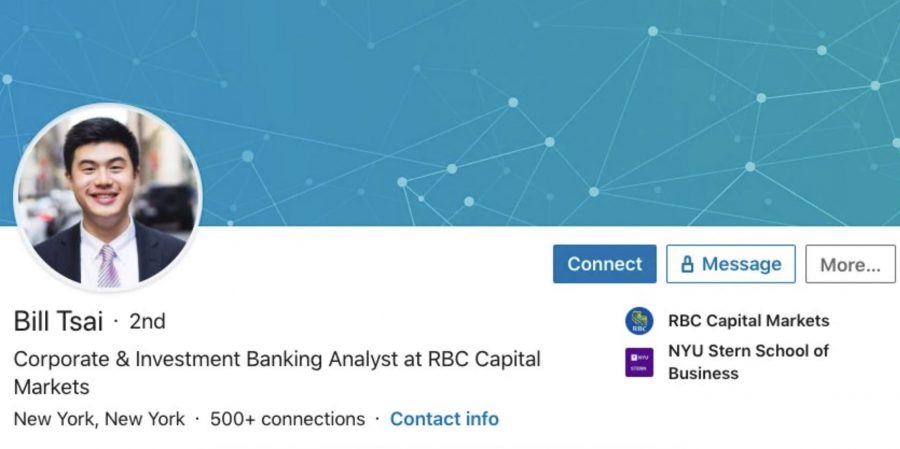

An NYU alumnus was arrested for insider trading earlier this month after allegedly leveraging private information to make almost $100,000 off the stock market, according to court documents.

Bill Tsai — who graduated from the Stern School of Business in 2018 and served as Stern Student Council President his senior year — worked as a junior analyst at the investment bank RBC Capital Markets after graduating. Through his job, Tsai learned that the private equity firm Siris Capital Group would buy Electronics for Imaging, a digital printing technology company. Using a brokerage account with a firm that was not permitted under his employment agreement with RBC, Tsai bought 187 EFI call options — which give the right to buy stocks at a set price during a set time — before it was announced that Siris acquired them, court documents claim.

Using non-public information that may have an impact on stock prices — such as the fact that EFI was going to be bought — to buy or sell stocks is illegal. Tsai’s prior knowledge, gained only through his work at RBC, allowed him to buy EFI call options when stock prices were low, and profit when the price increased after it was announced they had been bought by Siris.

EFI’s stock price jumped from $29.40 to $38 per share after the announcement, and Tsai made an estimated $98,750, according to court documents.

Tsai has since been charged by federal prosecutors with insider trading and had a civil lawsuit filed against him by the Securities and Exchange Commission.

“We were shocked and disheartened by the news reports,” Stern said in a statement to WSN. “NYU Stern requires professional and social responsibility coursework as a core pillar in the undergraduate business curriculum. Any incident such as this only deepens our resolve to maintain ethics education as a priority.”

Tsai interned at RBC in the summer of 2017 and was hired as a full-time employee in July 2018, according to the SEC. As a junior analyst, part of his job was to update a list of transactions that included mergers and acquisitions like that of EFI by Siris.

Tsai went through training that covered RBC’s policy on insider trading. RBC requires employees to keep non-public information confidential and clearly states that insider trading is both against its policy and federal law. He had also signed a form when he was first hired stating that he did not have “employee or employee related” trading accounts like the one he allegedly used to buy EFI call options.

“RBC has a zero-tolerance approach to any breach of the law or our code of conduct,” an RBC spokesperson said in a statement to WSN. “We have cooperated fully with law enforcement as it relates to this matter.”

The spokesperson also confirmed that Tsai has since been fired from the company. Tsai is set to appear in court on Sept. 11 for a preliminary hearing on his criminal charges.

Tsai and his attorney, Mark Hellerer, did not respond to a request for comment by time of publication.

NYU Stern Student Council did not respond to a request for comment by time of publication.

Correction, Aug. 27: A previous version of this article stated Tsai bought EFI stocks. Tsai bought EFI call options, giving him the right to buy stocks. The article has been updated to reflect the correction and WSN regrets the error.

A version of this article appeared in the Monday, Aug. 26, 2019, print edition. Email Victor Porcelli at [email protected].