Real estate needs further regulation

February 10, 2015

New York City is one of the wealthiest cities in the world, and as a result has one of the fiercest luxury real estate markets. A New York Times investigative report released Feb. 7 delved into this high-end market and found that a huge number of residences are owned by secretive, anonymous shell companies that allow foreign buyers — some of them criminals — to purchase condos. The regulatory loophole that has brought this infusion of foreign assets provides a safe haven for both dirty and clean money, and makes the real estate market not only less transparent, but also more competitive.

New York City’s elite real estate is being bought up at a staggering rate by anonymous shell companies. Due to the lack of legal imperative to investigate the identities of buyers, large numbers of unscrupulous ultra-rich have come to own a large percentage of New York’s most valuable real estate. In 2010, a $15.65 million condominium in the Time Warner Center was bought by Vitaly Malkin, a Russian banker and politician who has been linked to organized crime and subsequently banned from entering Canada. Similarly, Dimitrios Contominas, a Greek businessman arrested for corruption charges last year, purchased a $21.4 million unit on the 74th floor, the same floor as Malkin. The shell companies that owners use are often registered in the names of family, friends and consultants instead of the owners themselves, and their ownership can be changed without documentation. Even Tom Brady has been linked to buying real estate using these dubious methods.

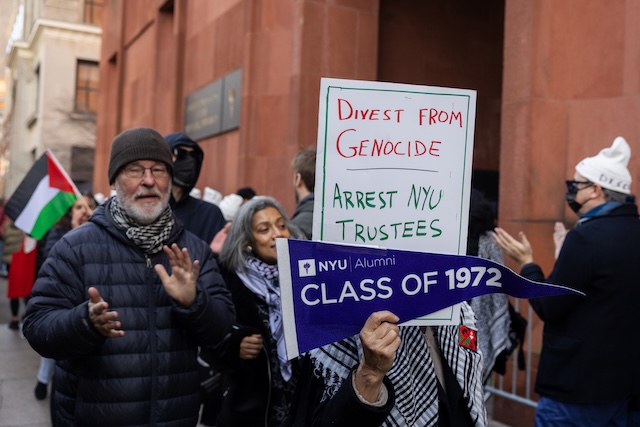

The shell company Columbus Skyline, which bought three condos for a total of $25.6 million, was traced to NYU Board of Trustees member Wang Wenliang. In 2010, Wang donated $25 million to the university and founded the NYU Center on U.S.-China Relations. Wang’s company, China Rilin Construction Group, was fined thousands of dollars for housing workers in overcrowded, unsanitary conditions in New Jersey. A second, similar case was dismissed. According to the NYU Board of Trustees page, trustee members are “keepers of the mission of NYU” who “must pay particularly close attention to the mission of obligations to society that are unique to the academic enterprise.” Wang’s questionable transactions show that he has failed to meet these standards.

It is clear that further regulation is needed for these shell companies that all too easily buy up real estate with untraceable funds. New York City’s expanding skyline may already be a symbol of wealth inequality, but it is still worsened by this influx of suspicious foreign funds. This is not just a matter of political integrity, but a real concern for the stability of the already skyrocketing real estate market. Seemingly boundless money flowing into the U.S. economy and universities seems nice, but it cannot be an excuse to ignore global political realities.

A version of this article appeared in the Tuesday, Feb. 10 print edition. Email the Editorial Board at [email protected].