Editorial: Larry Fink is a climate hypocrite

By calling on nations to reduce carbon emissions, but holding investments in fossil fuel corporations through BlackRock, NYU trustee Larry Fink fails to put his money where his mouth is.

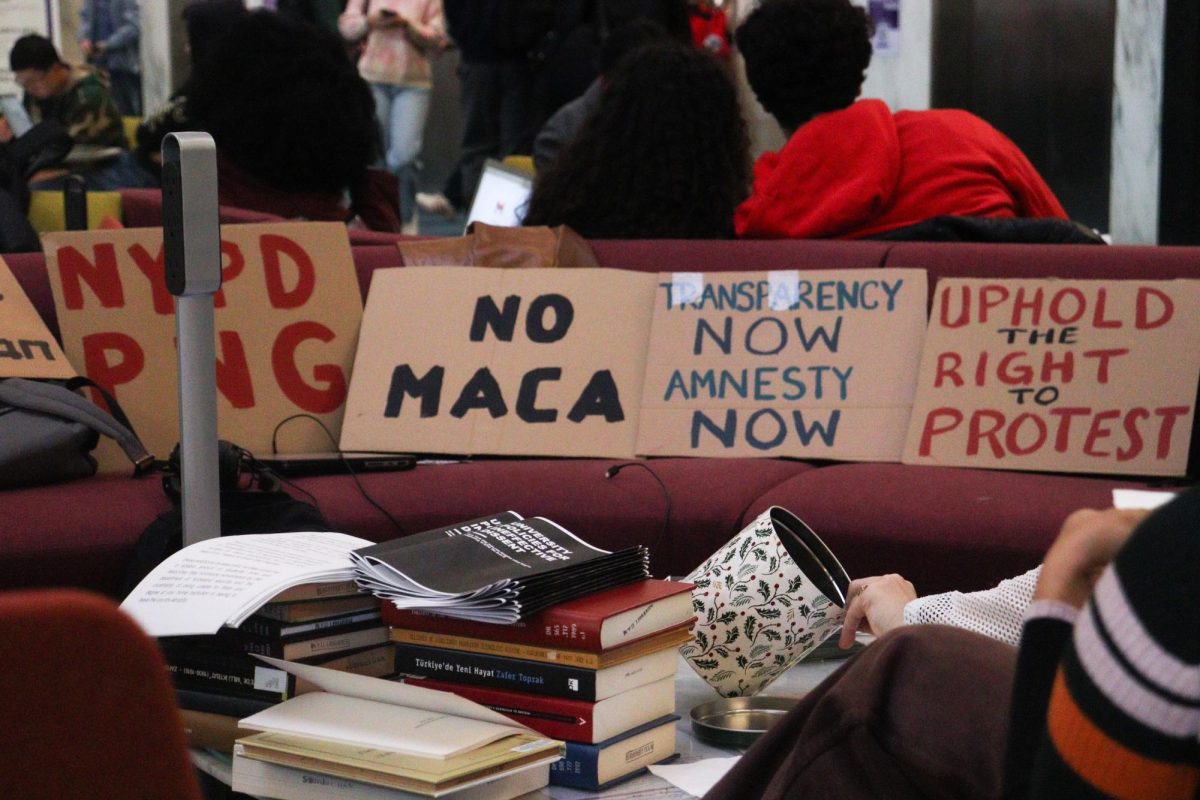

NYU trustee and BlackRock CEO Larry Fink has called on wealthy nations to reduce carbon emissions. As an investor in the fossil fuel industry himself, his actions contradict his rhetoric. (Staff Photo by Alexandra Chan)

October 18, 2021

NYU trustee and BlackRock CEO Laurence Fink wrote an op-ed in The New York Times last Wednesday arguing that wealthy countries must continue to invest more money in green infrastructure. In the article, Fink emphasizes how many countries in the Global South cannot shoulder the cost of building climate-friendly infrastructure; he also points out how private investors, like himself, are unwilling to help alleviate those costs. His solution: “Rich countries must put more taxpayer money to work in driving the net-zero transition abroad.” As one of the main investors in the fossil fuel industry, however, Fink’s supposed climate advocacy rings hollow.

As of February, BlackRock holds more than $12 billion in investments in the coal industry and almost $90 billion in the oil and gas industries. These investments endure more than a year after Fink made a statement pledging that BlackRock would integrate climate change into their risk assessments, invest in sustainable industries, and launch new financial securities that do not include fossil fuel holding.

In the fourth quarter of the 2019 fiscal year, BlackRock had invested nearly $160 billion in the oil and gas industry and $13 billion in the coal industry. Although BlackRock’s fossil fuel investments have declined since 2019, activists point out that BlackRock’s rate of divestment is insufficient.

Additionally, a loophole in BlackRock’s new policy allows the corporation to maintain holdings in companies that earn less than 25% of their revenue from coal — meaning the policy affects around 17% of all companies in the coal industry. Ultimately, BlackRock is still investing in some of the world’s largest polluters: Adani, Glencore, BHP and RWE. BlackRock is also investing a whopping $24 billion with Sumitomo and KEPCO, despite their own intentions to expand their coal production.

In writing his op-ed under the guise of climate advocacy, Fink is engaging in greenwashing. He is advertising his investment management firm and personal brand as sympathetic to sustainable climate policies, all while maintaining significant holdings in fossil fuel industries and making a handsome profit. Fink is contradicting himself by urging climate action even as his corporation funnels capital to companies contributing to the climate crisis.

In an attempt to justify his complicity in the climate crisis, Fink has stated that much of BlackRock’s investments in fossil fuel companies are made through passive funds, which simply track the performance of market indicators like the S&P 500 or the Nasdaq. However, it has been disproven that market indicators are neutral reflections of market trends. Adriana Z. Robertson wrote in the Yale Journal of Regulation about how passive fund managers are still setting “selection criteria,” intentionally including fossil fuel companies in their products. There are numerous sustainable passive funds that align with standards set out in the Paris Climate Accords. If Fink’s concern for the environment is genuine, perhaps he should immediately divest from fossil-fuel backed funds and invest in securities that, at minimum, are not causing the destruction of the earth.

Fink continues to advocate proactive global policy that will prevent the worst of climate change, but he doesn’t practice what he preaches. His company — one of the biggest asset management firms in the world — enables the worst offenders of pollution and overconsumption. Instead of telling governments to invest in fighting the climate crisis, he should use some of BlackRock’s money to accomplish that goal. By shifting the onus of climate action onto governments, Fink is fleeing his moral obligation to halt the flow of capital to fossil fuel corporations while hiding his dirty personal image under a veneer of green paint. Don’t let him get away with it.

A version of this article appeared in the Oct. 18, 2021, e-print edition. Contact the Editorial Board at [email protected].