The Uffizi Gallery proves NFTs are profitable, but will they last?

The Uffizi Gallery in Florence turns to NFTs due to the economic downturn created by Italy’s nosedive in tourism amid the COVID-19 pandemic.

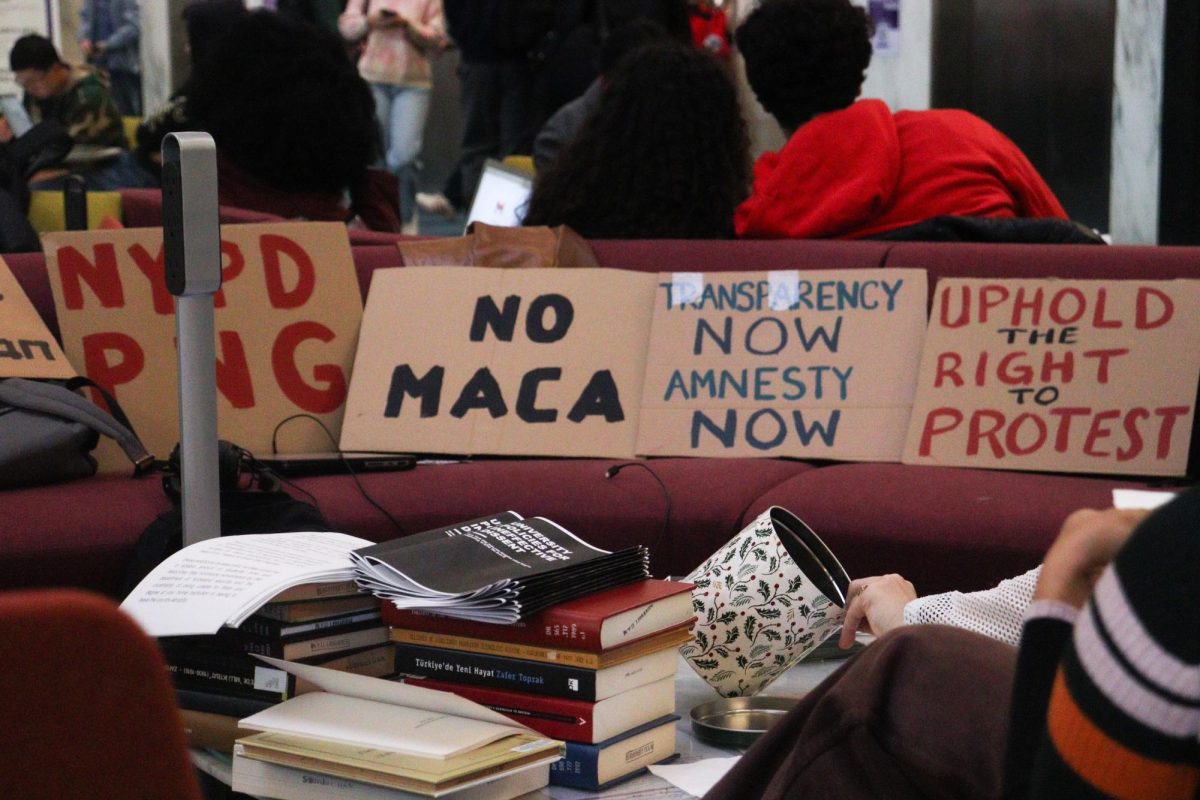

The Uffizi Gallery in Florence lost an estimated 10 million euros when it was forced to shut down during the COVID-19 pandemic. In May of 2021, Uffizi announced that they would be creating NFTs of some of their famous works to recover from the losses suffered during the pandemic. (Photo by Annie Hosch)

October 25, 2021

FLORENCE, Italy — As the pandemic surged through Europe last year, Italy’s museums and galleries shut their doors to the public. The subsequent shutdown of the tourism industry put the nation’s museums in dire economic straits, leading high art institutions to turn to fads, like NFTs — non-fungible tokens.

Among these museums was the Uffizi Gallery, which houses one of the largest collections of iconic Italian Renaissance works. Ranging from Leonardo da Vinci’s “Adoration of the Magi” to Filippo Lippi’s “Madonna and Child,” the Uffizi has long been a staple of Renaissance art collection and preservation as well as a key draw for tourists traveling to Florence. The museum typically receives over 4 million visitors each year.

The Uffizi was forced to close in early March 2020, placing it in an unexpected position of economic precarity with the daunting task of recovering from an estimated 10 million euros in losses. In a statement to the Foreign Press Association in Italy, Uffizi director Eike Schmidt announced that in 2020 the museum had lost nearly three-quarters of its visitors from the previous year.

While Italy’s tourism industry experienced economic distress, this past year has seen the rise of NFTs as they enter the mainstream discourse on art and art ownership. Gaining traction within the art world for high-profile sales, such as Beeple’s $69 million “Everydays: the First 5000 Days” or Larva Labs’ series of CryptoPunk characters, NFTs provide a method of possession over works of digital art.

Operating on the blockchain, NFTs are digital access tokens that provide a unique certification of ownership over a digital image. Controversial because of their relationship to cryptocurrency and high price tags, NFTs constitute one of the most high-profile developments in the world of art collection, in addition to being environmentally destructive.

NFTs have drawn criticism for their sizable environmental impact. The process used to authenticate NFTs is intensive, with a report by the digital artist Memo Akten estimating that the average carbon footprint caused by minting a single NFT is roughly equivalent to a month’s worth of electricity use for a person in the European Union.

In May 2021, high art and trend collided when the Uffizi announced that they would be minting NFTs of some of their most iconic works. Michelangelo’s “Doni Tondo” was the first, eventually selling for $170,000 as a woman’s birthday gift to her husband who collects Italian art. Following this sale, the Uffizi announced that Botticelli’s “The Birth of Venus,” Caravaggio’s “Bacchus,” Raphael’s “Madonna del Granduca” and Titian’s “Venus of Urbino” would each have their digital likeness represented as digital artworks, a specific form of NFTs developed by the Italian startup Cinello.

In effect, buyers can purchase a token made in collaboration with Uffizi and Cinello that gives ownership over a single digital image of the selected masterpiece. It doesn’t entail ownership over the physical work of art itself, nor does it give copyright over any other digital images of the art which already exist or may exist in the future. The scope of ownership is limited to lines of code and the image file itself, and is authenticated by the digital certificate — which is backed up by blockchain technology. The NFT buyer has no influence over what happens to the painting now or in the future, and the museum visitor’s experience of the physical painting is unchanged.

The creation of NFTs feels like a ploy to increase ticket prices. It is unlikely that the Uffizi would ever consider making any of their works of art inaccessible, as physically selling high-profile pieces is rare and legally complex for museums. However, in the United States, the pandemic has forced a relaxation of some regulations surrounding deaccessioning, which has in turn prompted a backlash from many in the art world.

In May 2021, the Uffizi reopened their doors to visitors, a sign that they would begin to recover from the pandemic downturn. Alongside the environmental concerns that accompany NFT production, it remains to be seen whether or not the Uffizi’s digital artworks are a pandemic-based fad or a long-term supplement to museum fundraising. While most museumgoers’s purchases are a gift shop tote bag or print, digital artworks may well become the new souvenir for ultra-wealthy art lovers.

A version of this story appeared in the Oct. 25, 2021, e-print edition. Contact Annie Hosch at [email protected].