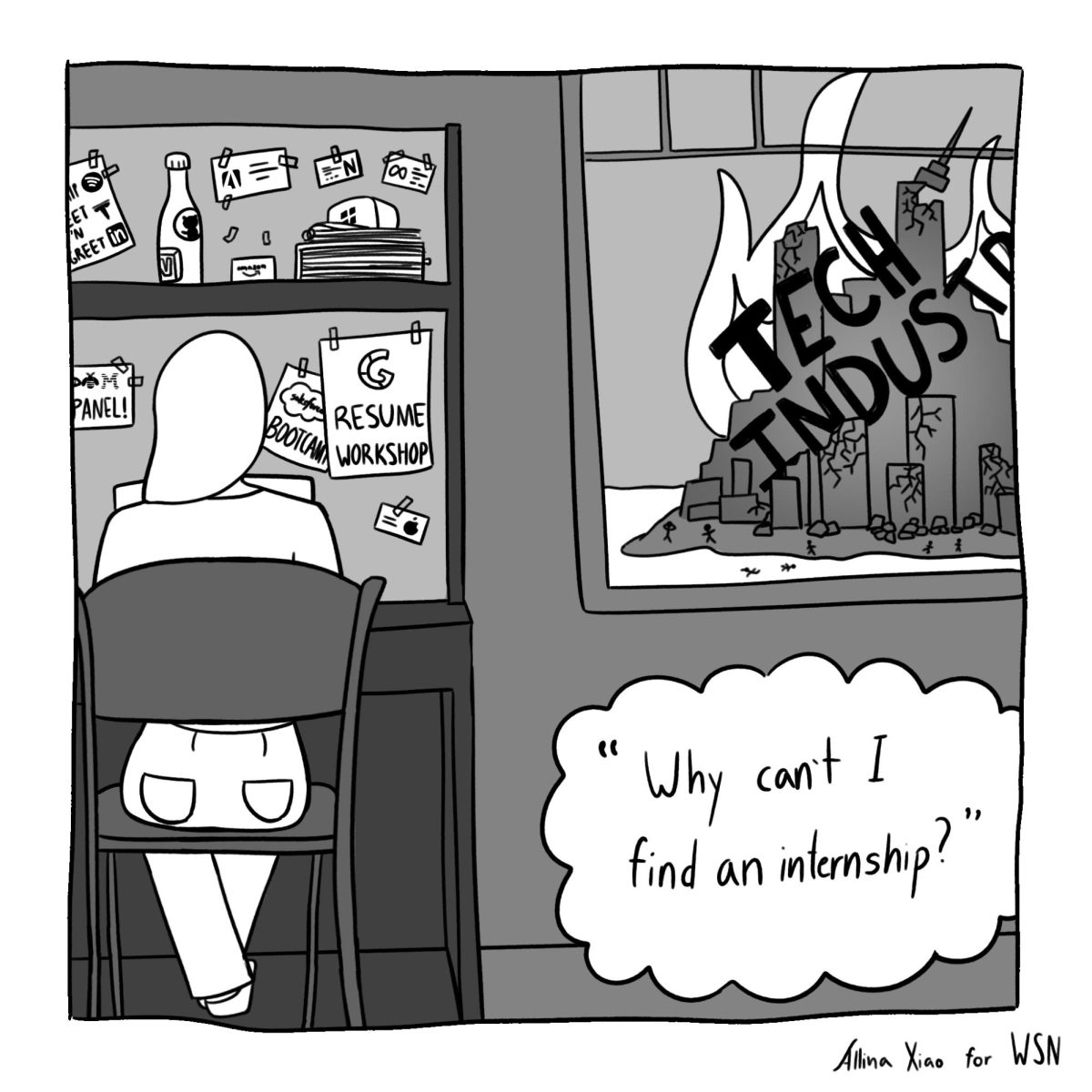

An NYU student from a family with less than $30,000 in income owes an average of $23,250 in federal loans. It is also common practice for students to secure private loans to cut down the costs of college, so the amount that it is owed by graduation day could possibly equal or surpass the $30,000 mark. Several universities like NYU have an admissions policy that is need-blind, where one’s ability to pay for school is not factored into decisions, but there are several benefits of having an admissions policy that is conscious of student need. Need-blind policies often treat students from low-income households the same as those from high-income families, which does not account for the unique and circumstances of a given student’s financial background. Incoming classes would be as diverse in terms of socioeconomic status, and a great portion of institutional aid would go to individuals who do not have the financial means of attending elite or even state schools.

Universities cannot solve the student loan problem themselves. The federal government can help alleviate student loans by restructuring the Public Service Loan Forgiveness Program, a program which forgives the remaining balance on Direct Loans after 120 qualifying monthly payments while working full-time. Instead of 120 payments, or 12 years paying for loans, the balance should be settled after 80 payments. Doing this would undoubtedly help people from defaulting on their loans by guaranteeing that they will be rewarded for almost a decade’s worth of work.

The next U.S. president needs to guide this government effort to fix student debt, reducing interest rates and making them more fixed. Students need to be protected from loans that prey on their desperation and force graduates to pay twice or more than what they borrowed. All of the 2016 presidential candidates have suggested some kind of plan towards tackling the student loan crisis. Washington must actually follow through on whoever’s leadership our nation is under. Student debt is a national epidemic that is crippling some of the most vulnerable members of the workforce, and it is the role of universities and government to help stem the crisis.

Opinions expressed on the editorial pages are not necessarily those of WSN, and our publication of opinions is not an endorsement of them.

A version of this article appeared in the Monday, Feb. 22 print edition. Email Tegan Joseph Mosugu at [email protected].