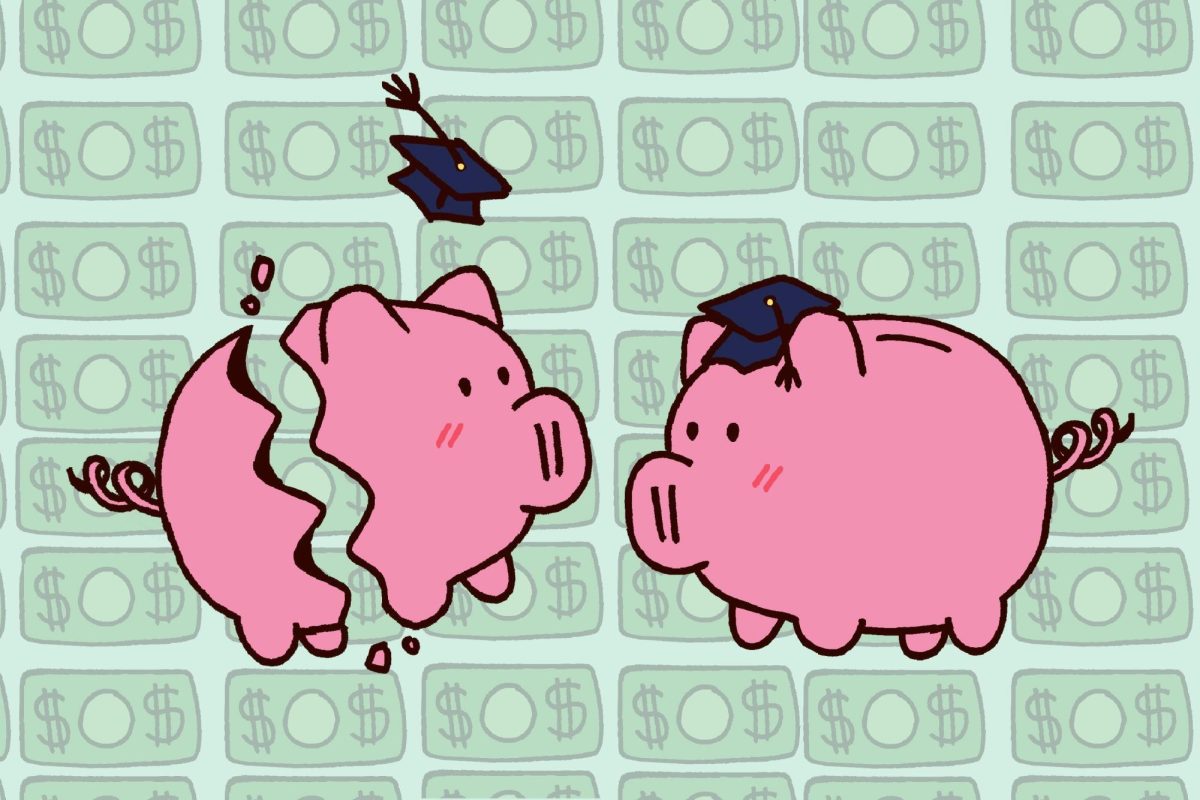

Over 1,000 students may have trouble verifying their income in order to receive federal financial aid, as the Internal Revenue Service may not be able to provide official tax transcripts in a timely manner due to the ongoing government shutdown.

NYU’s Office of the Bursar has identified students whose federal financial aid may be affected and taken steps to correct the issue.

The partial federal shutdown, which began on Dec. 21 and is now the longest in history, started after Democrats refused to meet President Donald Trump’s demand to fund a wall along the United States’ southern border. Around 320,000 government employees deemed non-essential have since been furloughed, while another 480,000 essential employees continue to work without pay.

A press release by NYU explained that certain university operations may be affected. Proposals for research grants may not be processed and no new grants will be awarded; review panels for the National Science Foundation are likely to be rescheduled; visa applications may be prolonged, and students selected to provide additional verification on the Free Application for Federal Student Aid may have difficulty following through with said verification.

Due to the IRS experiencing some disruptions, students may not have access to an official tax transcript — a document providing proof of income, one of the requirements for students needing additional verification.

University Bursar Anthony Bonano explained why some students need to take this extra step.

“The U.S. Department of Education requires that Federal Title IV applicants provide documentation to verify the accuracy of the information submitted on the [FAFSA] each year,” Bonano wrote in an email to WSN. “The Federal Government randomly selects students from each school every year for verification.”

According to Bonano, the DOE has recently published guidelines for alternative documentation students can submit in place of an IRS tax transcript. NYU’s Office of the Bursar and Financial Aid has identified students at risk of being affected and ensured they will be exempt from the de-enrollment process during class registration so any disruption in the verification process does not impact their ability to enroll in classes.

About 4,100 NYU students had been selected for verification and 1,230 of them are potentially affected by the tax transcript issue, according to Bonano.

“A communication has gone out to this population and they have been responding accordingly now that the alternative guidance from the [DOE] has been provided,” Bonano wrote. “The Office of Financial Aid is prepared to review the incoming documents quickly and have safeguards in place to ensure that spring registration is not disrupted.”

The press release by NYU urged students who believe they are impacted by the IRS disruption to contact the NYU Office of Financial Aid for more information.

This is a developing story. If you have been impacted by the IRS disruption and would like to share your experience, please reach out to Victor Porcelli at [email protected].