NYU Students React to Versace Buyout

Bold move or detrimental to an iconic label?

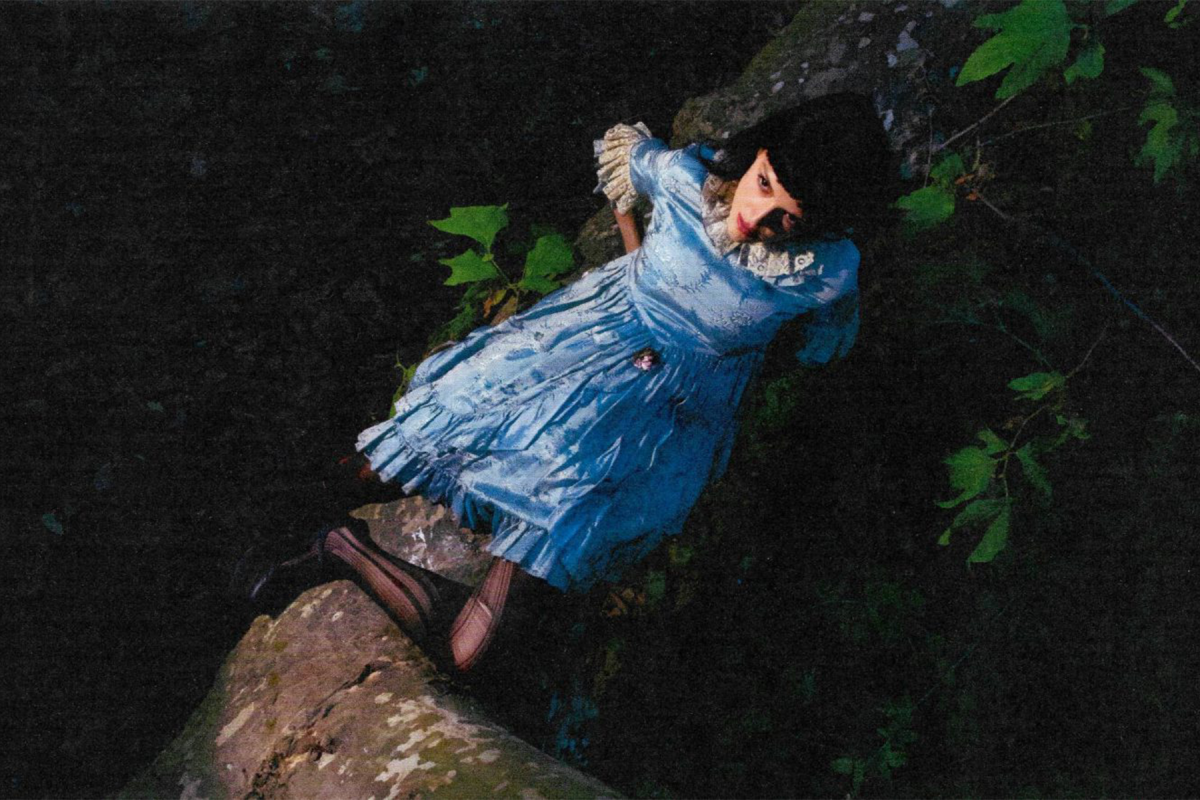

Donatella Versace, chief designer of the Versace Group, will stay after Michael Kors acquired the company.

October 1, 2018

The instant Michael Kors bought luxury brand Versace for $2.12 billion on Sept. 25, social media exploded with commentary on the future of this brand. The buyout came as a shock to loyal Versace customers, who value the elite stature and quality of the Versace brand. However, the move is part of a larger plan for the Kors company.

“The acquisition of Versace is an important milestone for our group,” Michael Kors CEO John Idol said in the press release. “We believe that the strength of the Michael Kors and Jimmy Choo brands, and the acquisition of Versace, position us to deliver multiple years of revenue and earnings growth.”

Versace closed 42 stores in 2017, the same year that Jimmy Choo was bought by the Kors company. Under the new ownership, there are plans to double the brand’s sales, aiming for $2 billion in global revenue. This quantitative information may sound far out, but the larger narrative of corporate buyouts is not lost on students. News of this kind can strike as unexpected and unusual as consumers are not always paying attention to the common thread –– money.

“Michael Kors buying out Versace is strange because, although both brands are sophisticated and output luxury products, Michael Kors’ audience is more in tune with the upper-middle-class working woman in America, whereas Versace encompasses the vivacity and eccentric upper class of Italian woman and showcases this through their use of bold colors and prints,” CAS sophomore Elle Shurm said.

Some students noted the chance for a positive impact, that the sale will have on the stature of the Kors company, aside from revenue. Fashion majors, in particular, had interesting analyses of the sale of the company, recognizing the benefits of the sale rather than mirroring the initial appall from most consumers who view the move as profit-driven.

“Michael Kors bought Versace because they want to move away from lower-end stores that they are currently sold in and go into higher-up stores, such as Harrods,” Gallatin sophomore Noa Feingold said. “Versace is already grouped with the most expensive, high fashion and high-end stores.”

Stern junior Julia Sheykhet also believes Kors is using Versace’s well-established name to help push itself into the high-end realm. She shared a hopeful vision for the future of Michael Kors but also voiced concern for the Versace brand.

“It will strengthen Michael Kors’ brand and allow them to position themselves in the luxury market,” she said. “However, for Versace, I think this acquisition devalues the existing brand and image. I think the move might push away Versace’s existing customer base who were drawn to the brand’s exclusivity and prestige.”

Upon the closing of the acquisition, the Michael Kors company, Michael Kors Holdings Limited, will be renamed to Capri Holdings Limited. It will become the United States’ first global luxury group, joining the ranks of LVMH, which owns iconic brands such as Louis Vuitton, Fendi and Dior, and Kering, which owns Gucci, Saint Laurent and Balenciaga.

Despite the corporate reshuffling, one thing at Versace isn’t changing. The brand’s Creative Director — and founder’s sister — Donatella Versace is here to stay.

Email Claire Wright at [email protected].