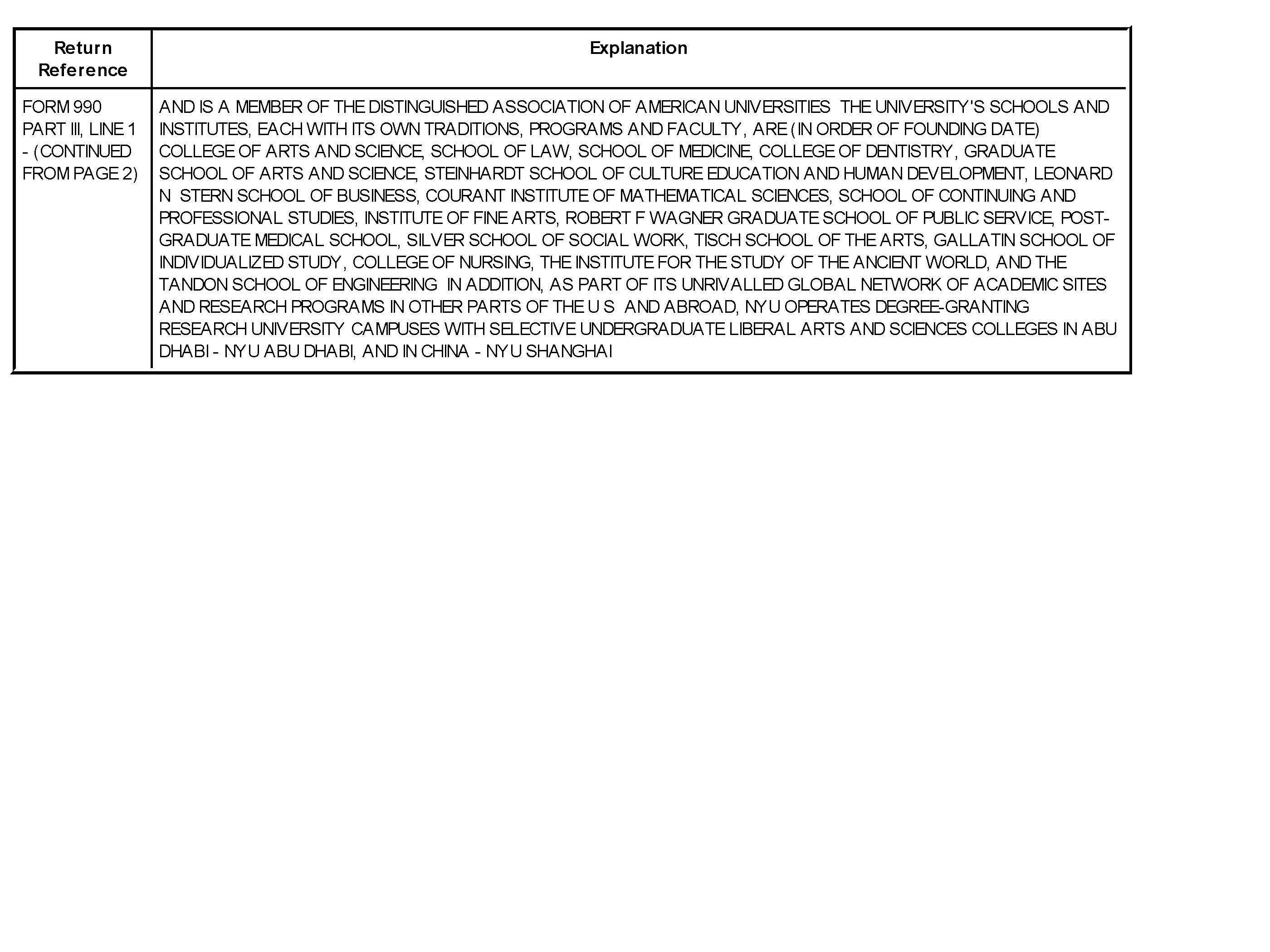

NYU Tax Return Breakdown

NYU Athletics Received $338,379 from Charity Linked to College Admissions Scandal. (Photo byAlex Muhawi-Ho)

April 18, 2017

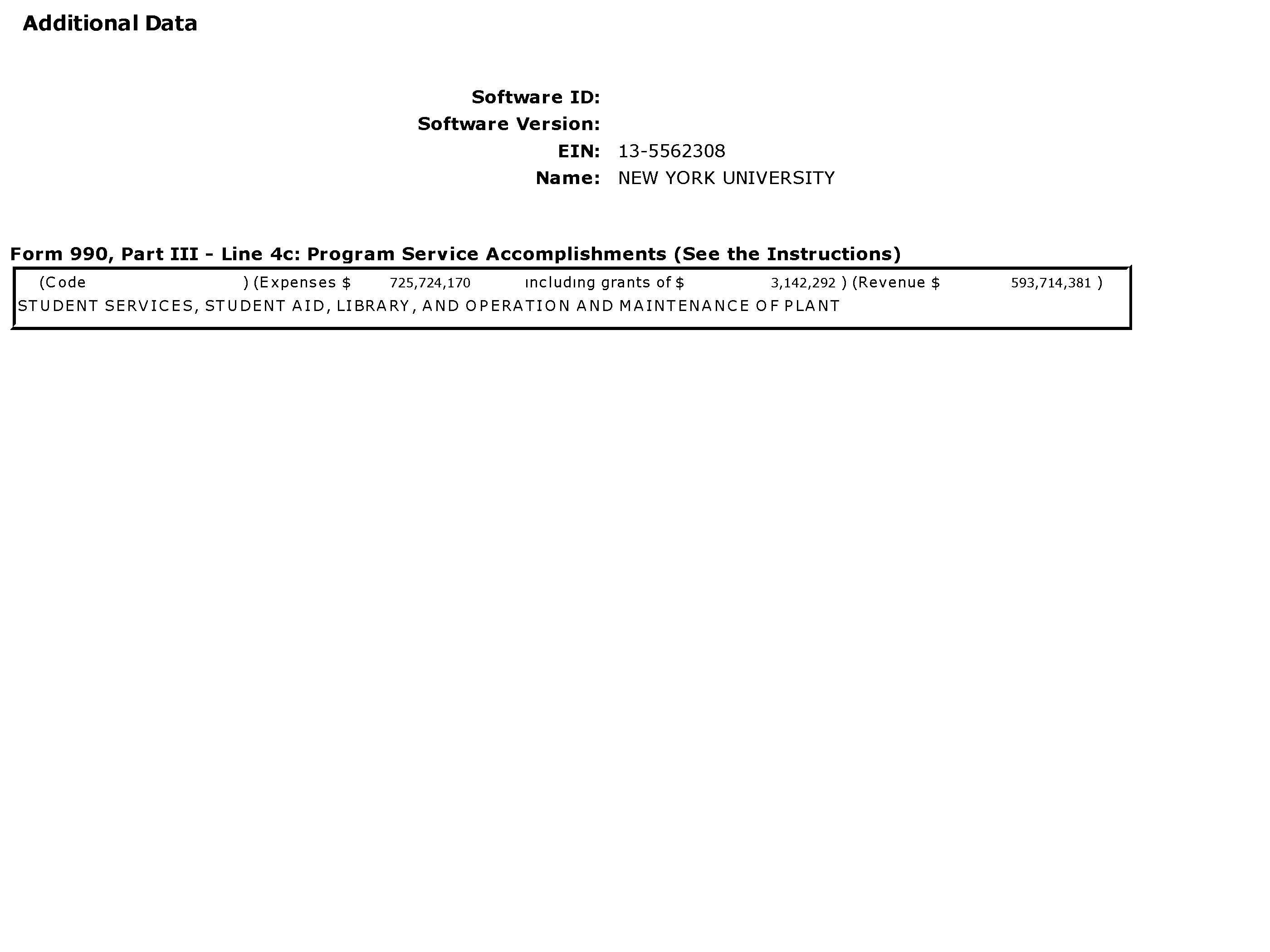

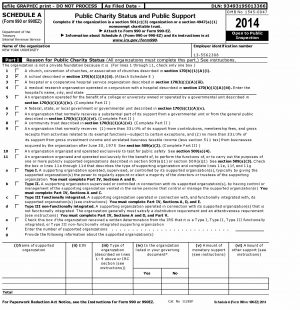

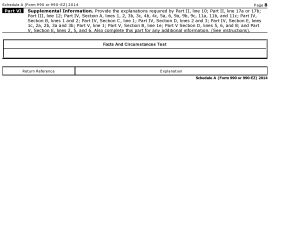

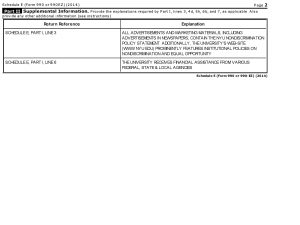

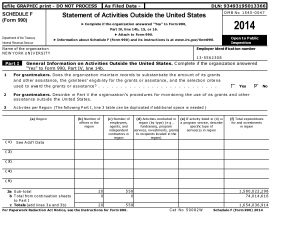

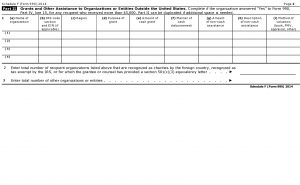

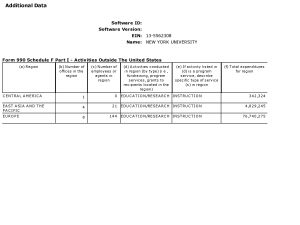

In the spirit of Tax Day, Washington Square News went through NYU’s September 1, 2014 – August 31, 2015 tax return. Below are the highlights of the document, as well as the tax return itself.

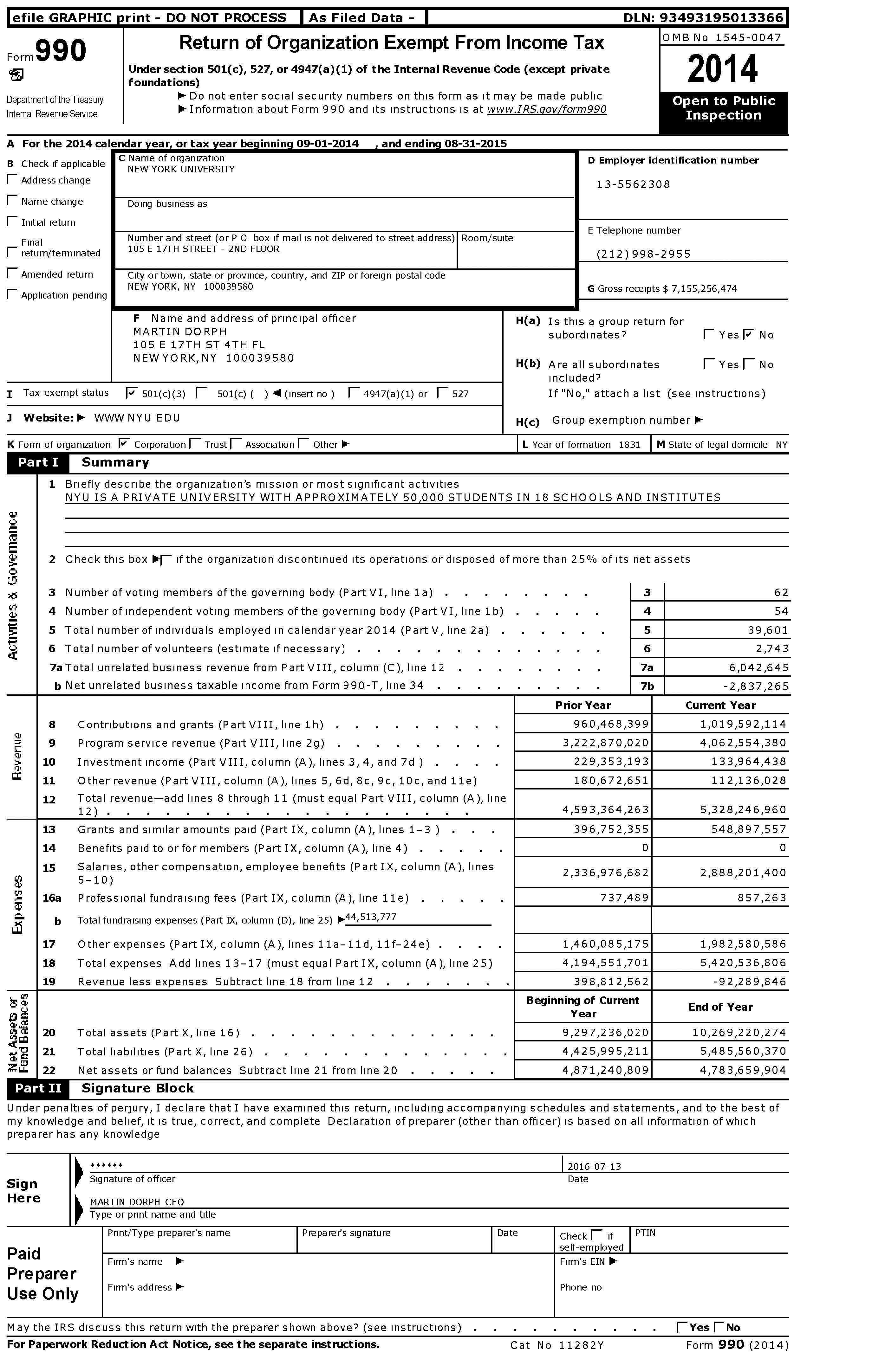

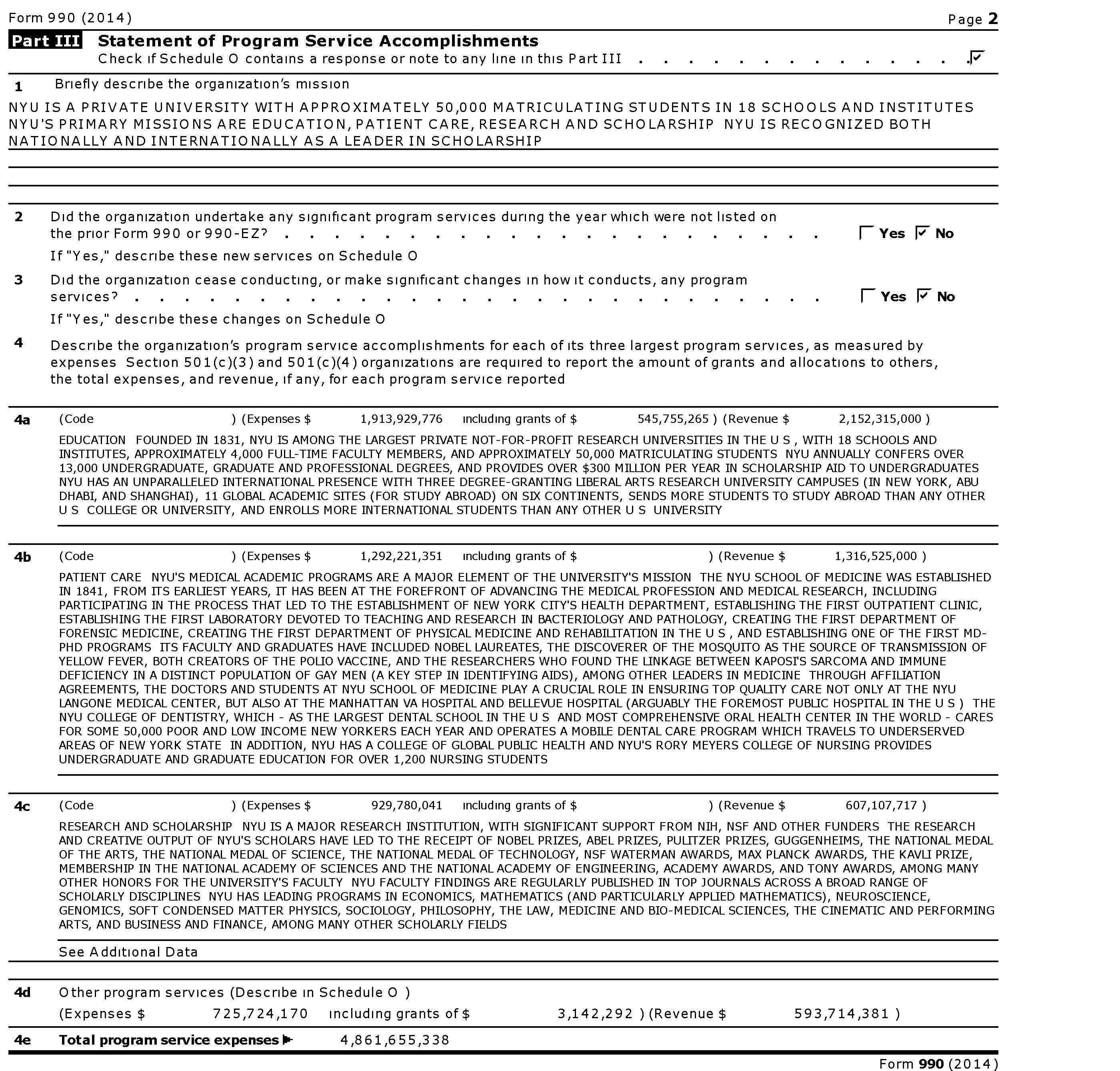

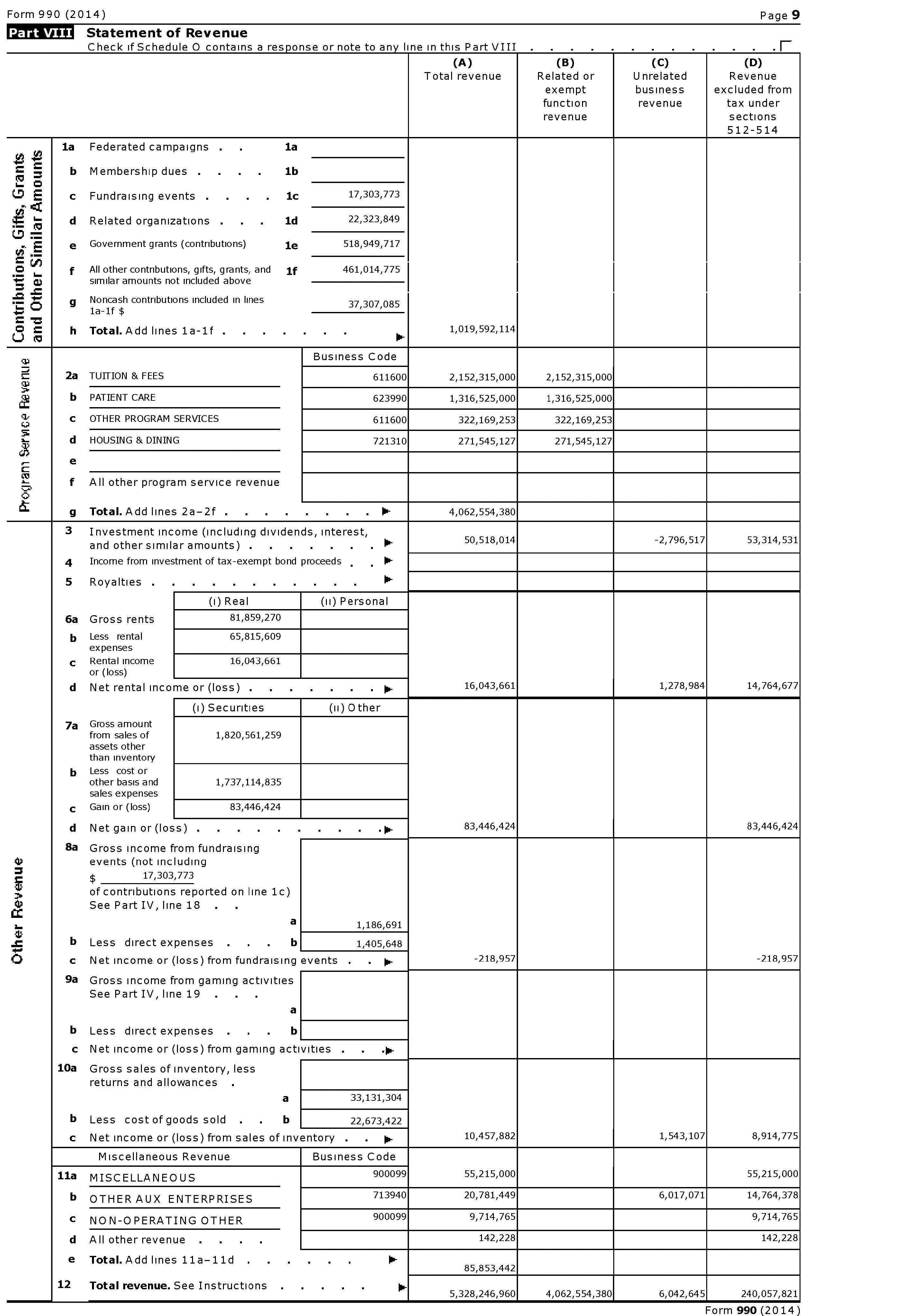

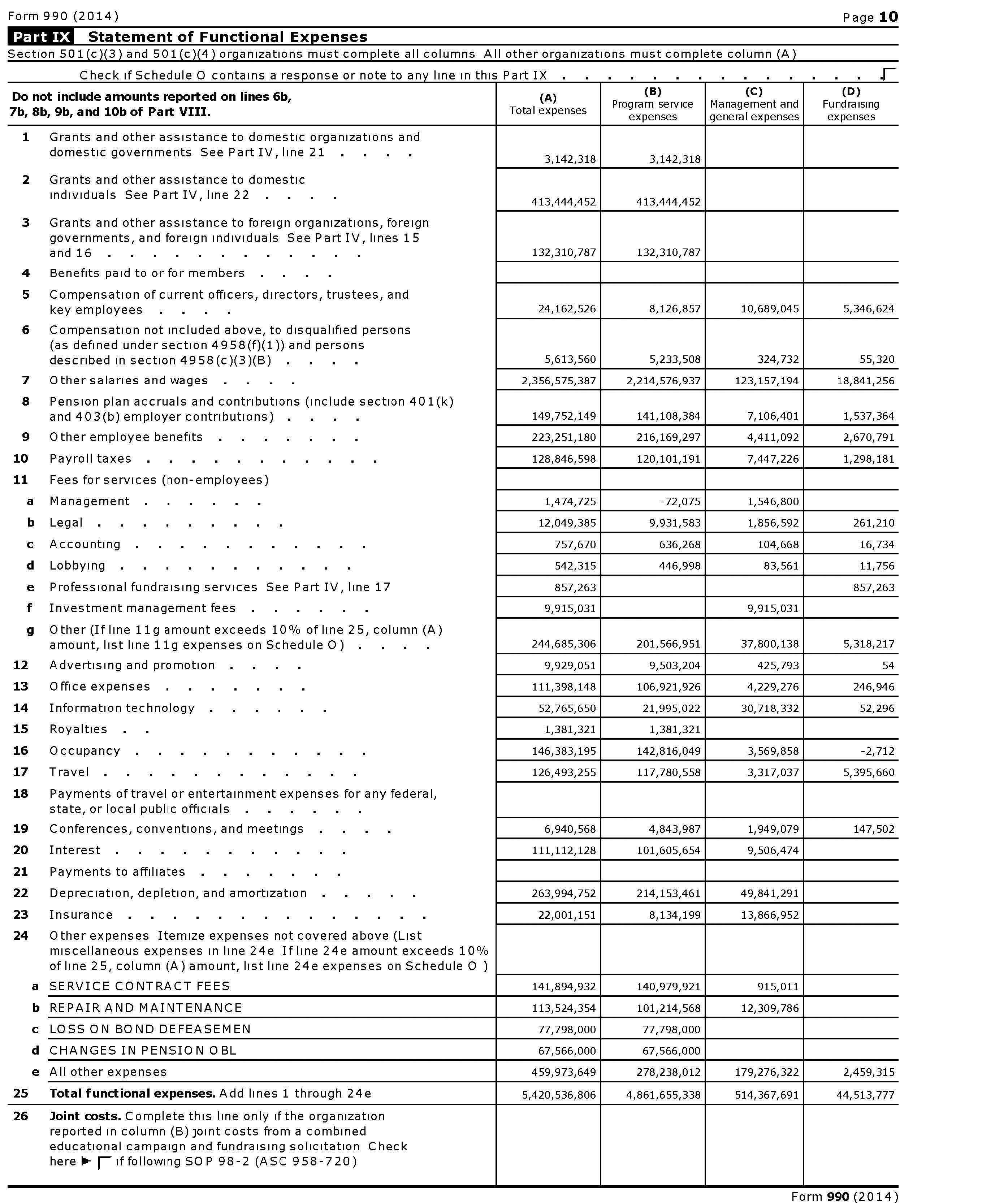

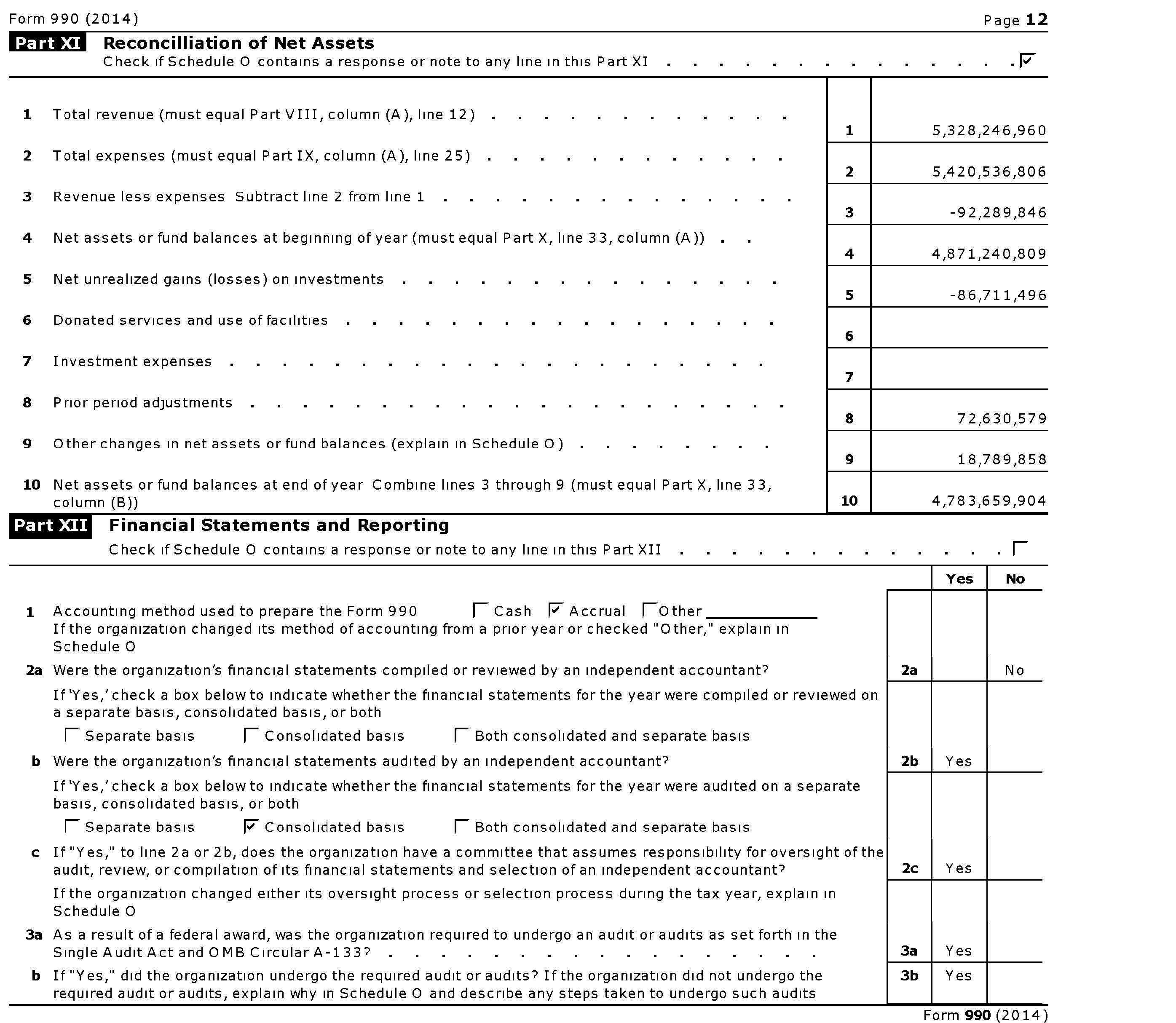

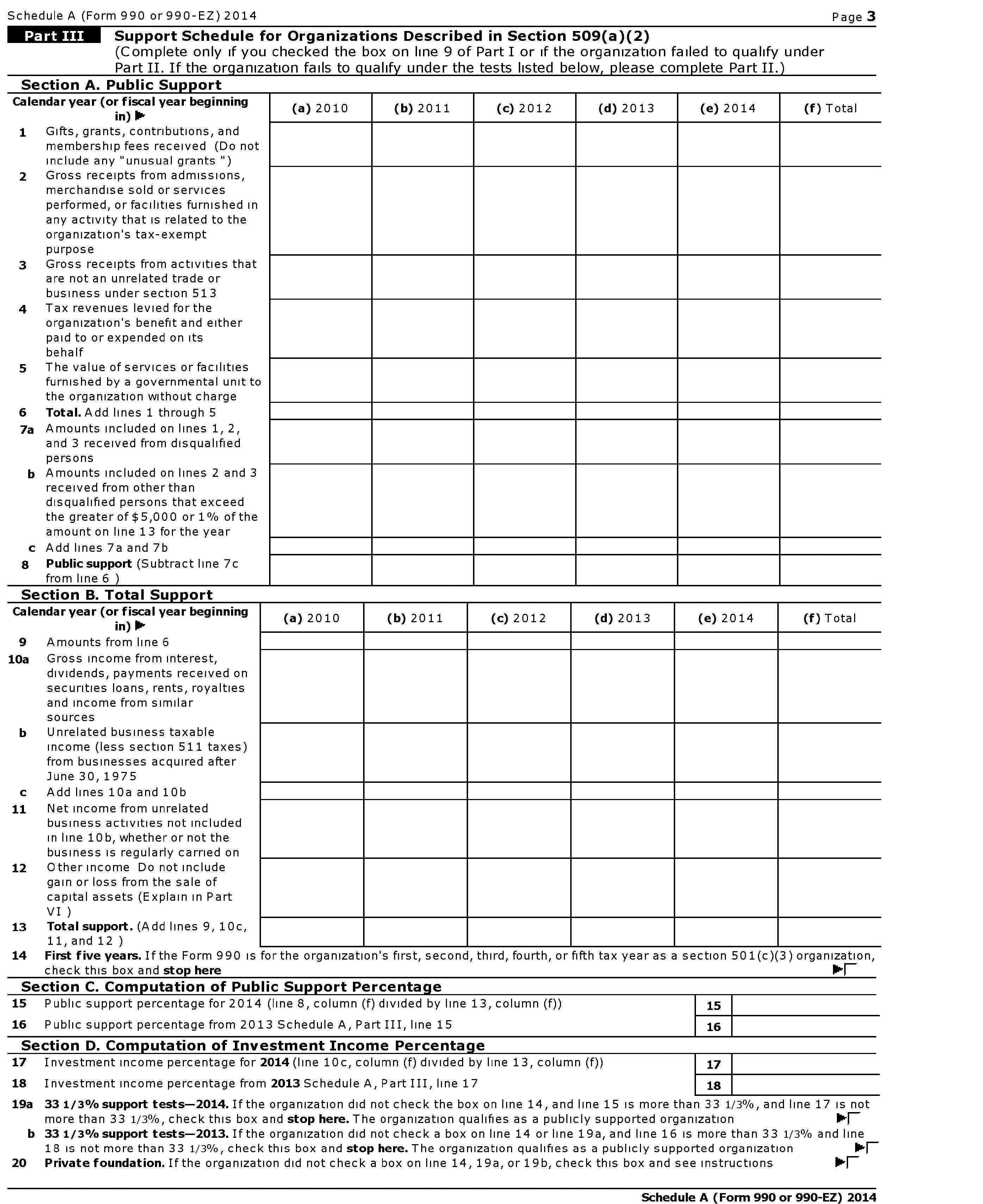

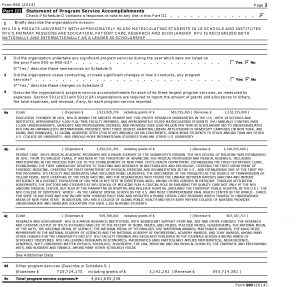

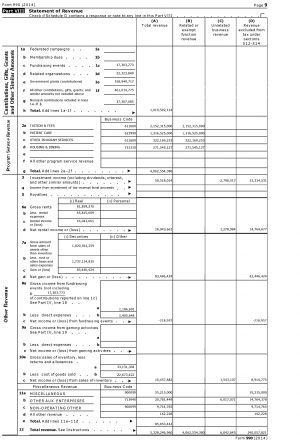

Revenue and Expenses

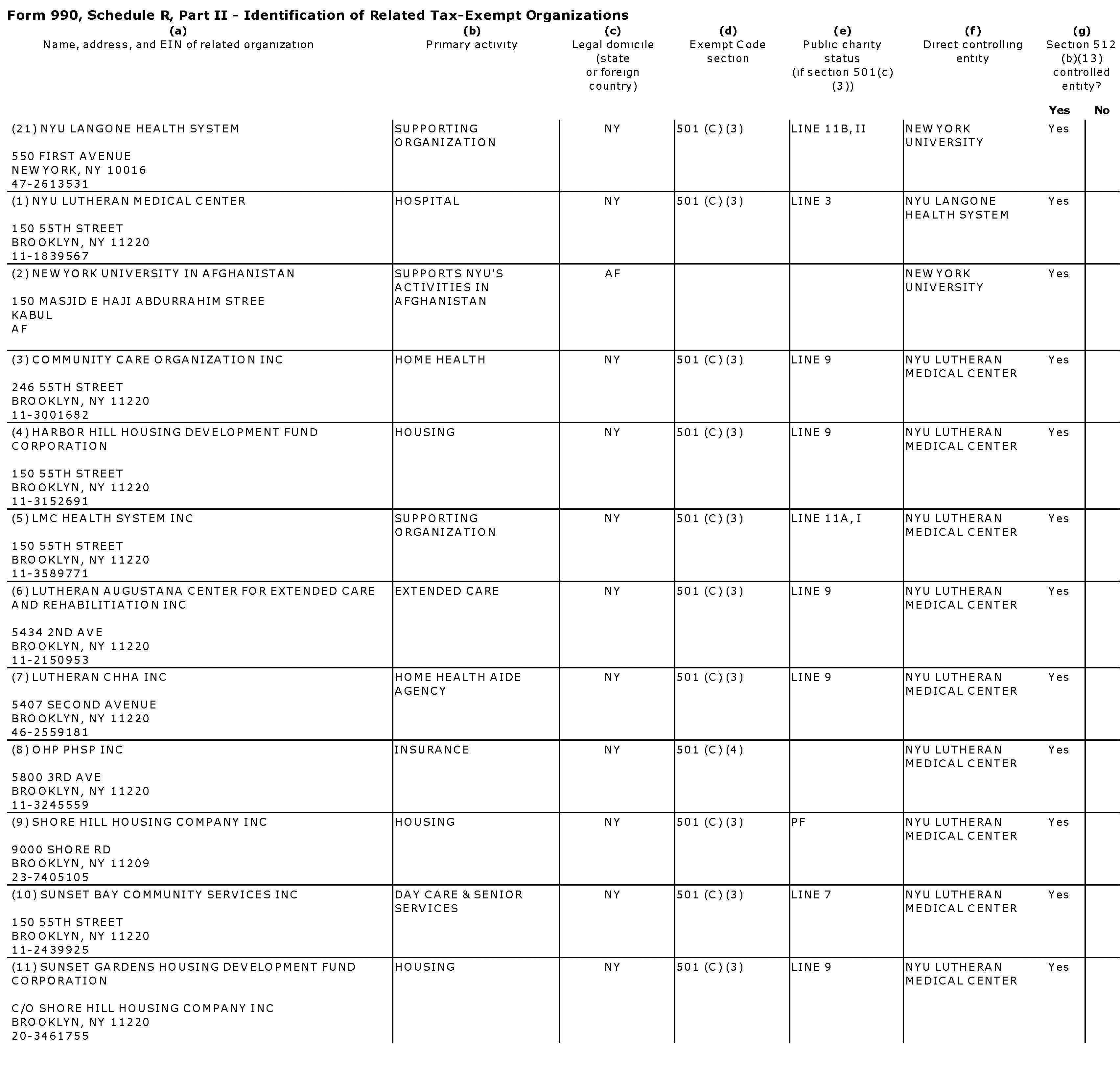

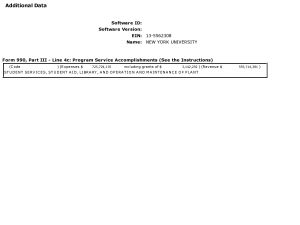

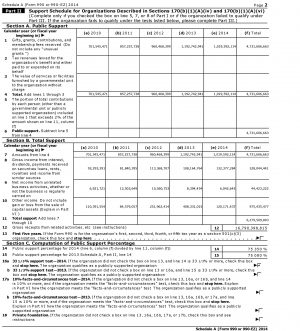

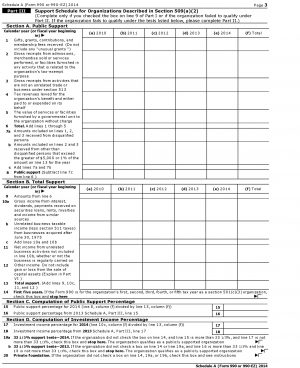

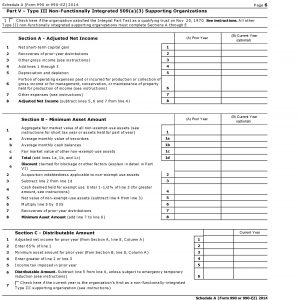

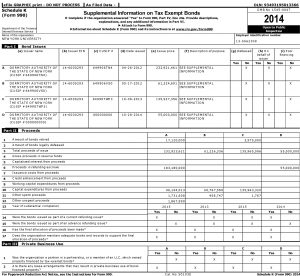

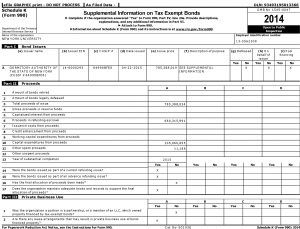

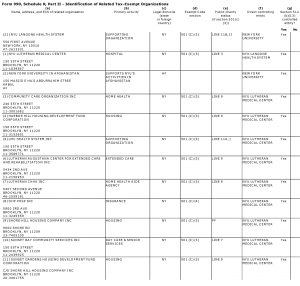

In total, NYU spent $5.4 billion. This includes the university’s spending on all academic institutions, the medical center, research labs and more. $1.9 billion was spent across all of NYU’s academic services. This includes all of NYU’s global sites, all colleges and schools affiliated with NYU or any other institution to which students pay tuition. The university received $5.3 billion in total revenue, and it pulled in $2.2 billion from tuitions and fees. Patient care by NYU Langone accounted for $1.3 billion in revenue and cost $1.3 billion.

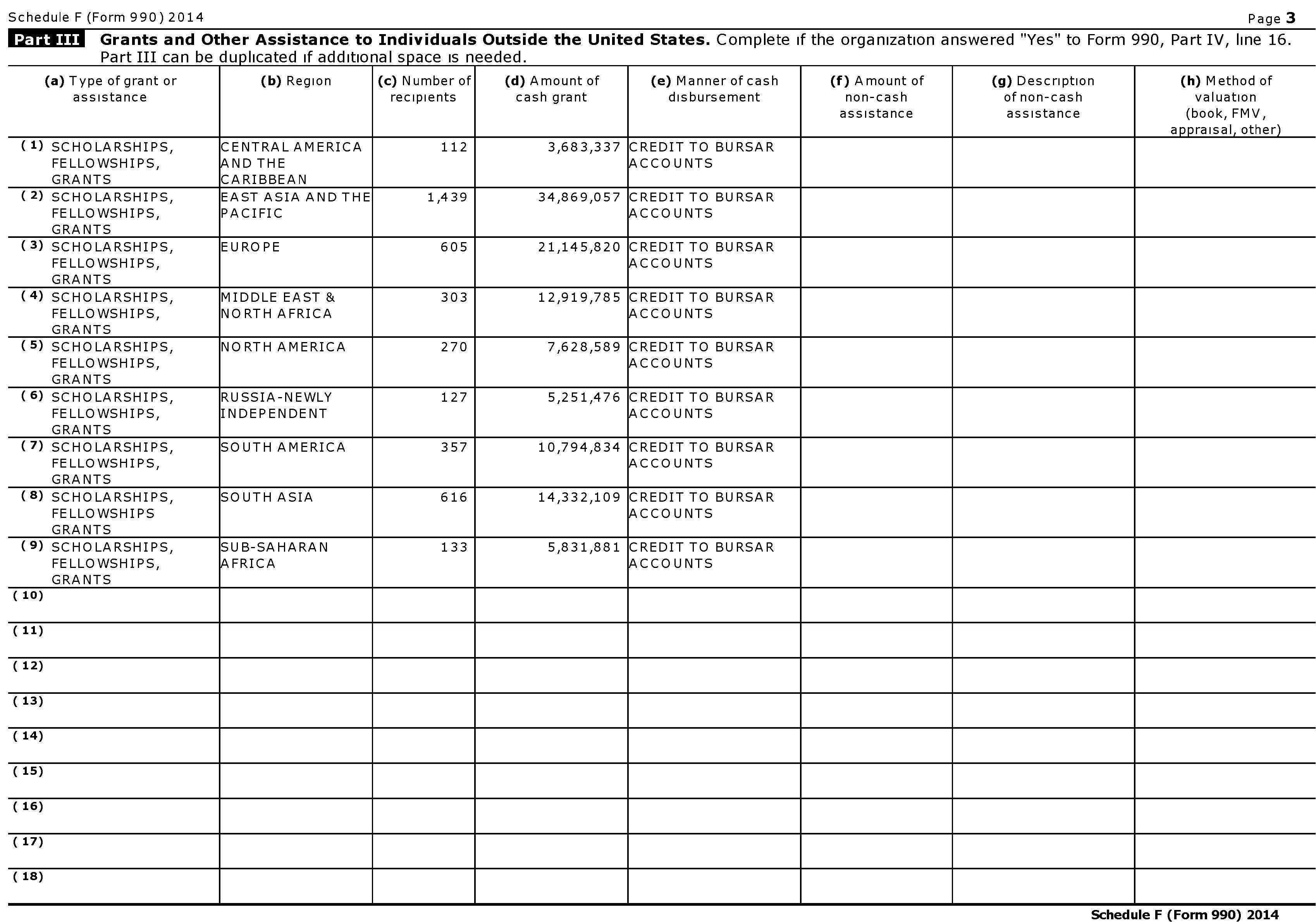

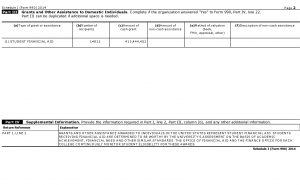

Student Aid

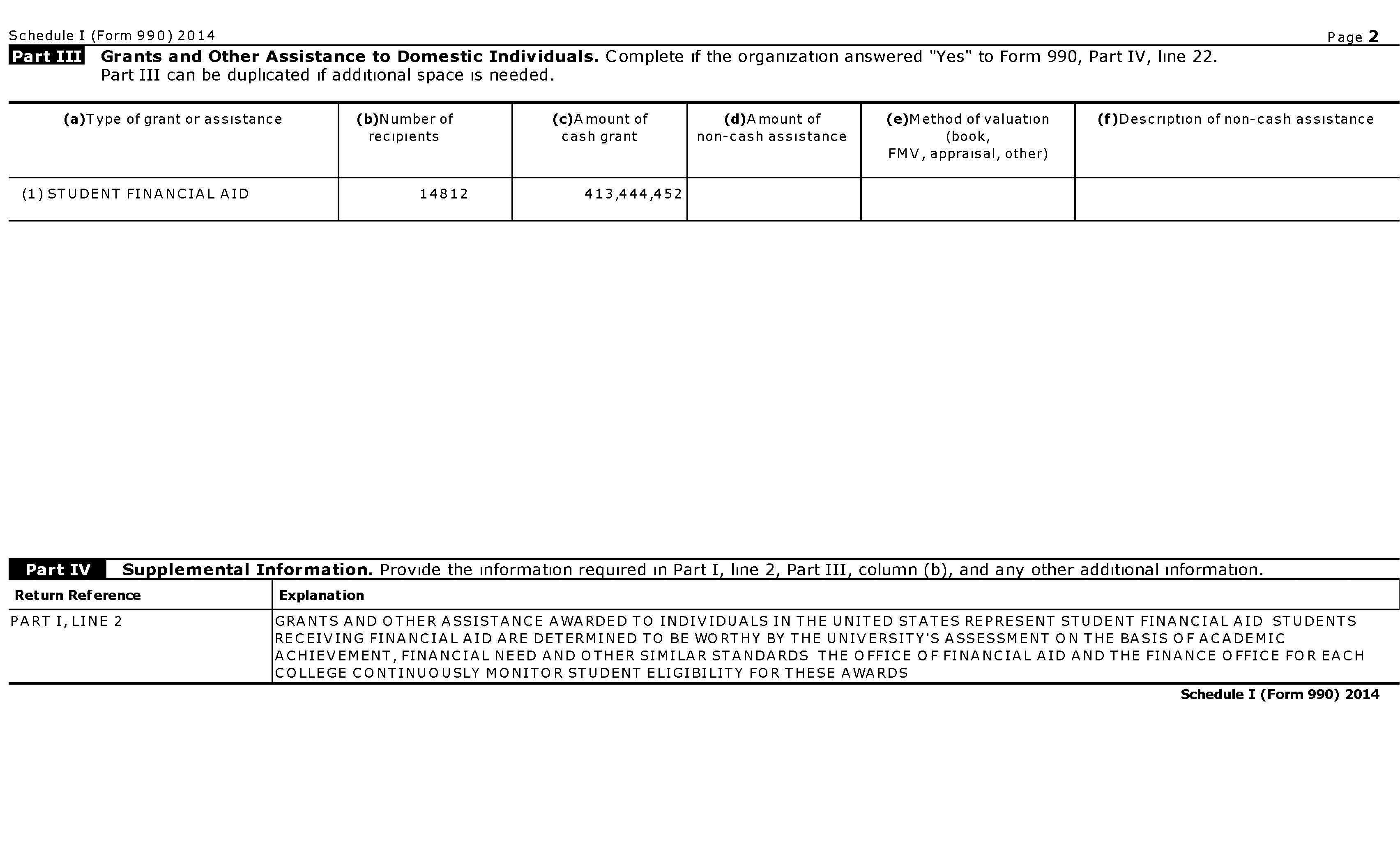

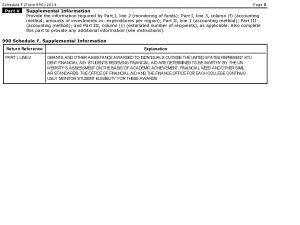

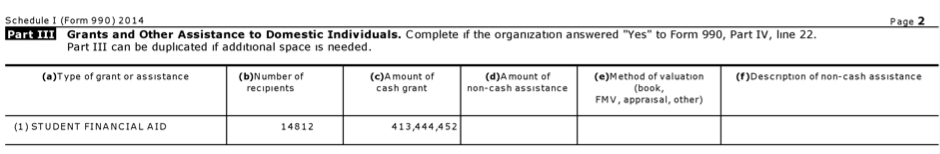

NYU spent approximately $413 million on financial aid for 14,812 students, serving approximately 26 percent* of the student body. As of Fall 2014, the university had a total enrollment of 57,245 students, according to NYU At A Glance. This means that if NYU were to award each student in the university with financial aid, they would receive an average of $7,124.60. An average of $27,882.798 was spent on each of the 14,812 students who were actually awarded financial aid.

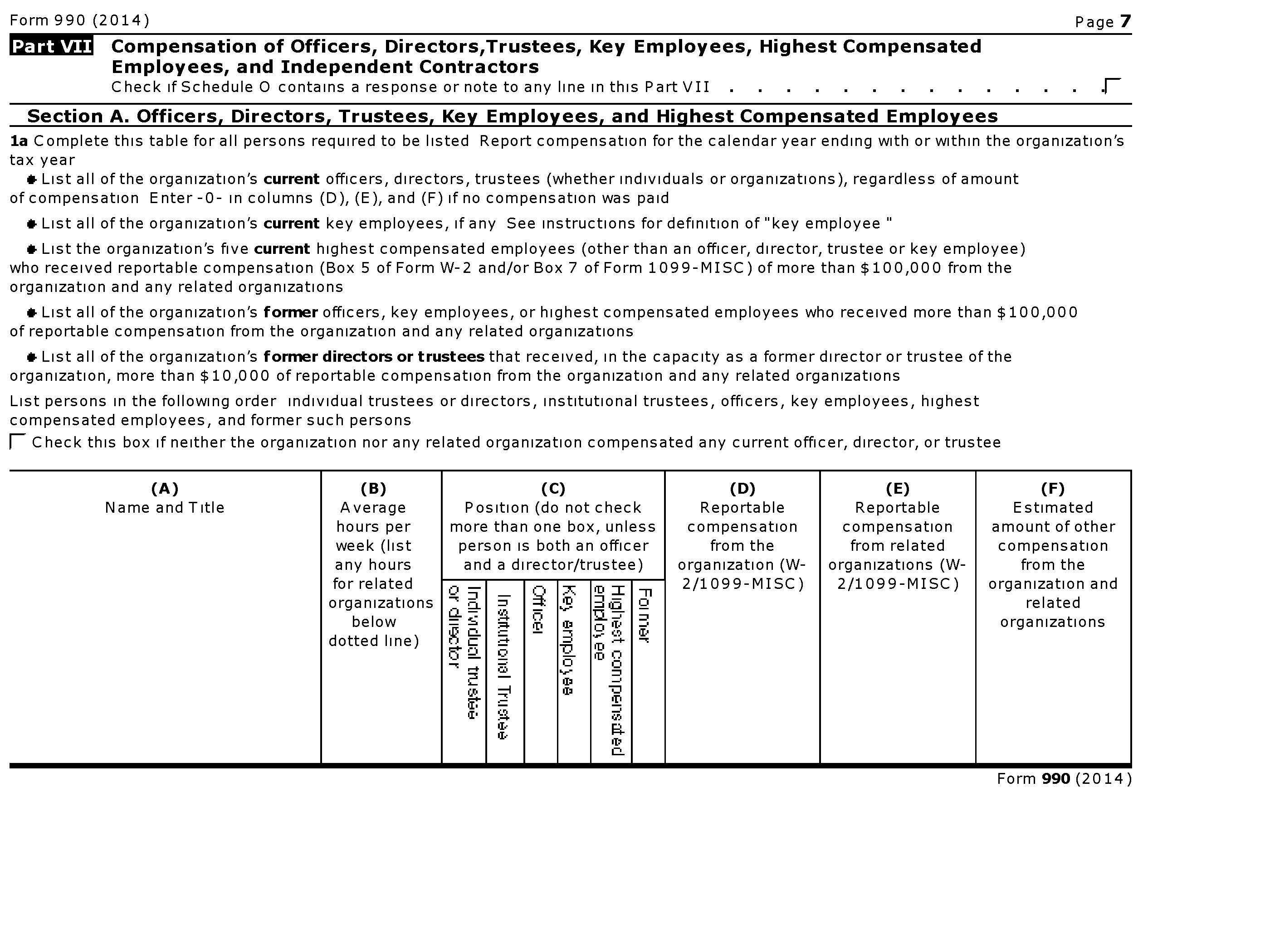

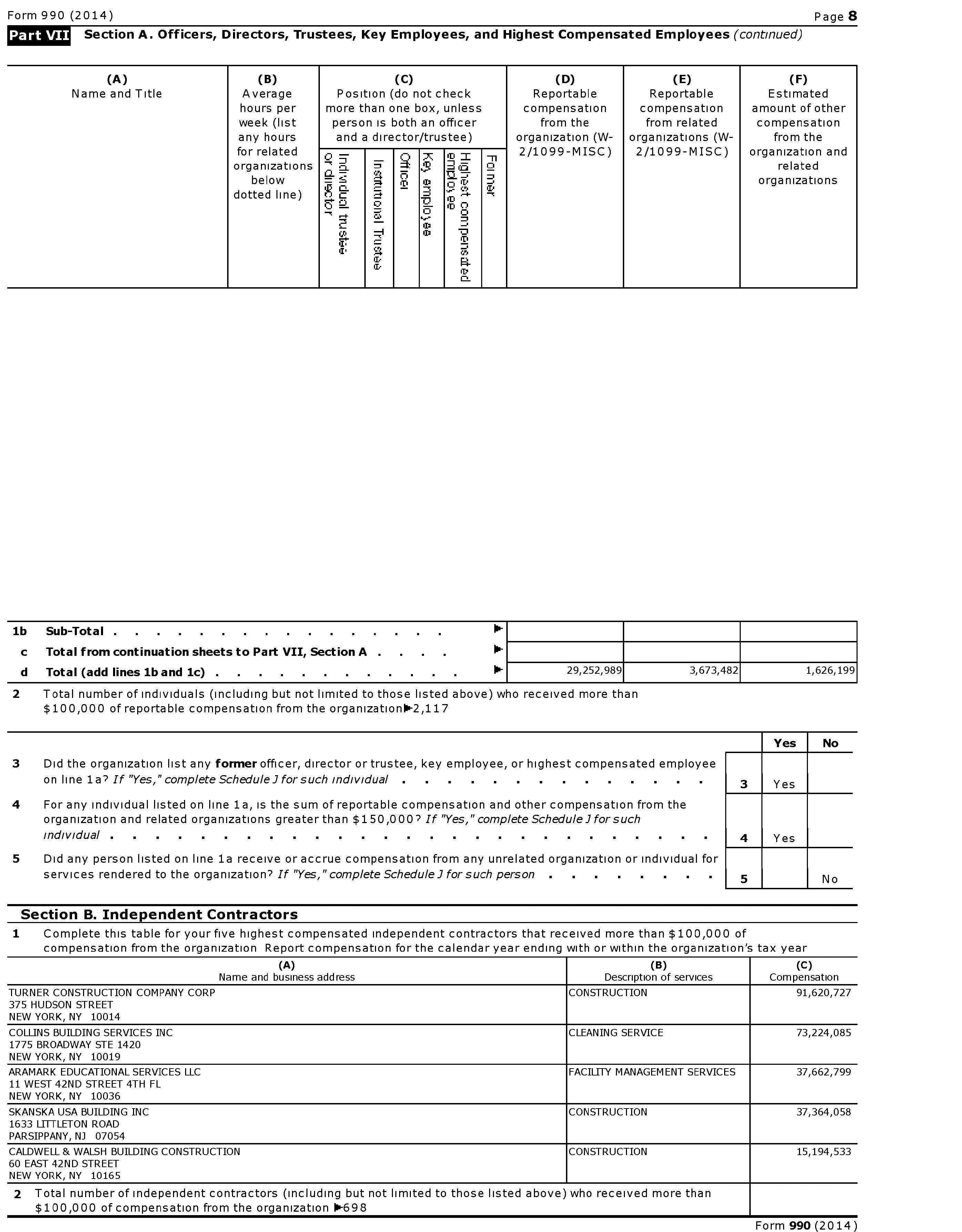

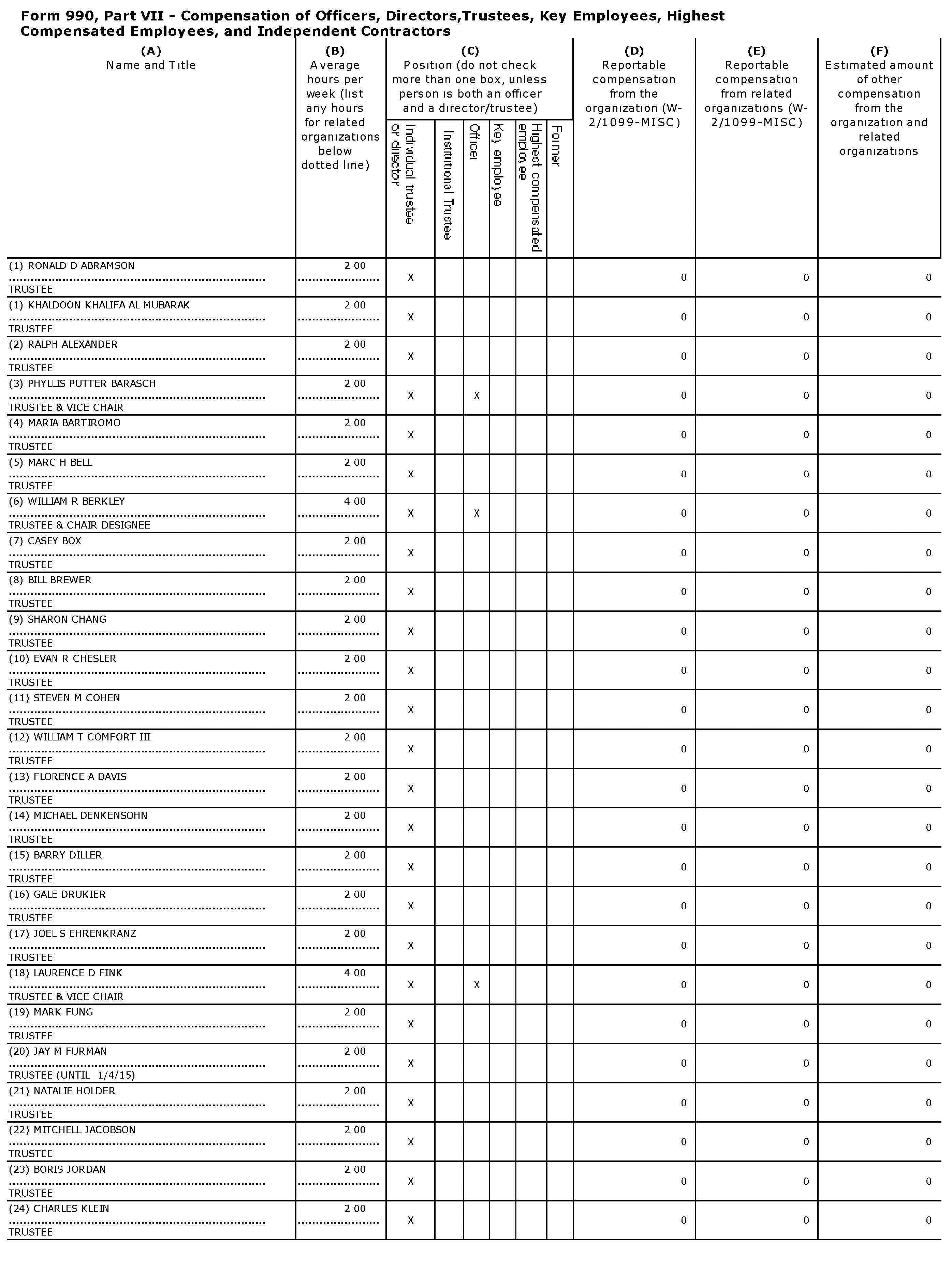

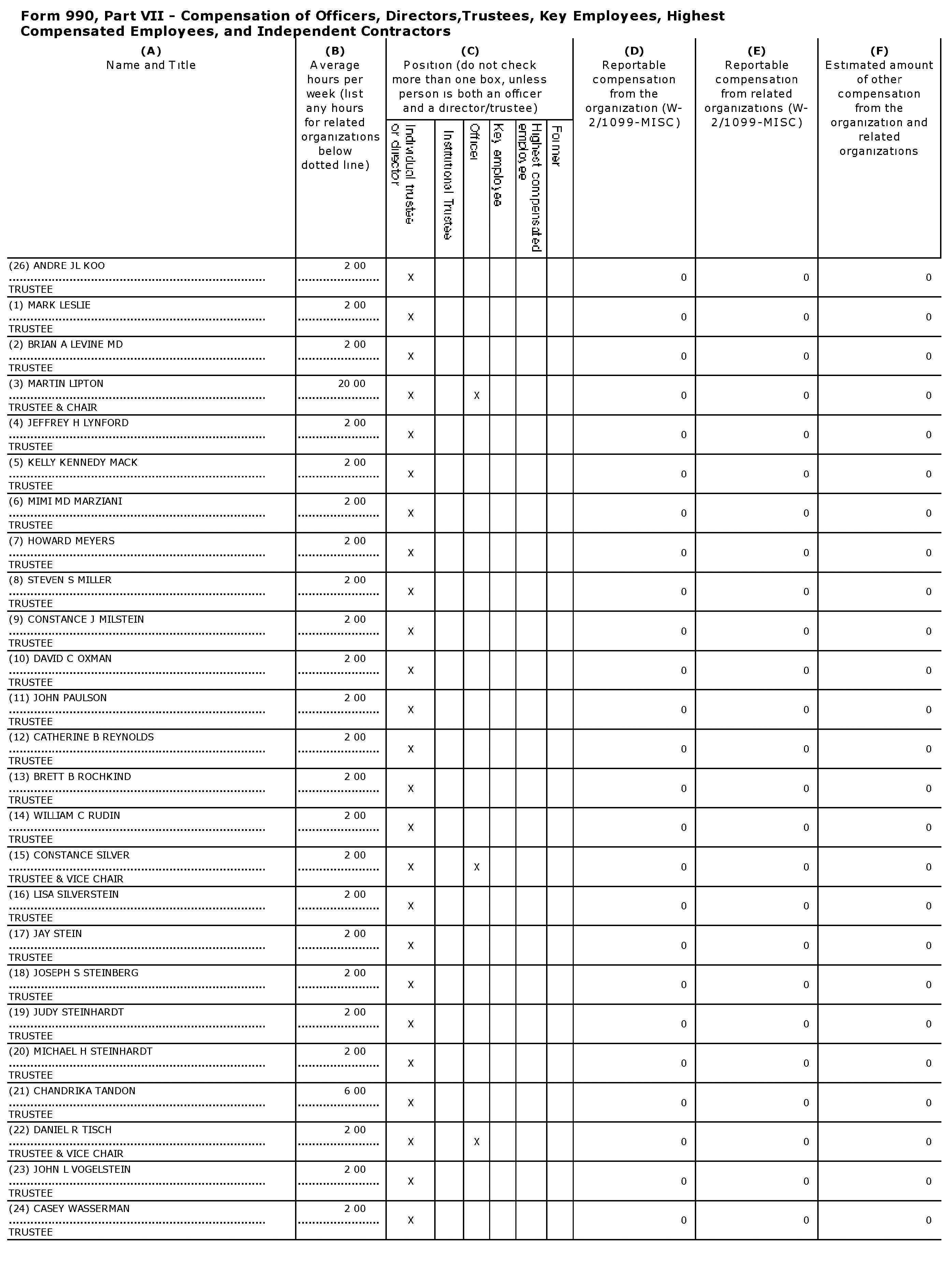

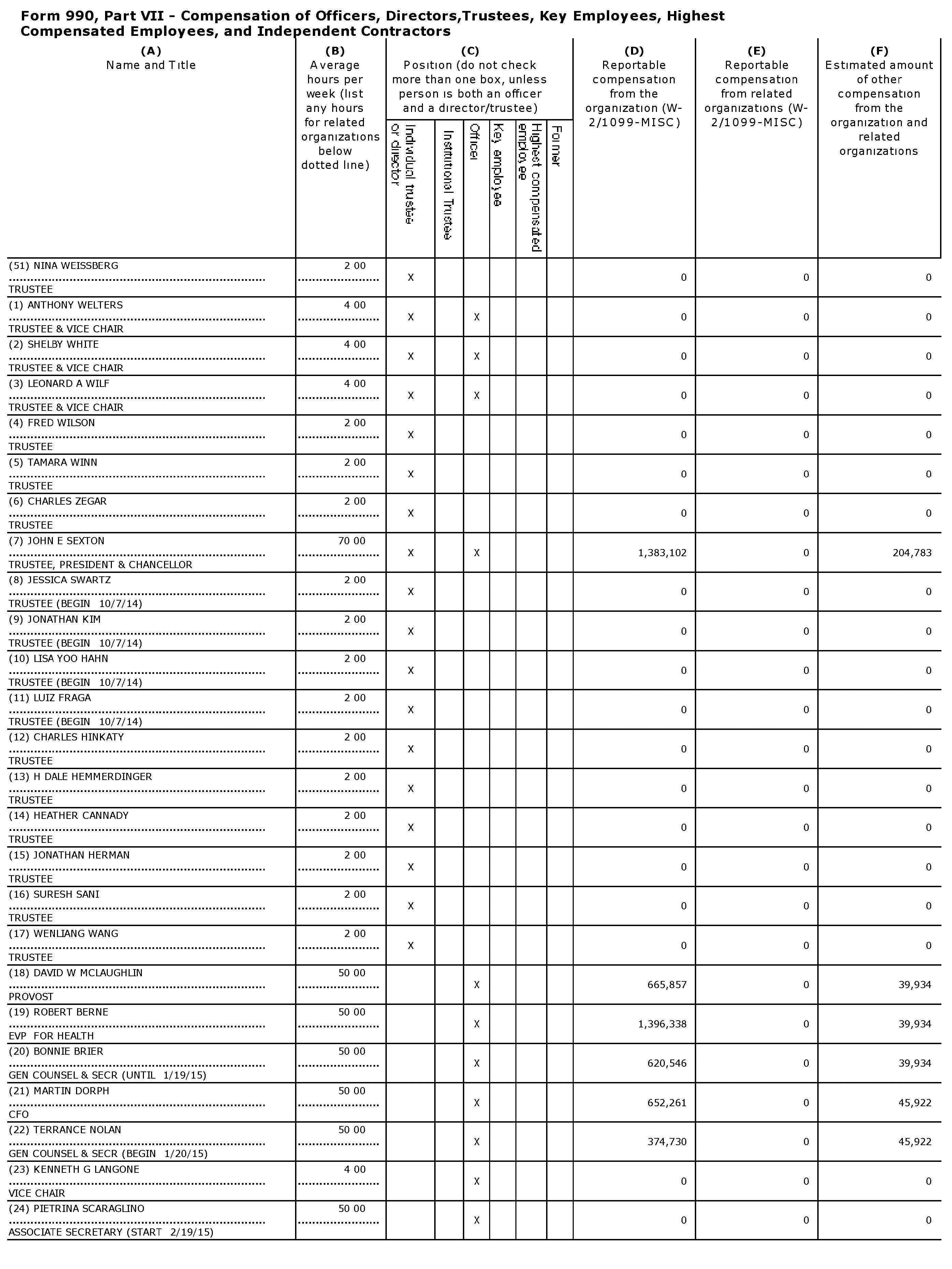

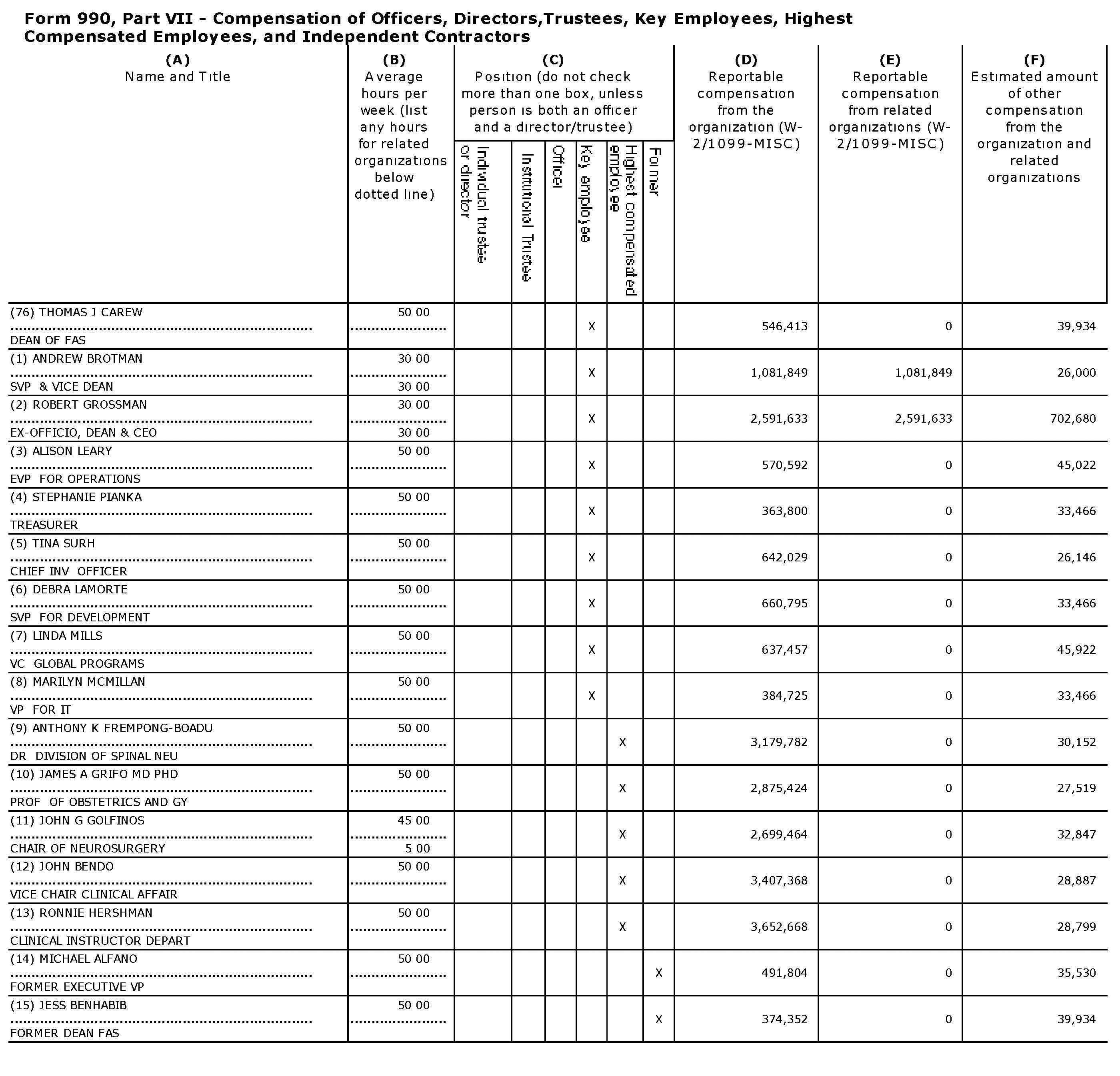

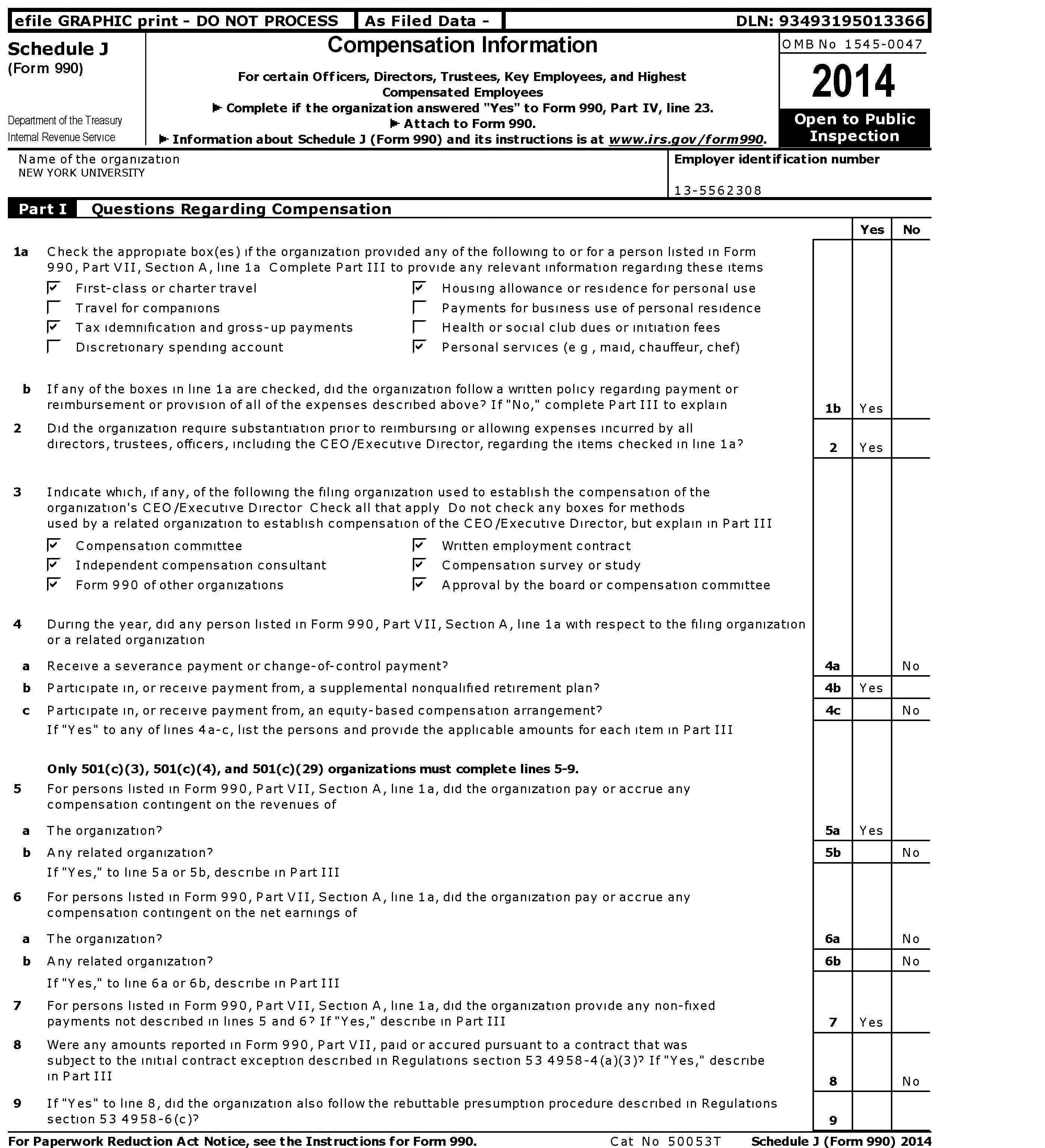

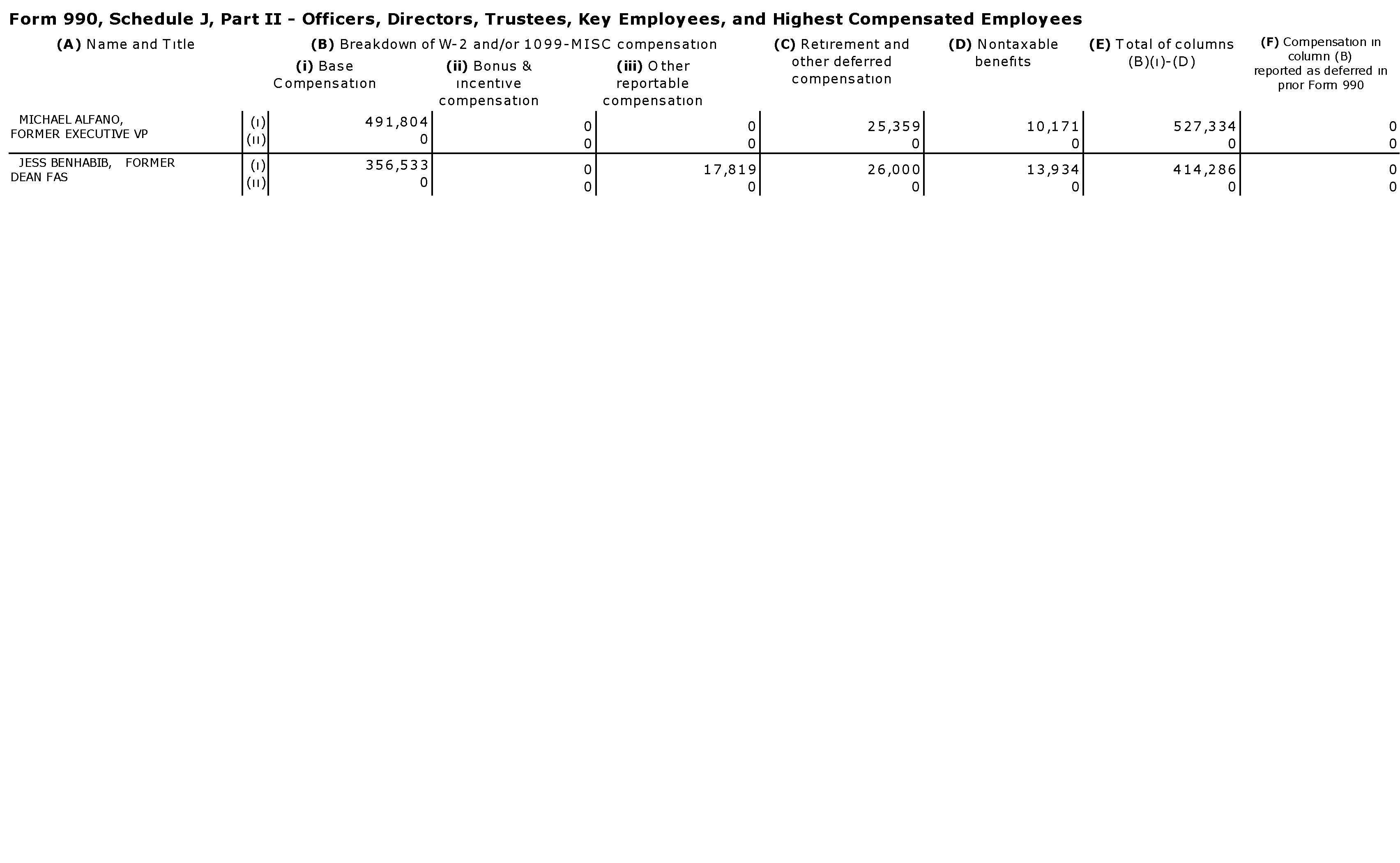

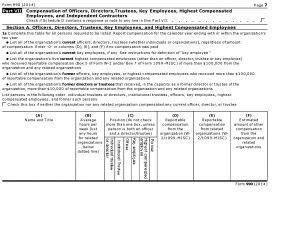

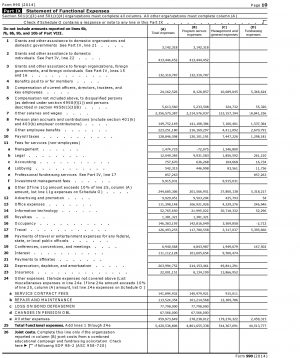

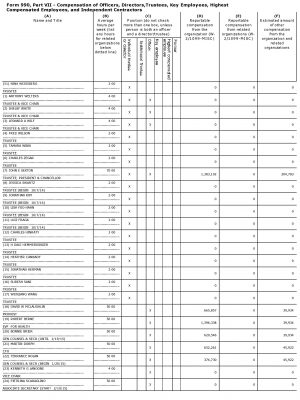

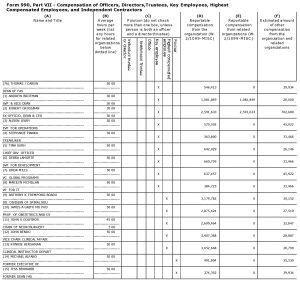

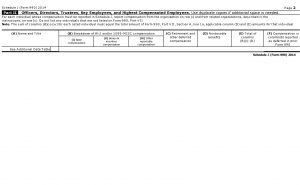

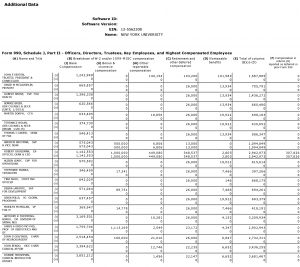

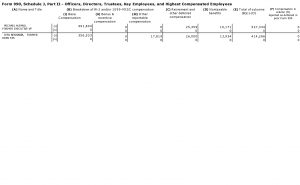

Salaries

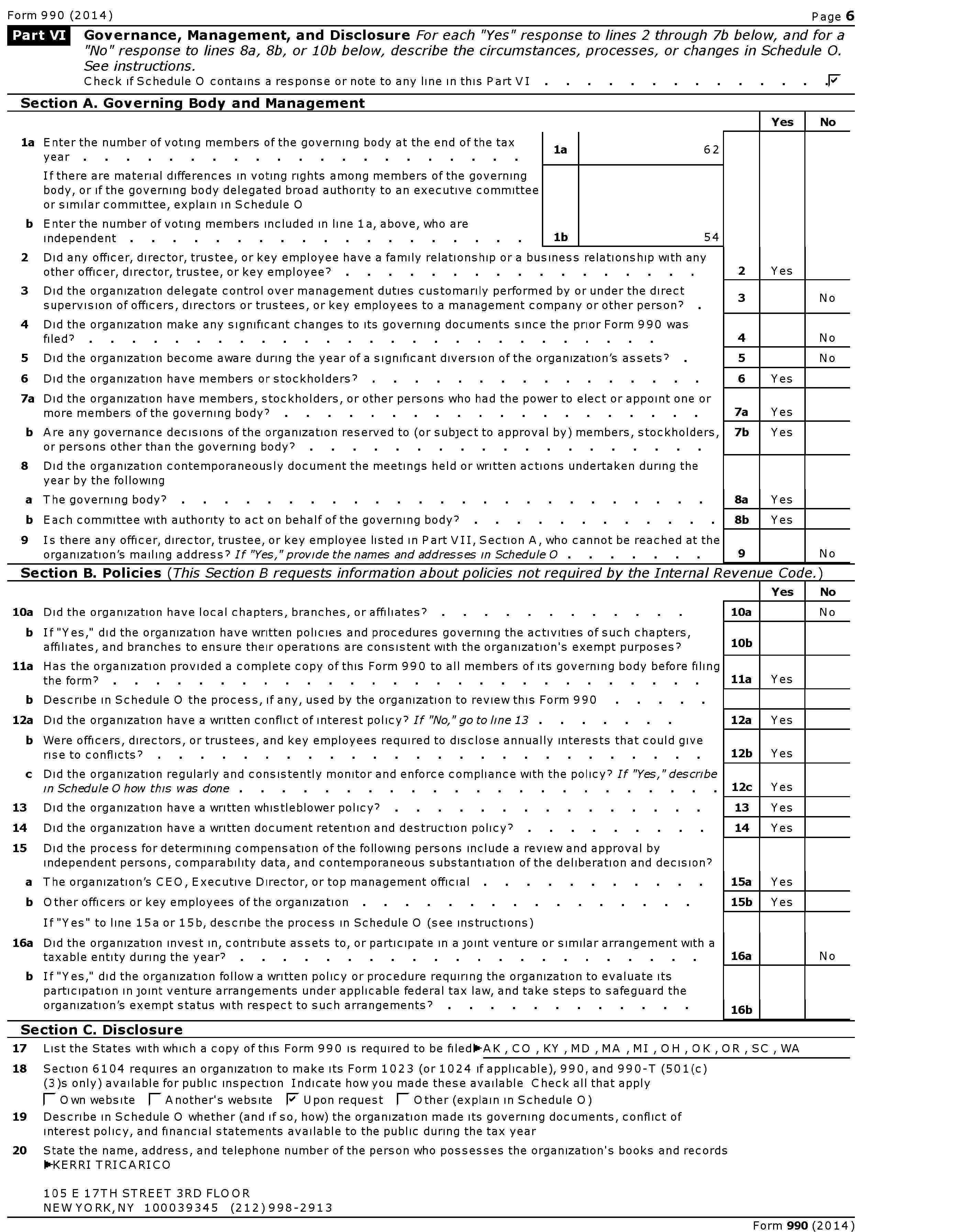

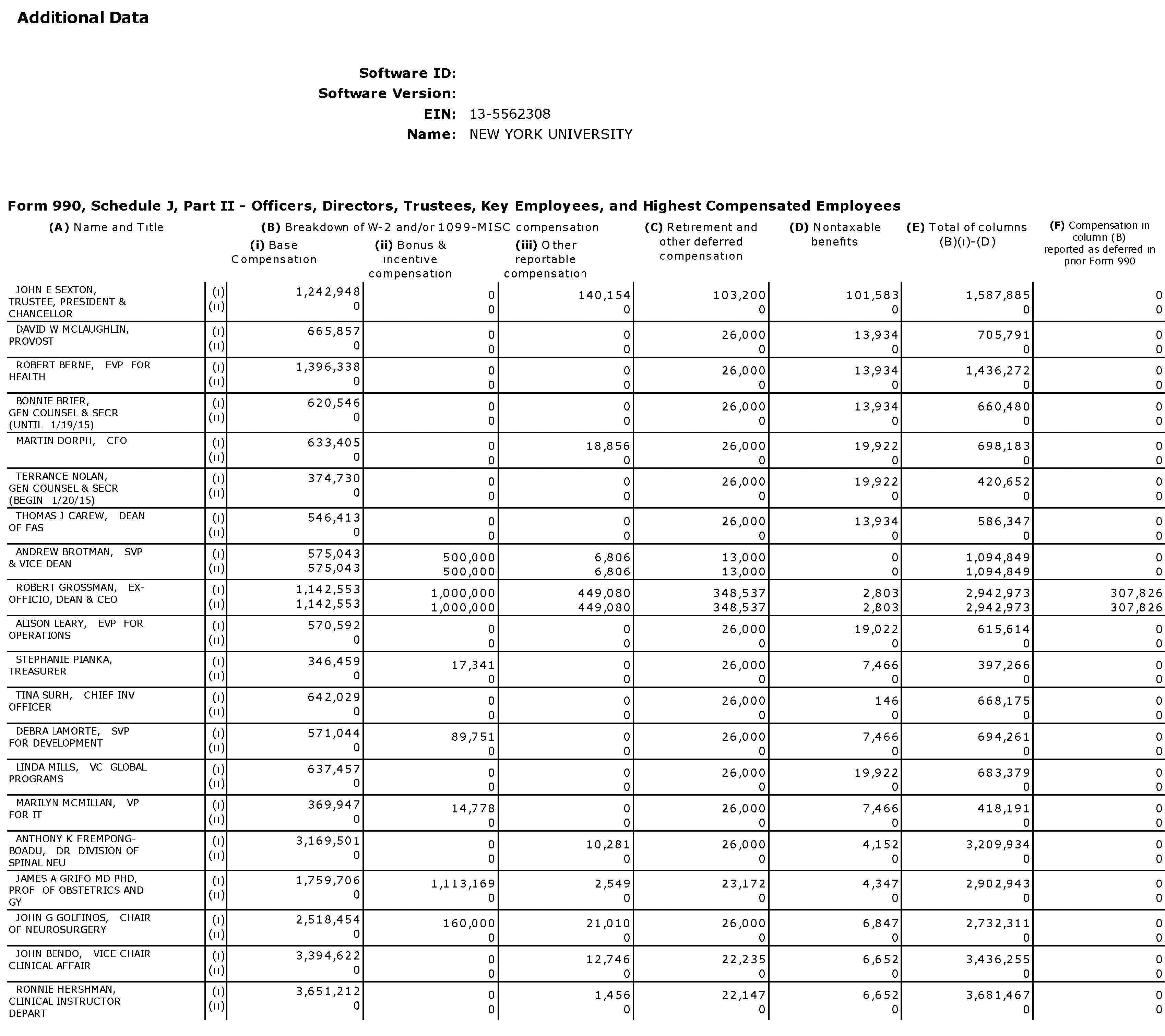

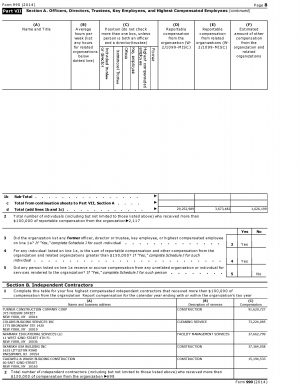

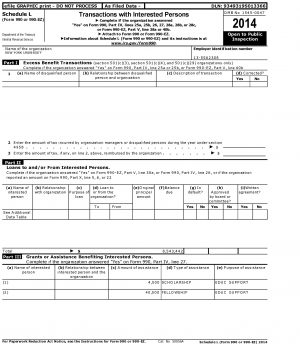

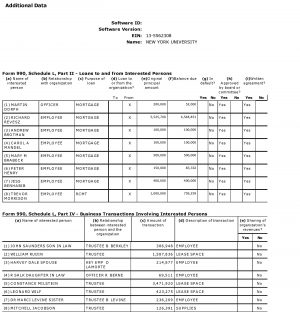

The 17 highest-paid administrators and key employees (as described in the document), earned an average annual salary of $790,487 and worked an average of 48.8 hours a week.

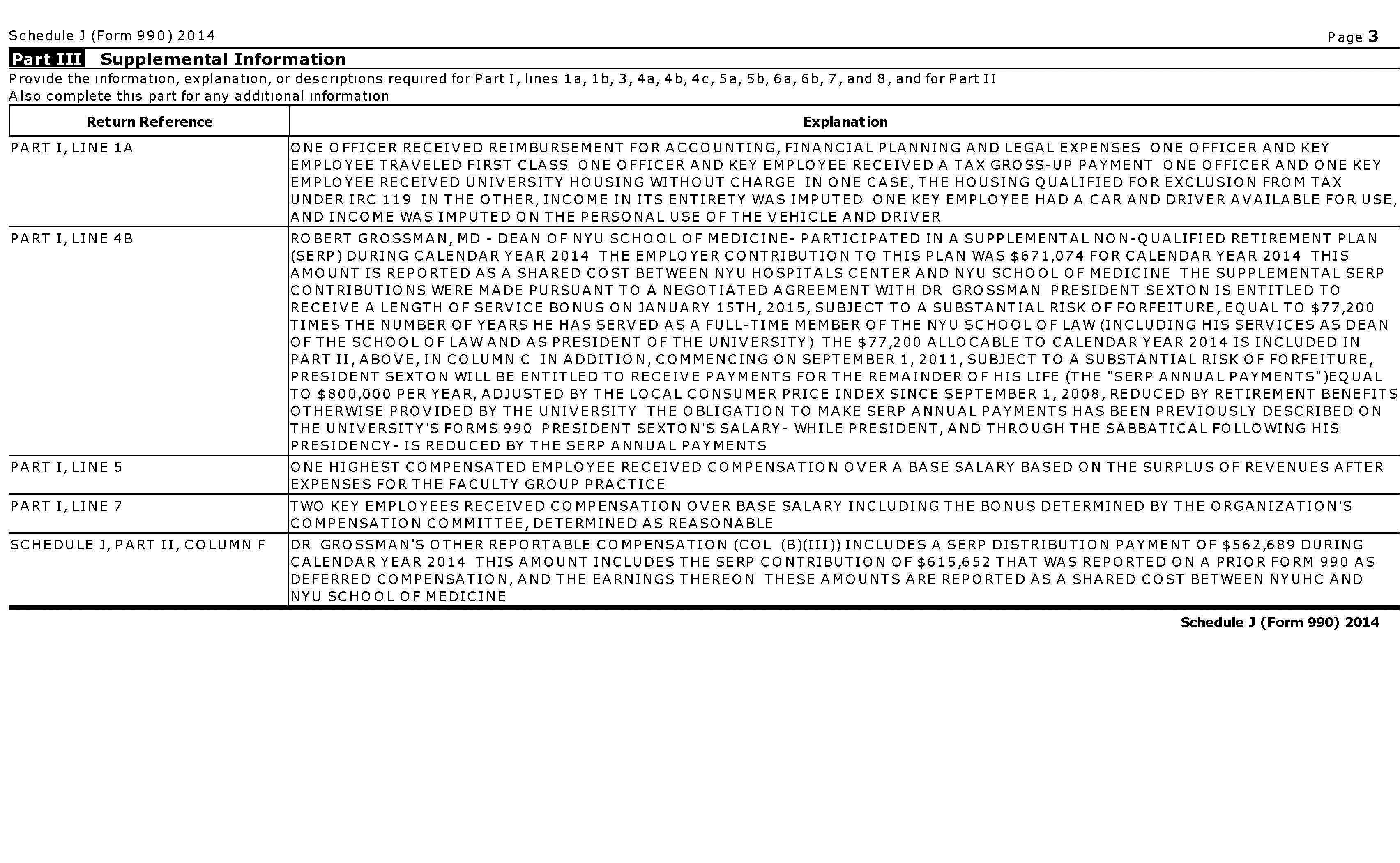

Former President John Sexton made a $1.4 million salary, earned $200,000 in other compensation and worked 70 hours a week. In 2014, Robert Grossman, dean of the NYU School of Medicine and CEO and Ex Officio Trustee of NYU Langone, made $2.6 million in salary and $700,000 in the form of a retirement plan contribution. Grossman worked 30 hours a week.

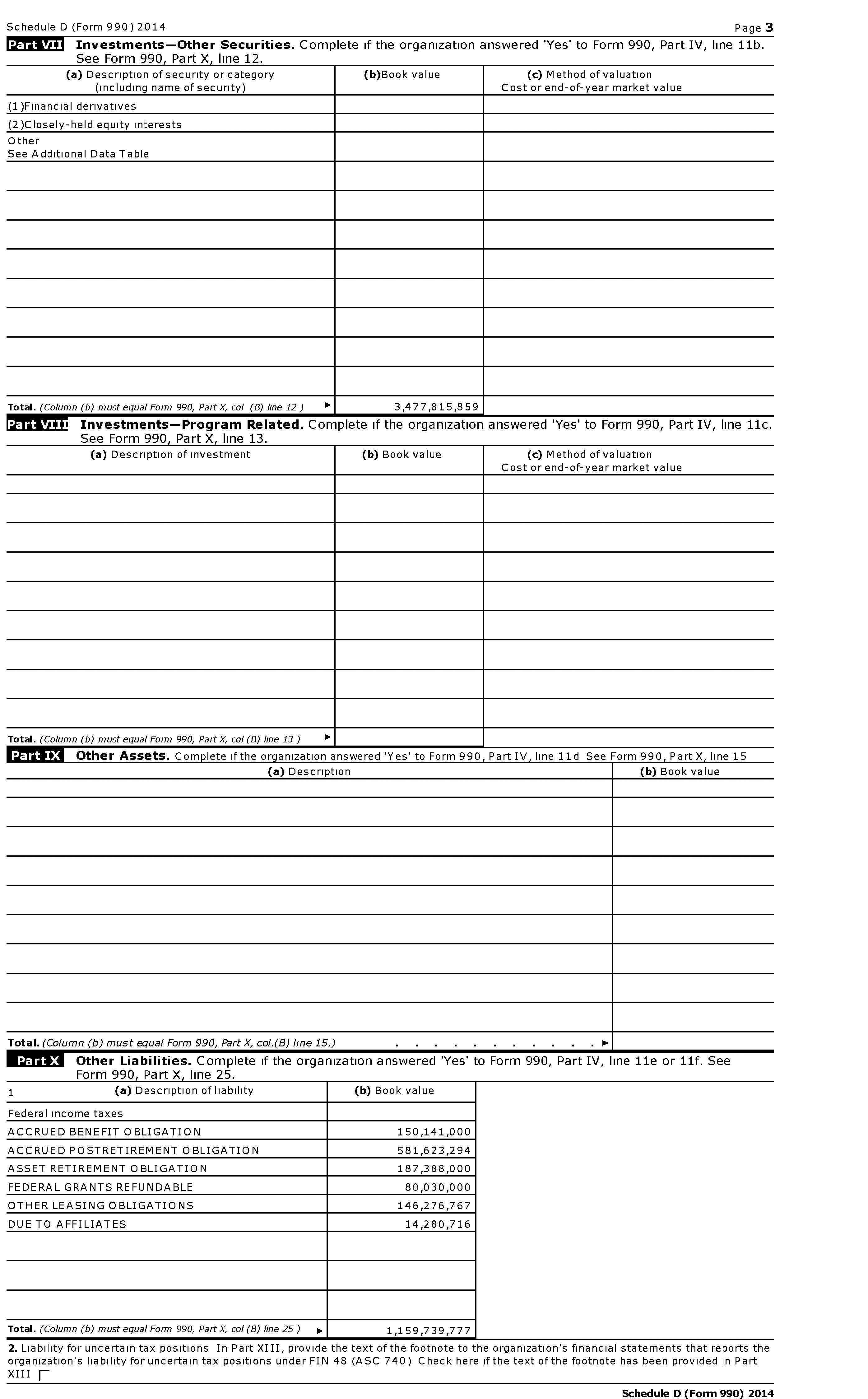

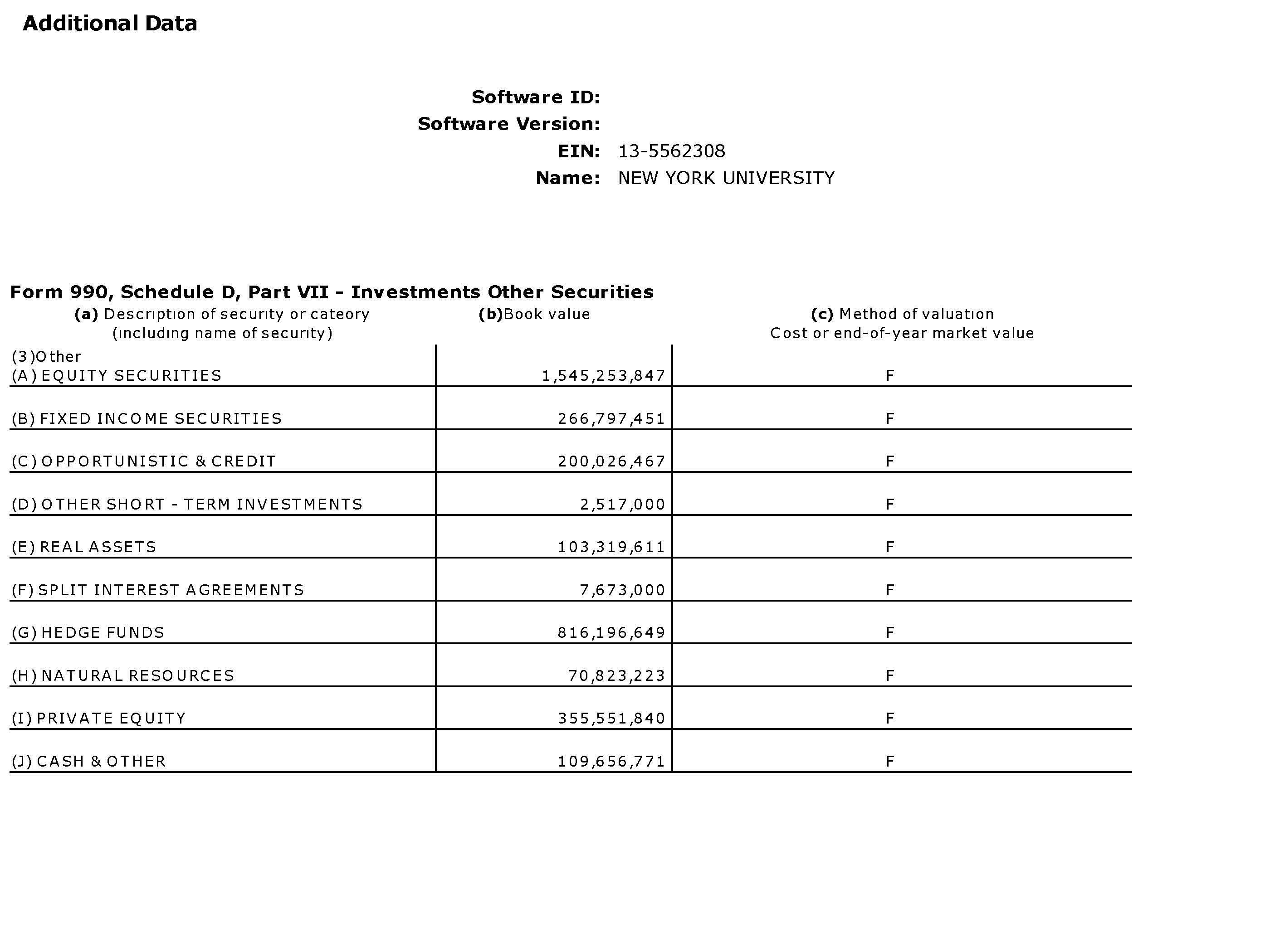

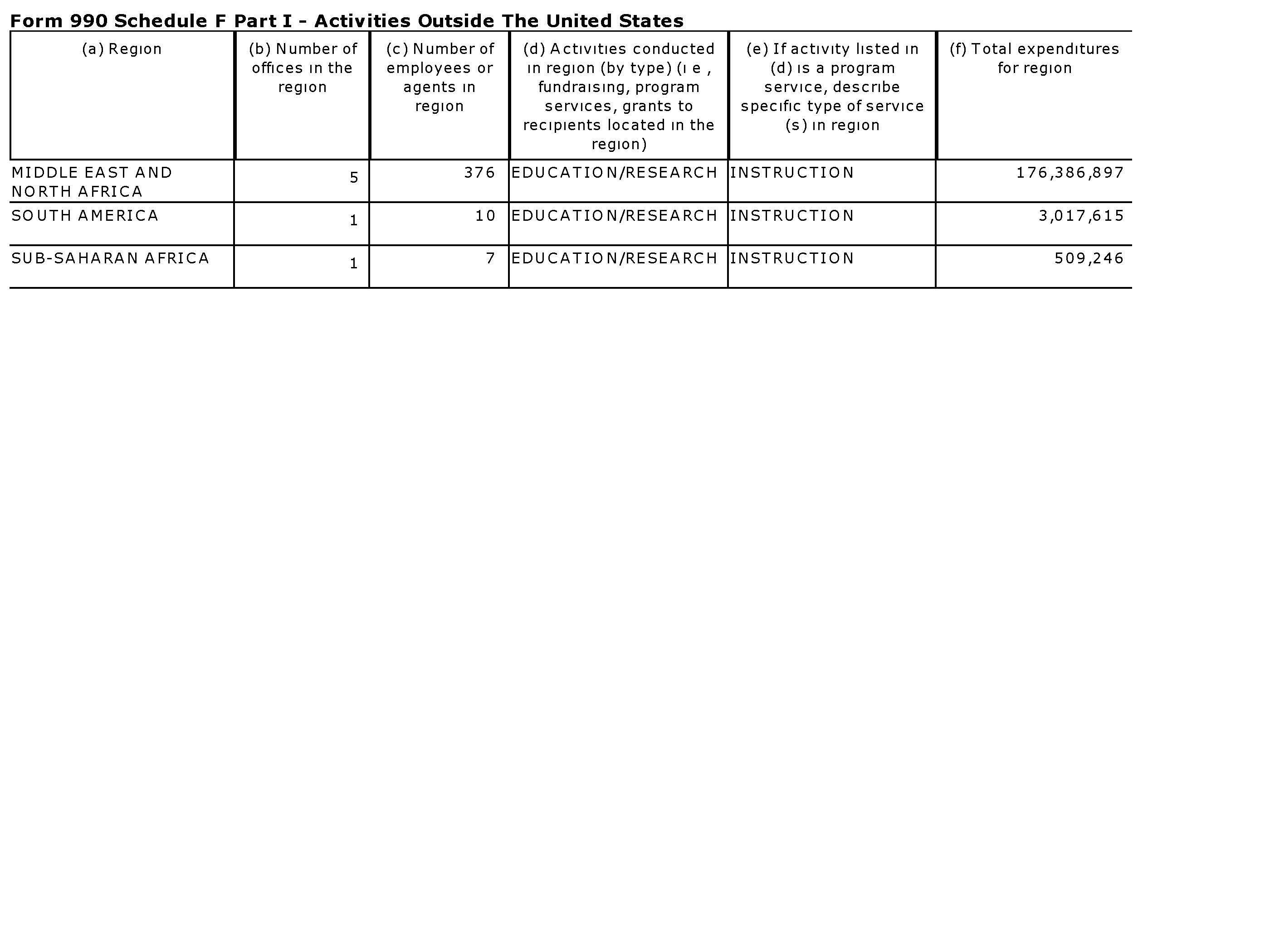

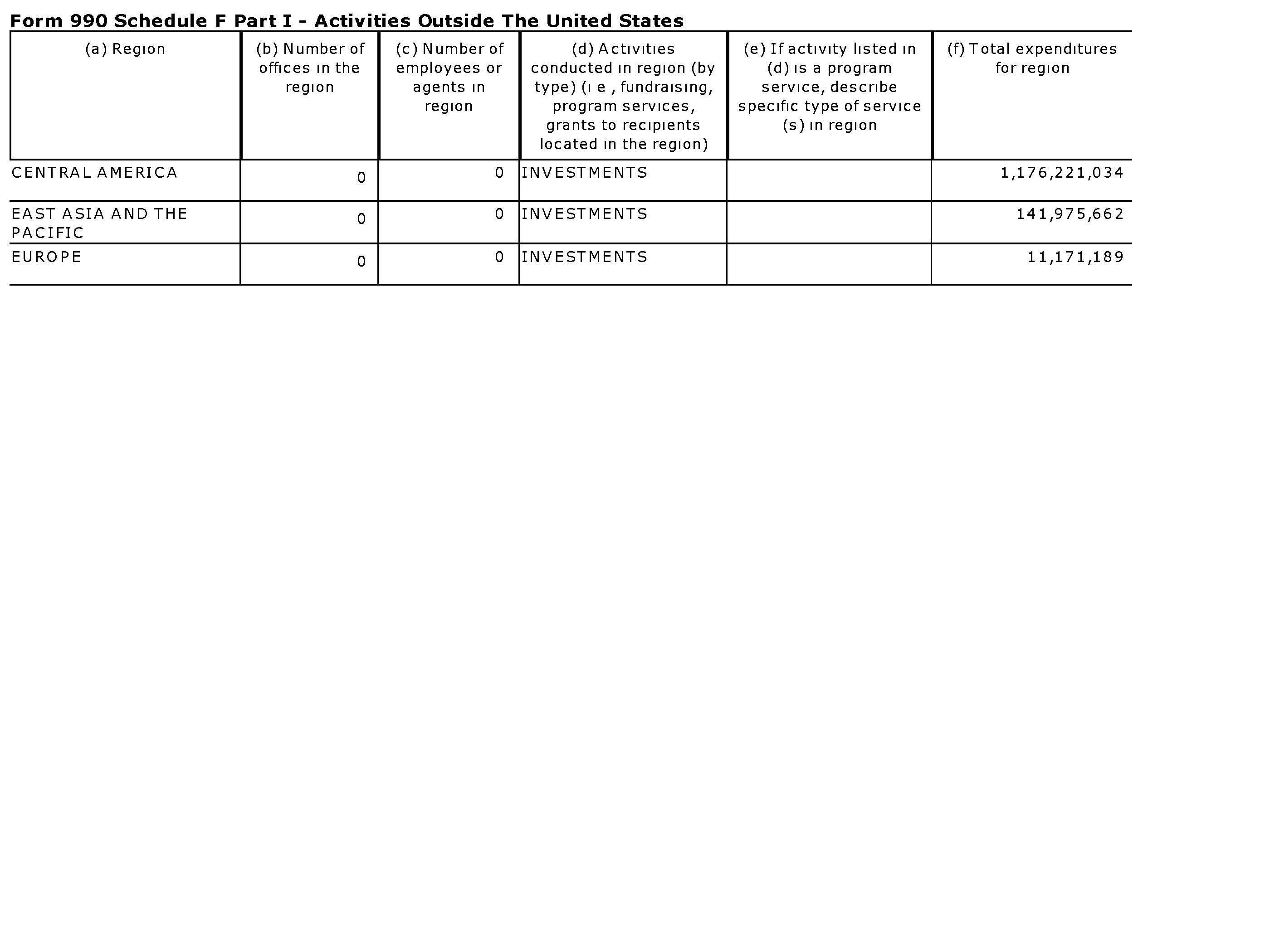

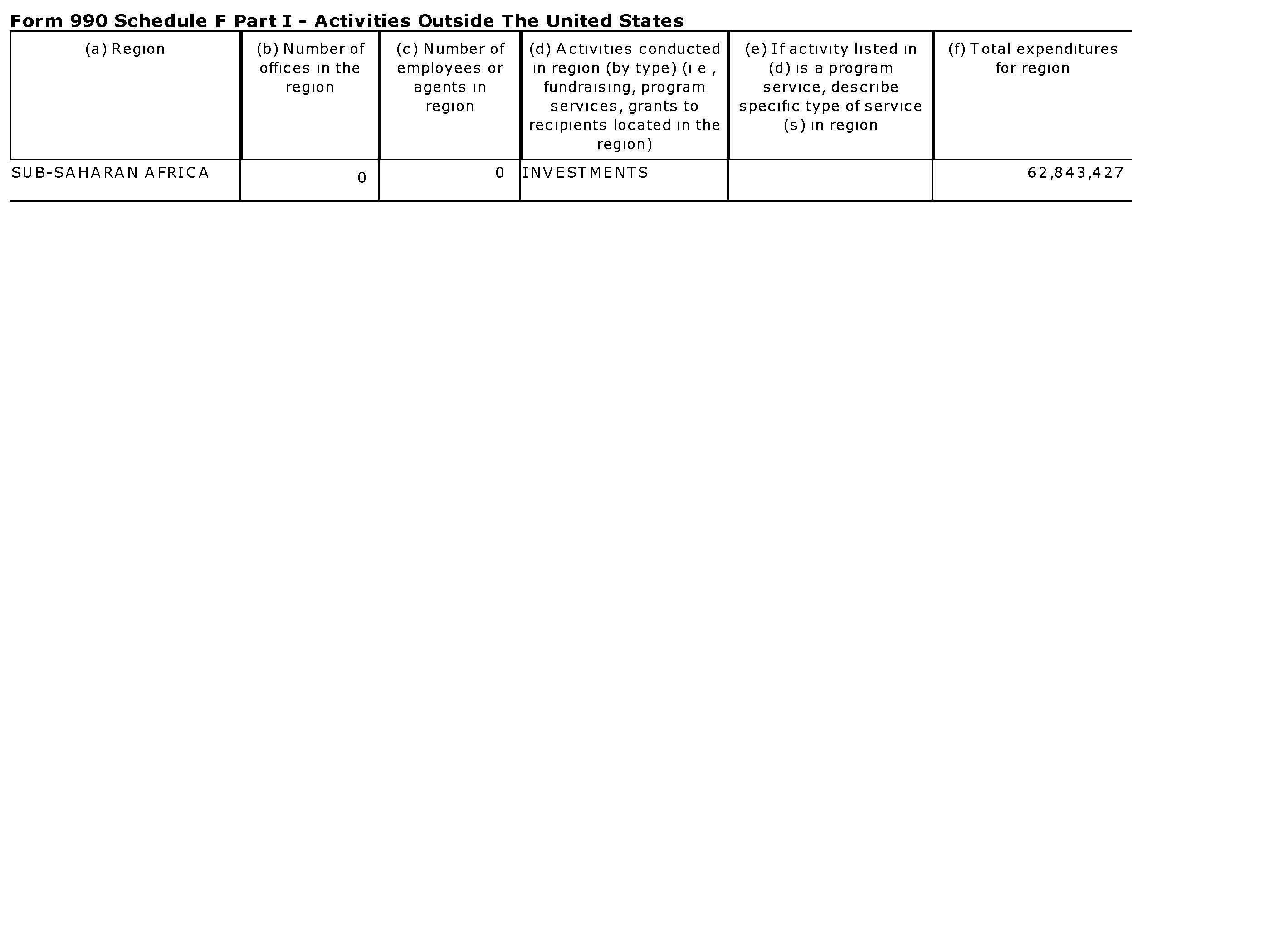

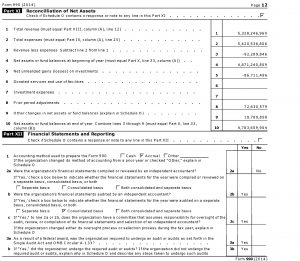

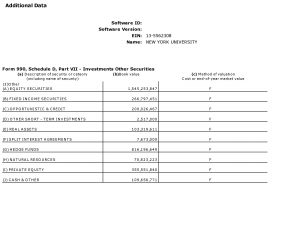

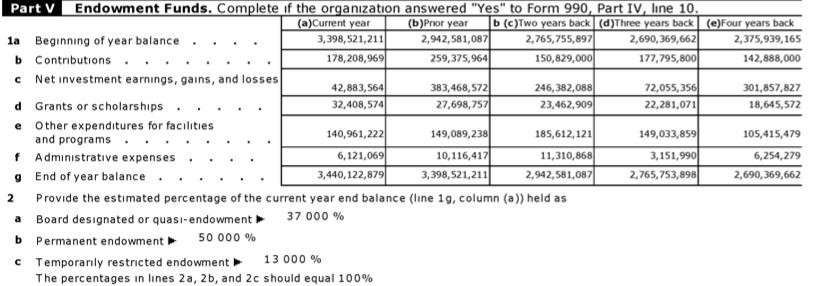

Investment

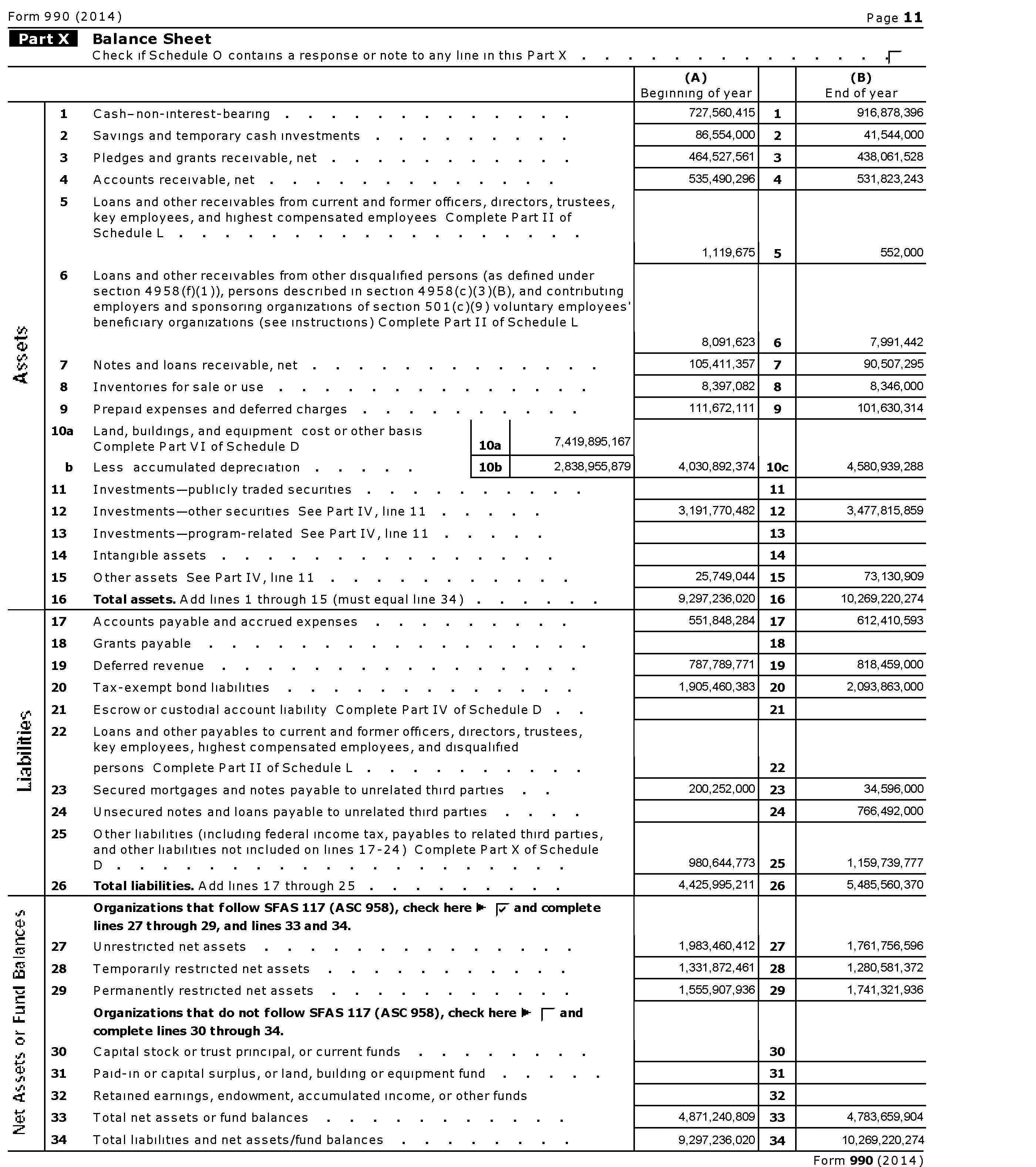

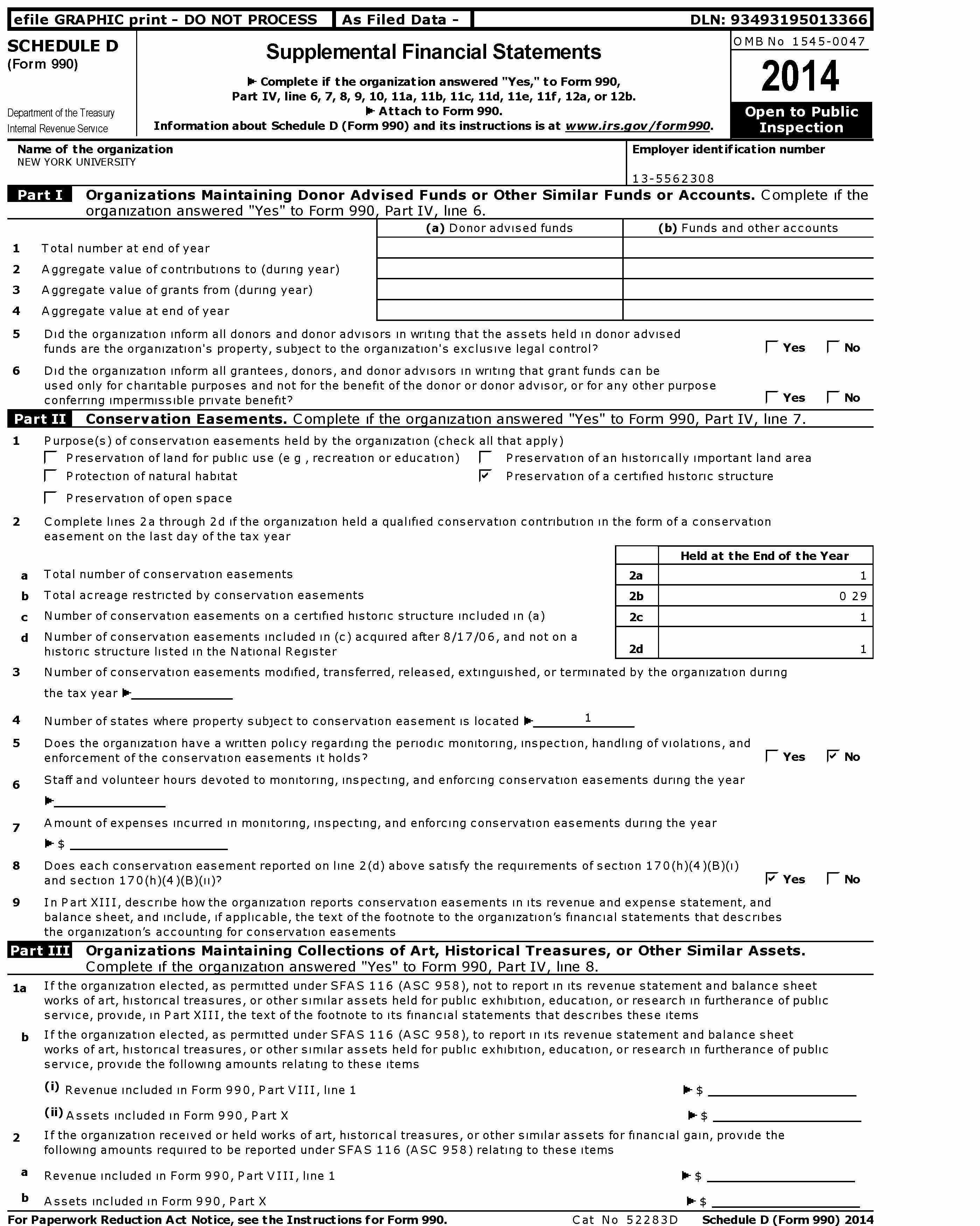

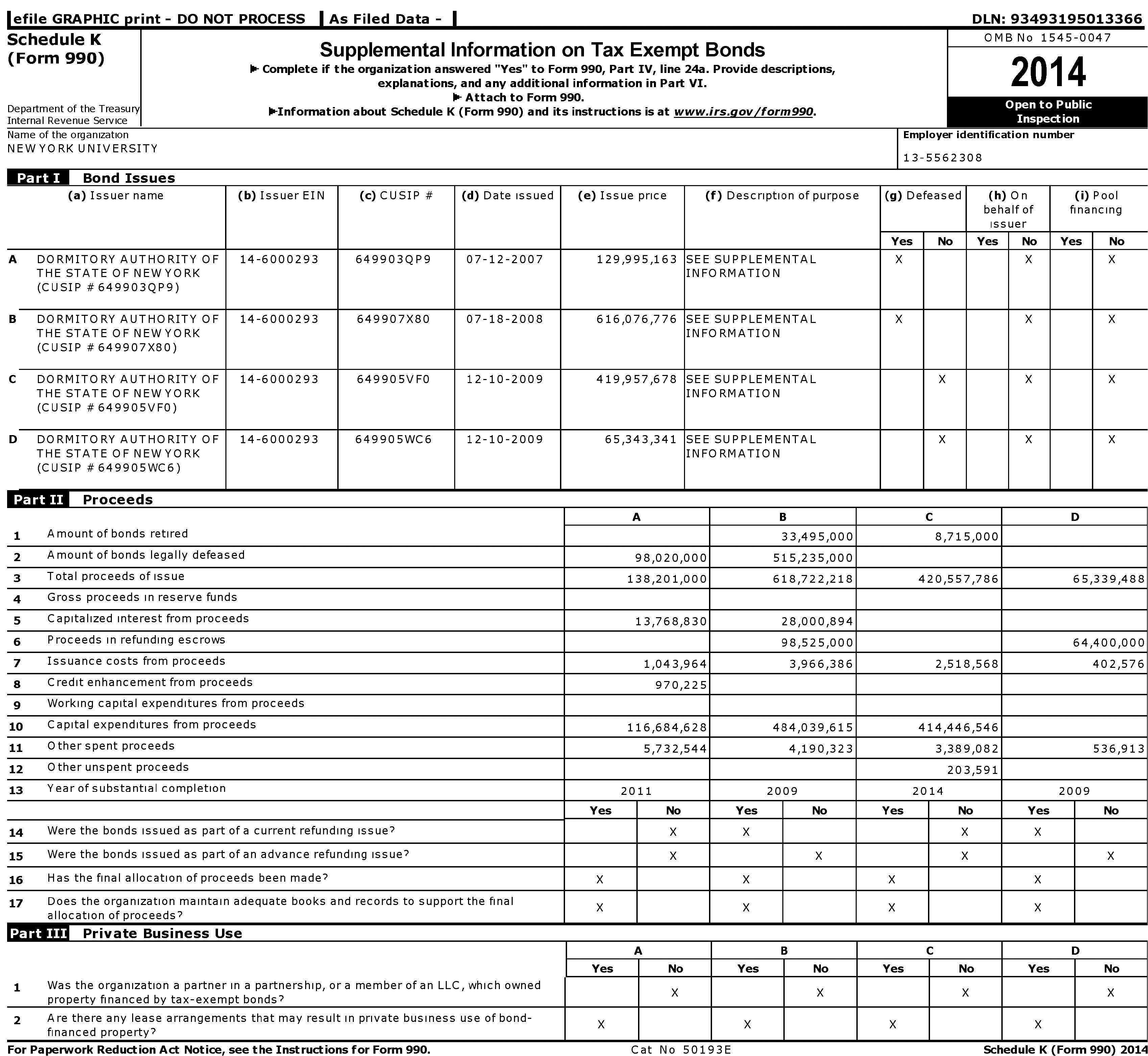

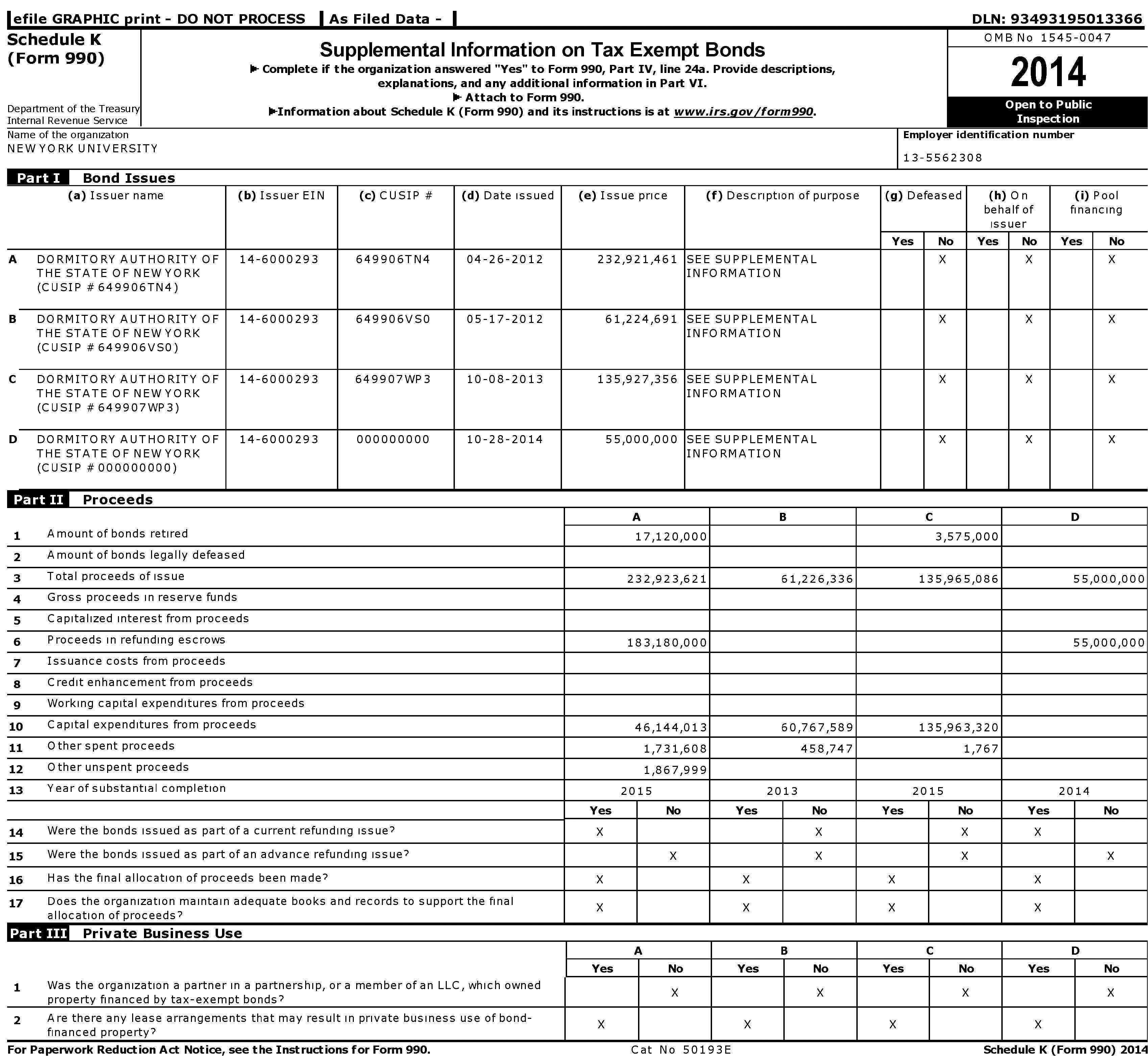

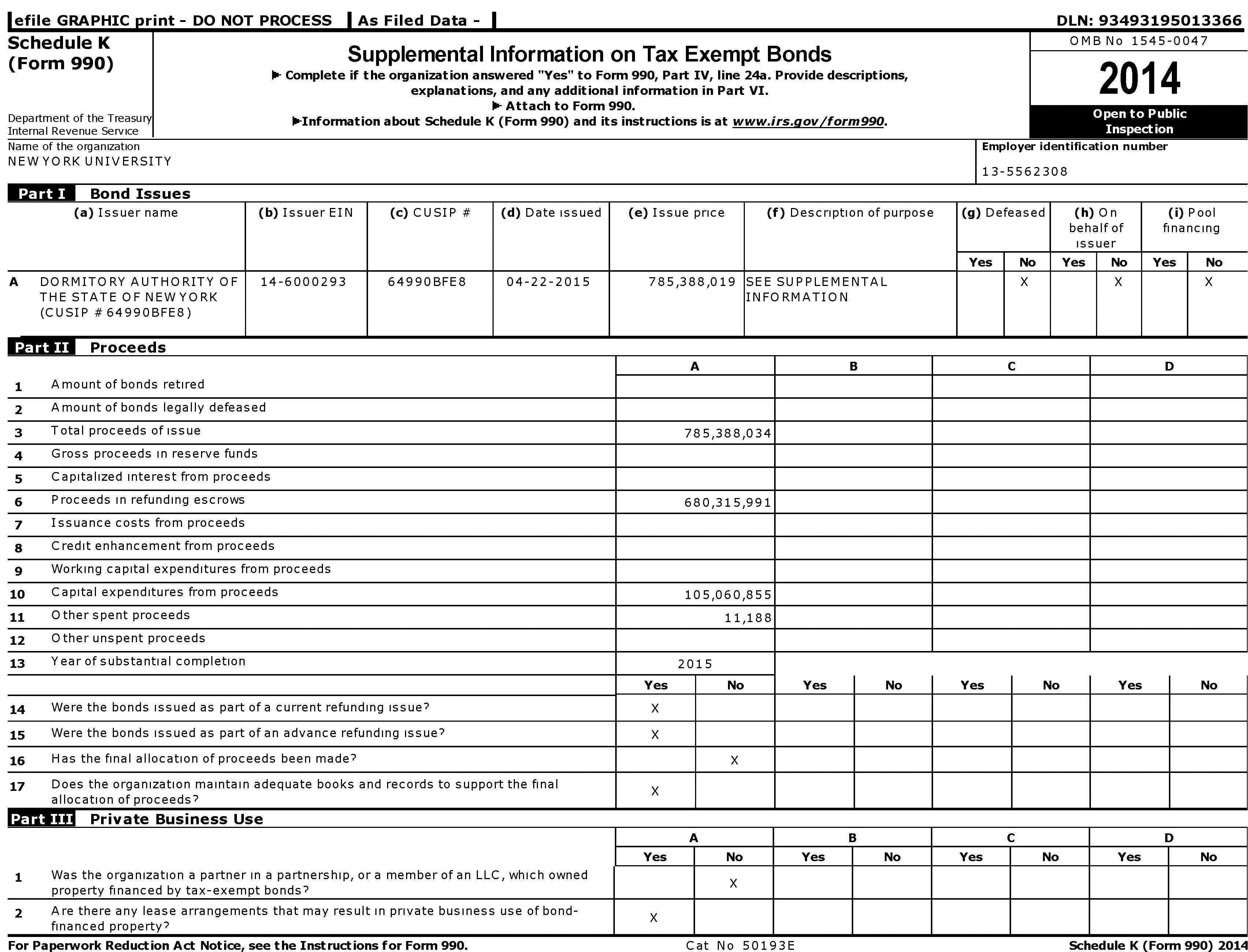

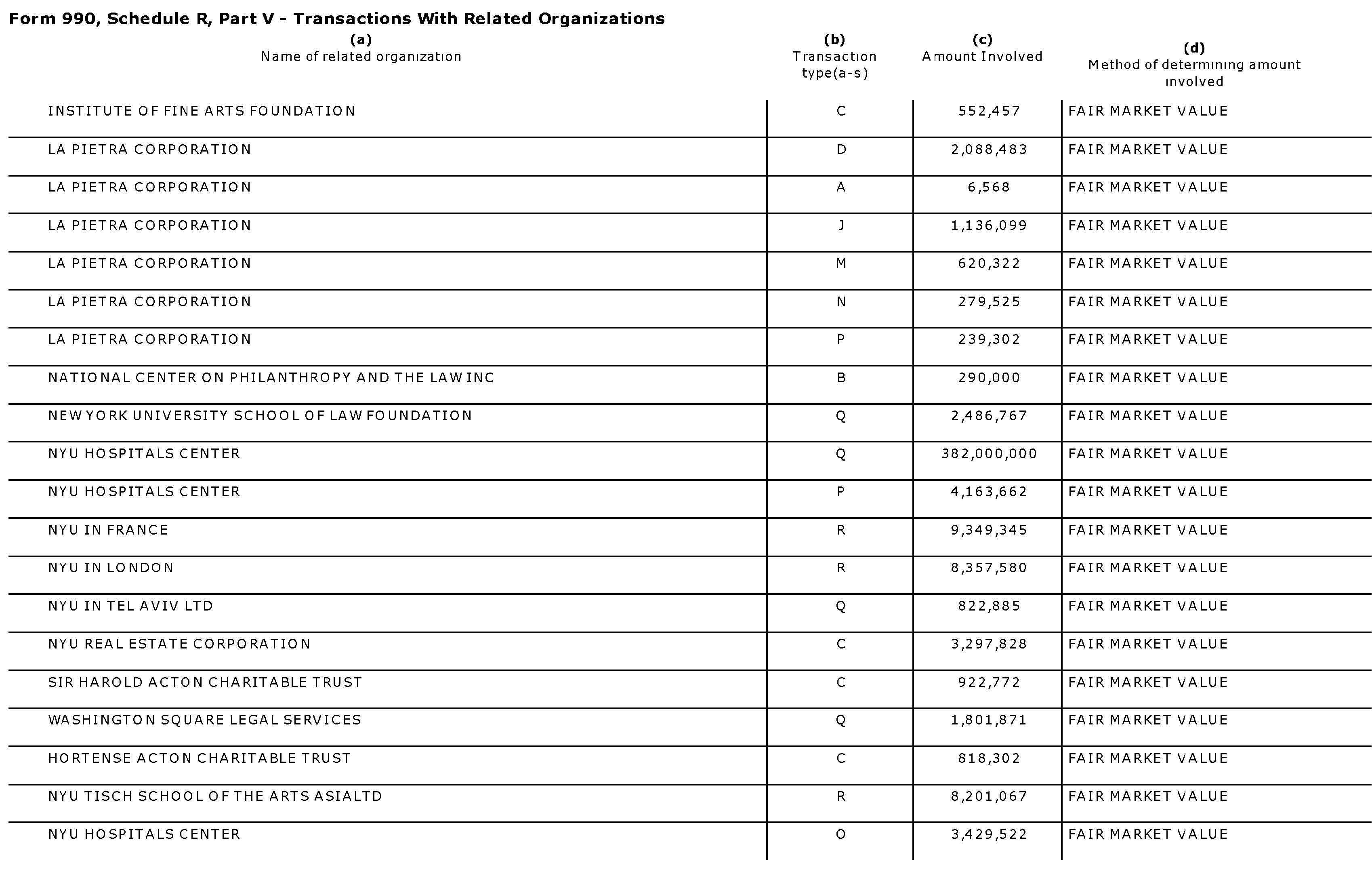

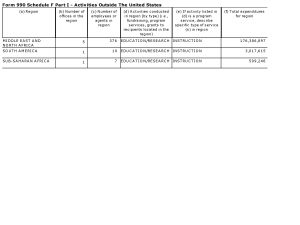

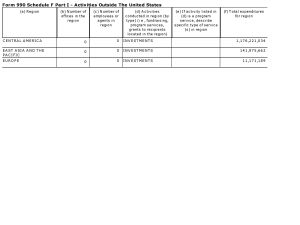

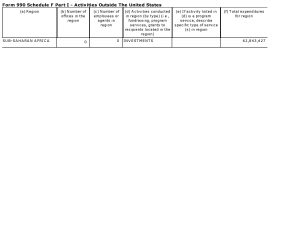

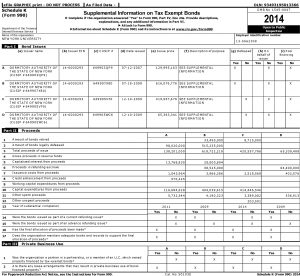

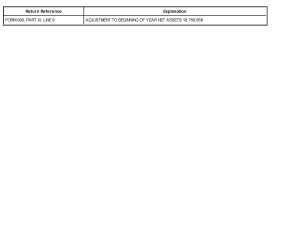

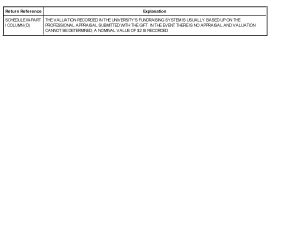

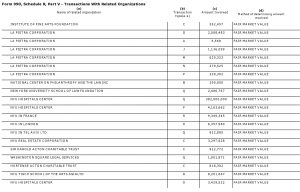

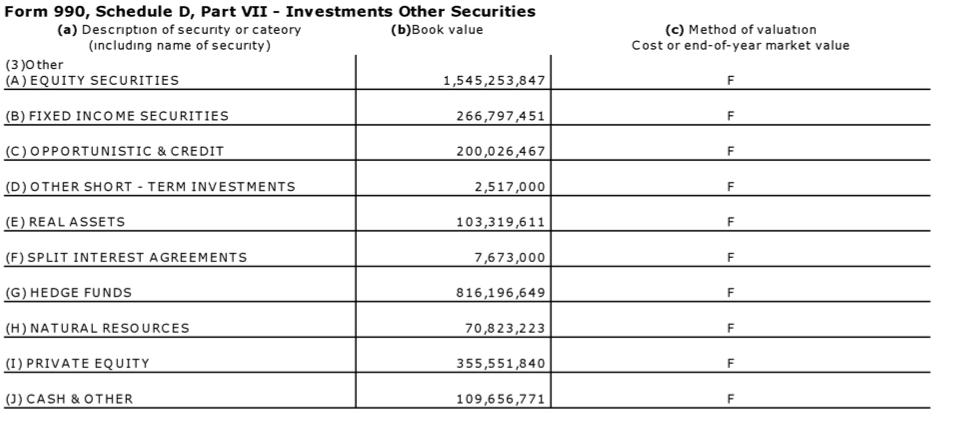

NYU’s endowment in 2014 was $3.4 billion. The university invested $1.5 billion in stocks, $817 million in hedge funds, $356 million in private equity and $267 million in fixed income securities such as bonds.

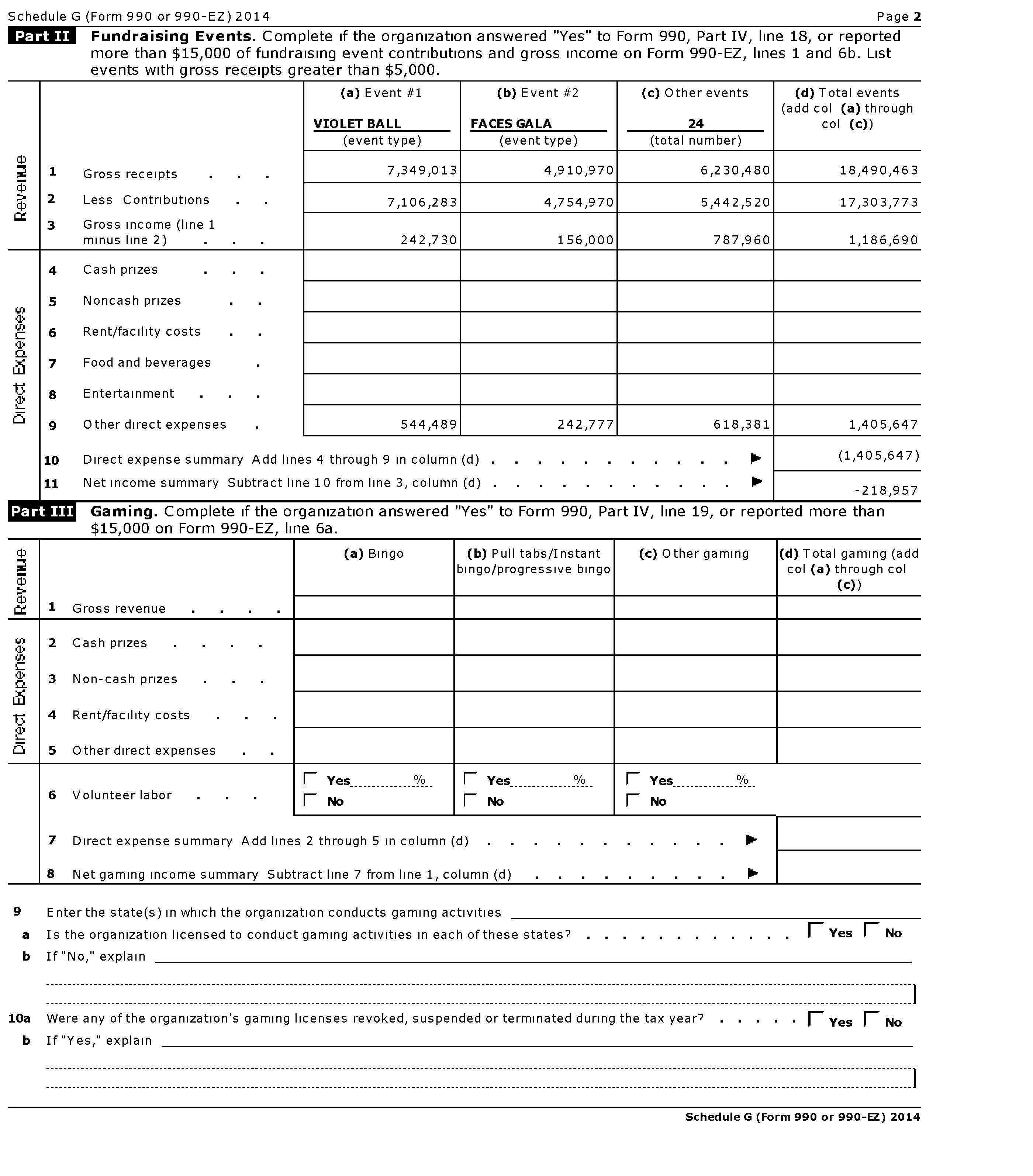

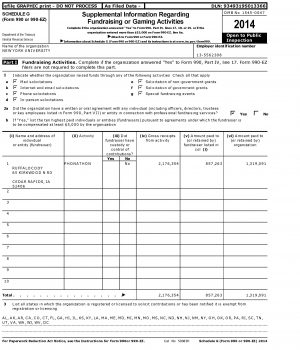

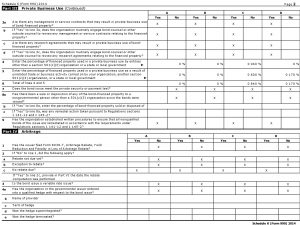

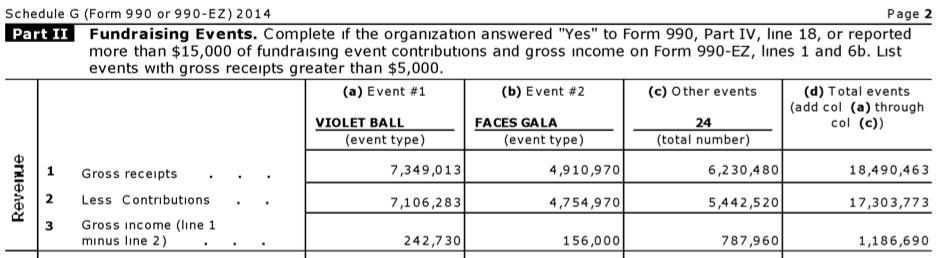

Violet Ball

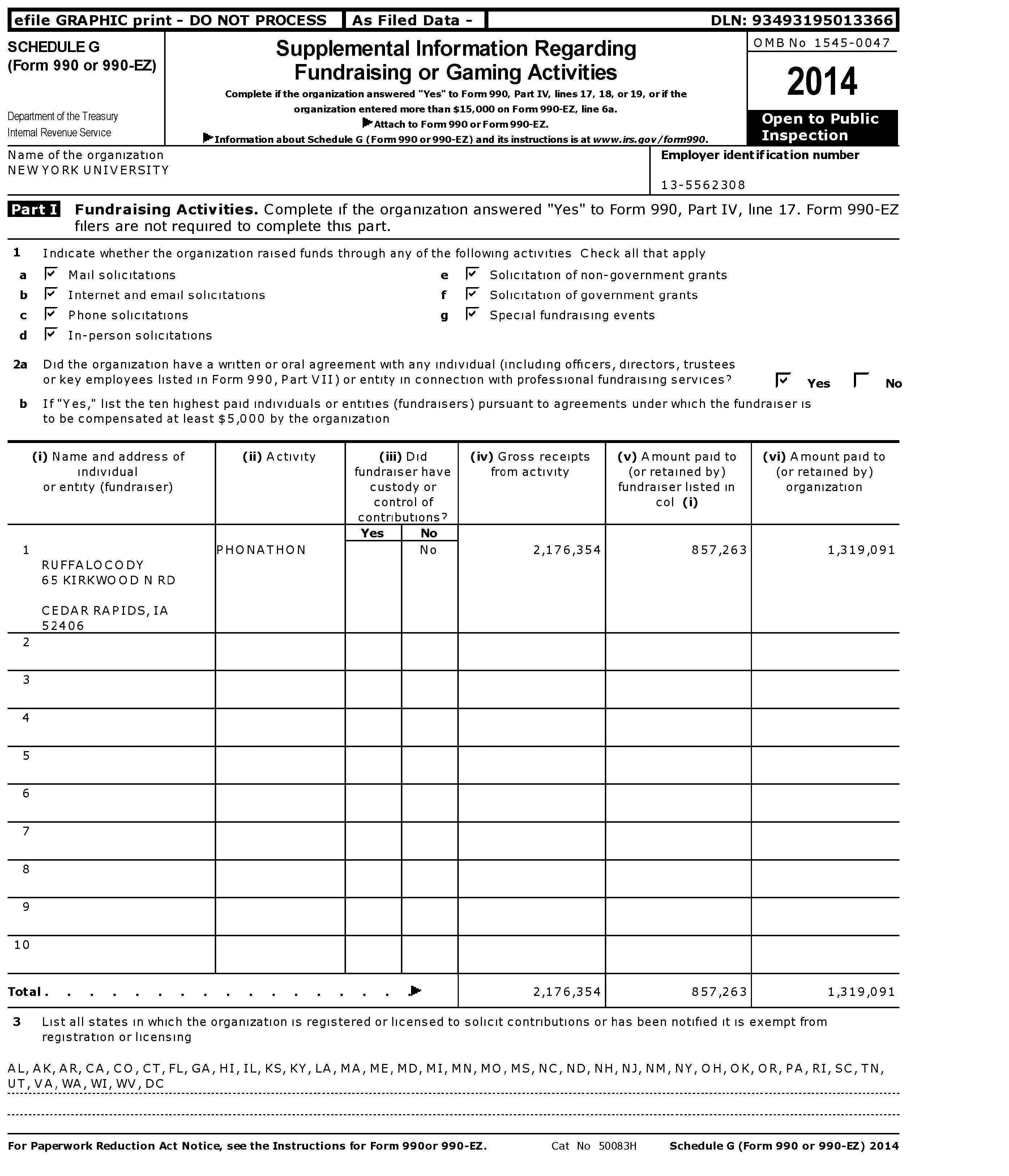

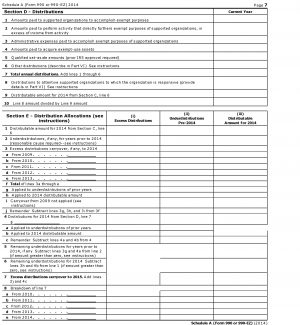

Violet Ball, an annual fundraising event, cost the university $544,289 and brought in $14,455,296 in contributions, yielding a profit of $13,910,807, according to John Beckman, university spokesperson.

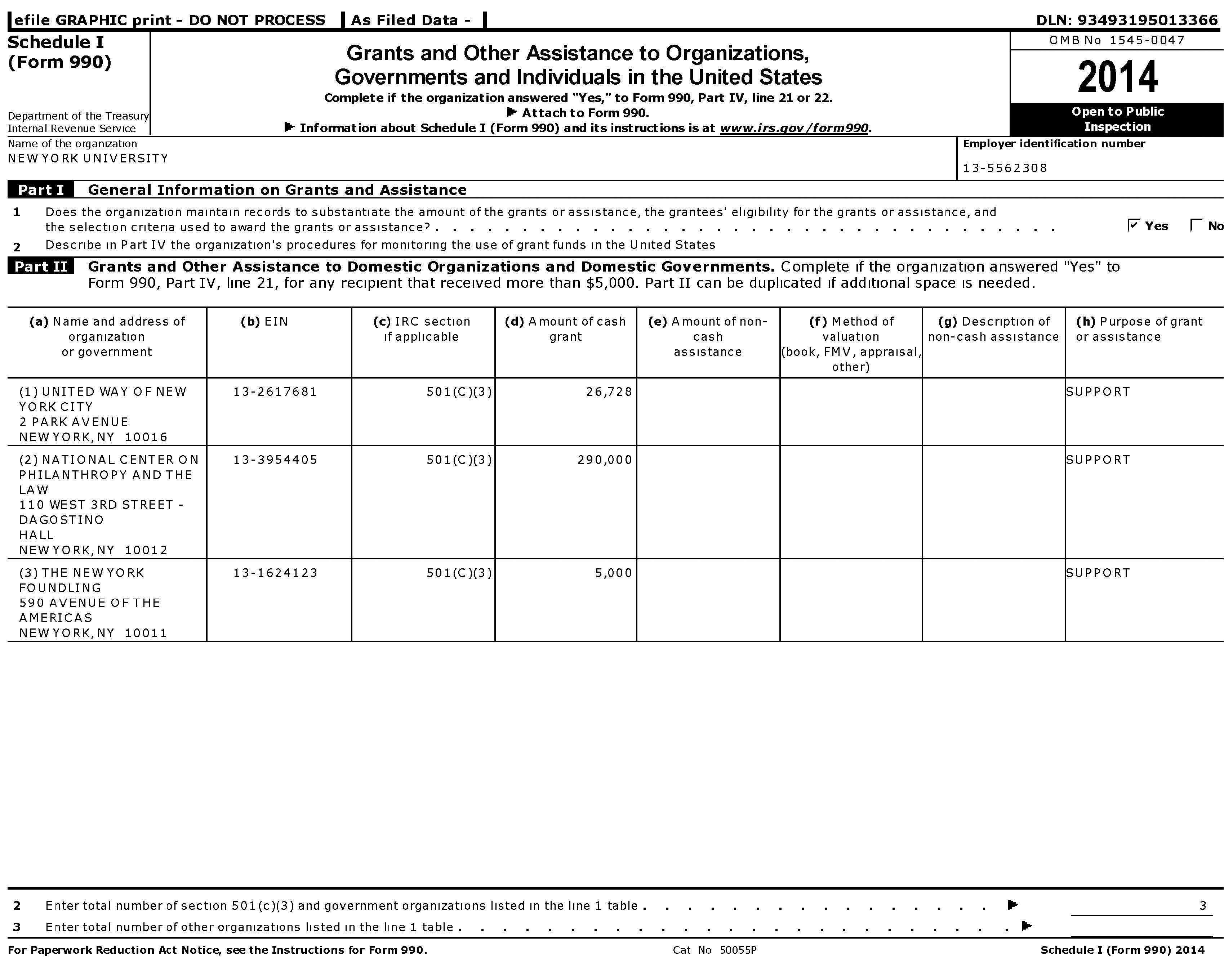

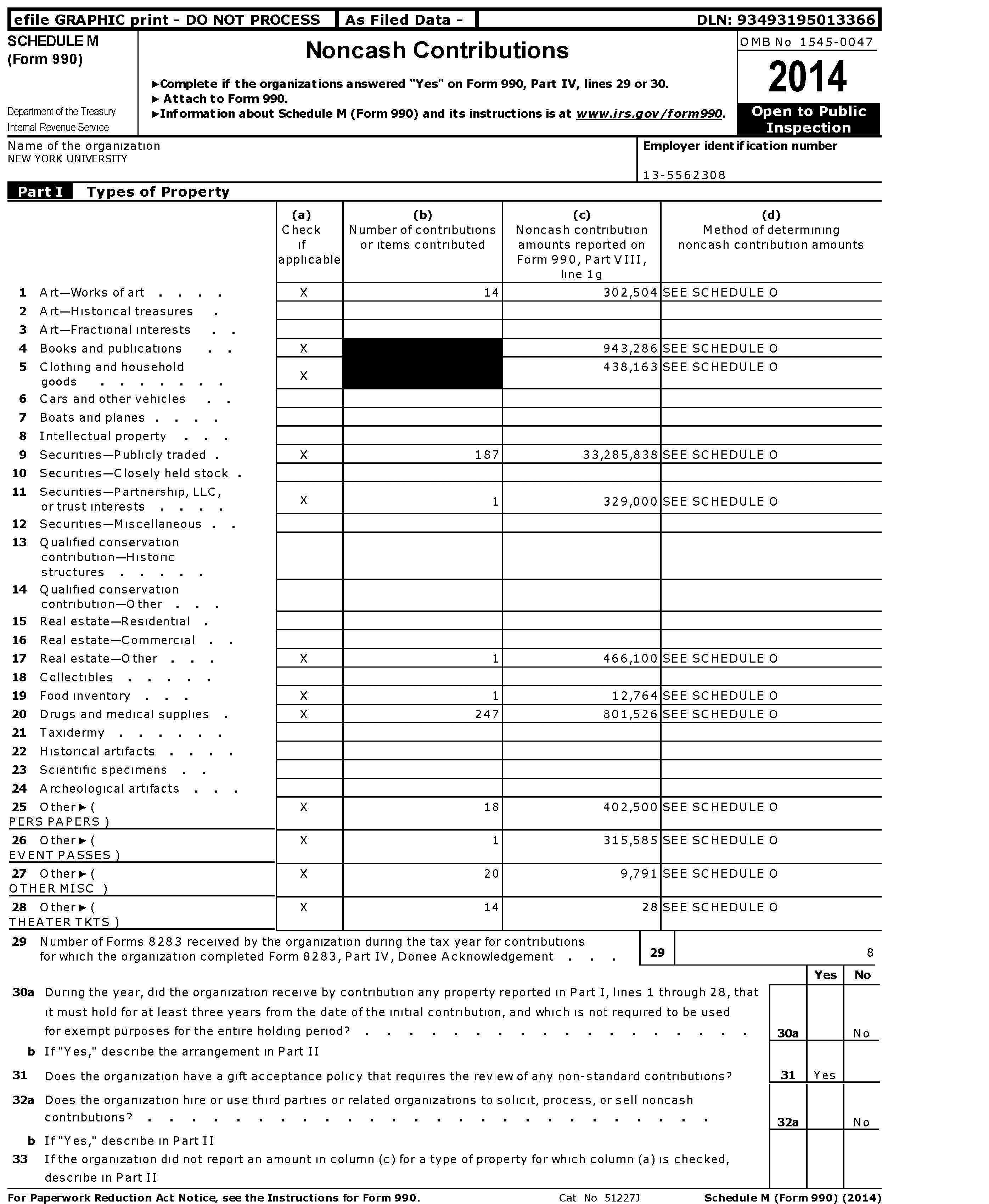

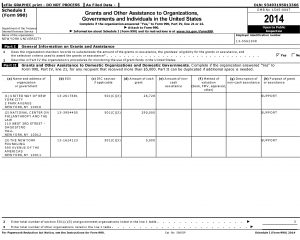

Contributions

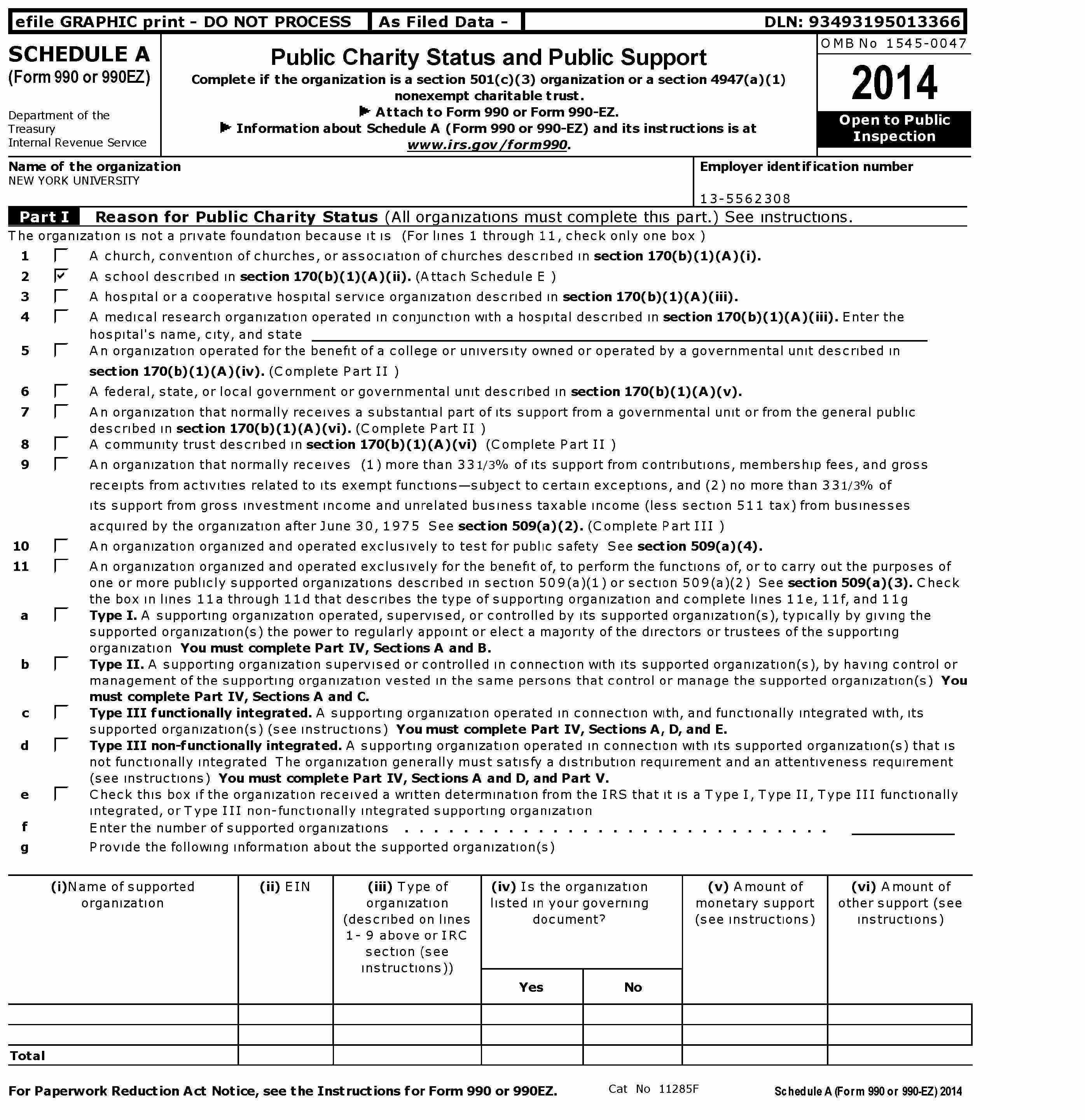

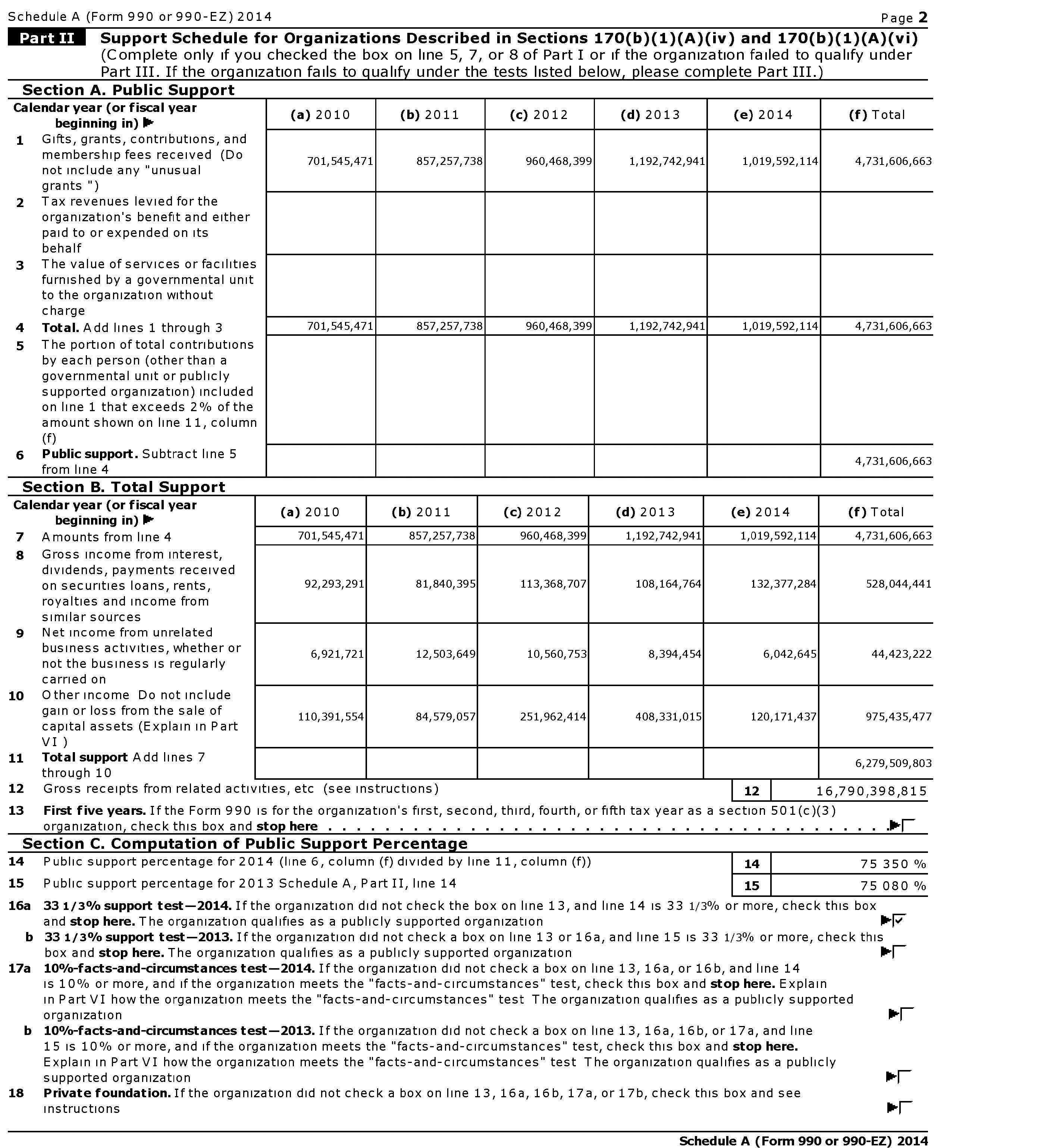

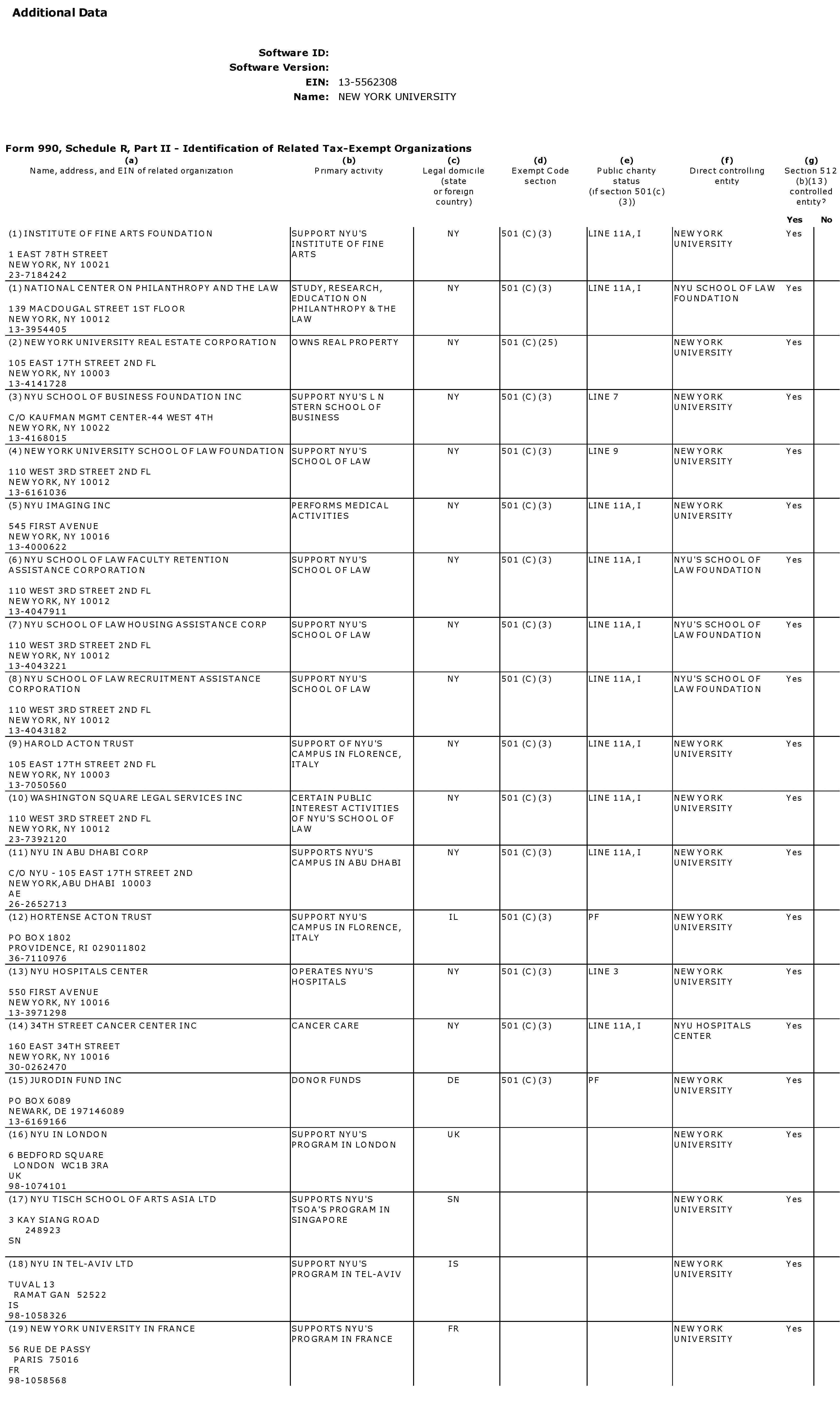

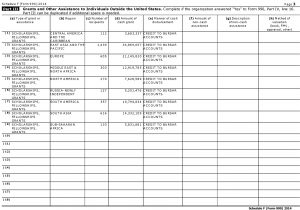

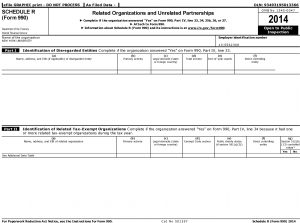

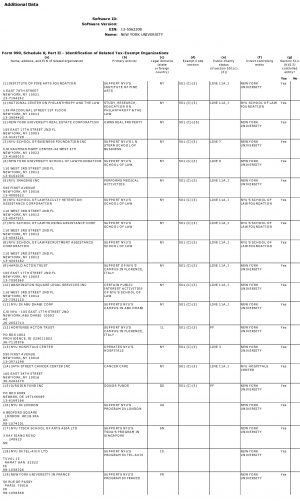

NYU received just over $1 billion in “contributions, gifts, grants and other similar amounts,” according to the tax return. $518 million came in the form of government grants, and $461 million were in the form of other contributions.

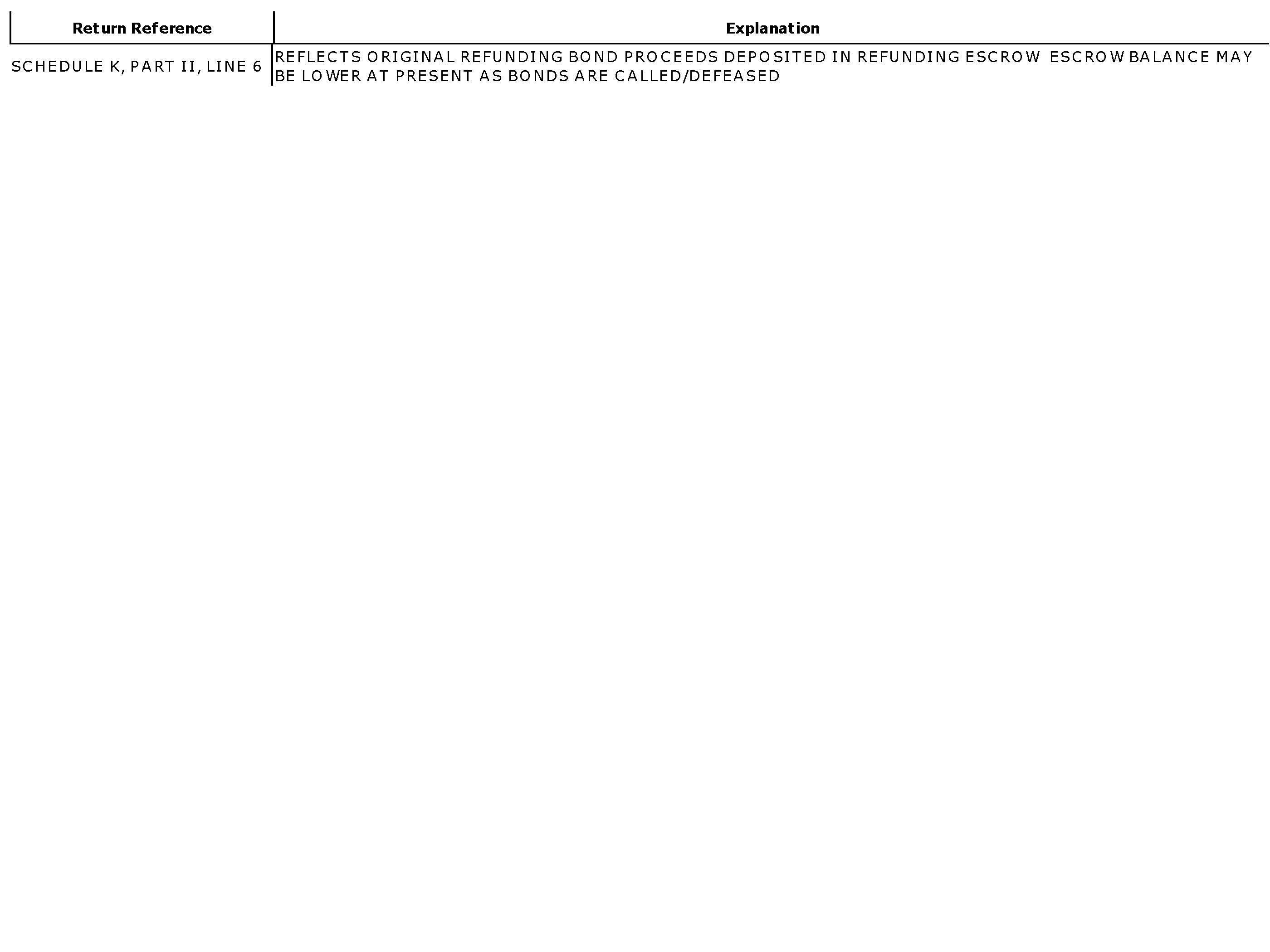

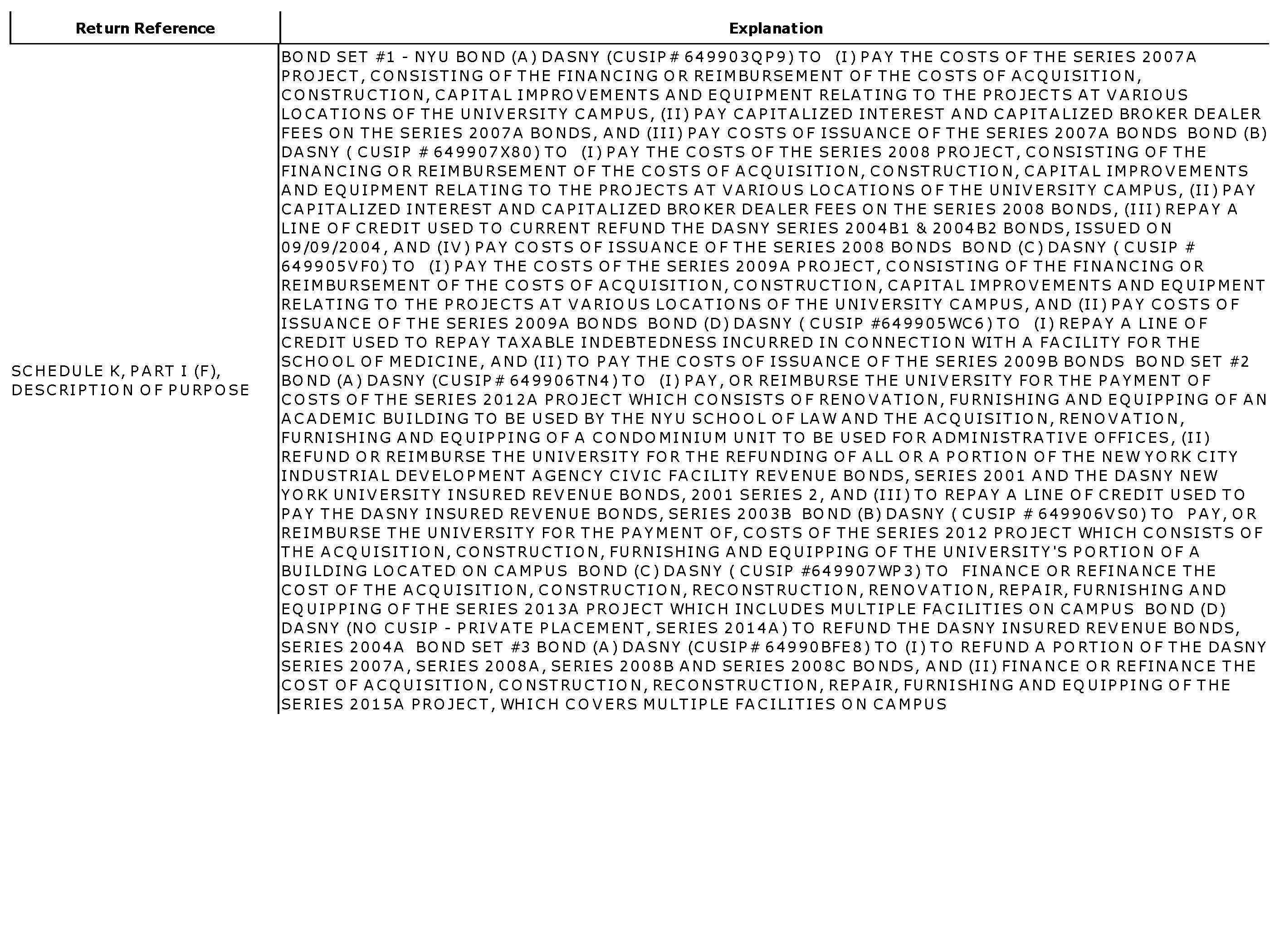

Construction

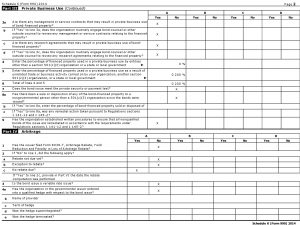

Three of the five highest paid independent contractors hired by NYU are construction firms that received a net payment of approximately $144 million. Among the other top-earning independent contractors is Aramark, a facility management service protested by NYU Prison Divest earlier this year regarding the company’s ethics and practices. NYU paid Aramark approximately $37 million.

CORRECTION: An earlier version of this article said that Violet Ball cost the university $7.1 million and brought in $7.3 million in contributions, yielding a profit of approximately $200,000. Violet Ball actually brought the university $14,455,296 in revenue, and cost the university $544,489. The university made a net benefit of $13,910,807.

University Spokesperson John Beckman said, “The 990 requires us to allocate a portion of these events to Contribution revenue. For instance if you went to an event with a dinner valued at $50 and gave NYU $200, then $50 will be included on line 1 ‘Gross Receipts’ and $150 will be allocated to Lin 2 ‘Contributions.’

*This figure was calculated by dividing the number of financial aid recipients, 14,812, by the total number of students, 57,245. These numbers were taken from NYU At A Glance.

Additional reporting by Jemima McEvoy and Natasha Roy. Email Sayer Devlin and Miranda Levingston at [email protected].