New School professor lectures on debtors’ prisons

February 13, 2014

Renowned thinker in economic anthropology and New School professor Gustav Peebles spoke Feb. 12 about the history of debtors’ prisons as a part of the Question of Method Speaker Series hosted by NYU’s Department of Social and Cultural Analysis.

Renowned thinker in economic anthropology and New School professor Gustav Peebles spoke Feb. 12 about the history of debtors’ prisons as a part of the Question of Method Speaker Series hosted by NYU’s Department of Social and Cultural Analysis.

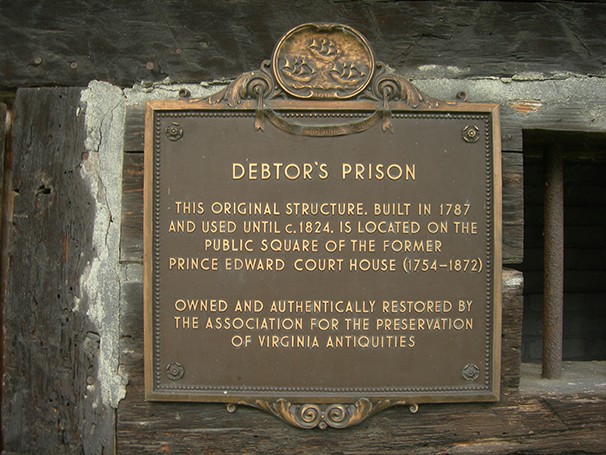

Starting in the 16th century, countries all over the world created and maintained prisons designed to keep debtors from fleeing their creditors. The complicated relationship between debtor and creditor in the 16th and 17th centuries required that a debtor either give up his assets or his liberty in exchange for an unpaid debt. Counterintuitively, these so-called prisons became safe havens for debtors. The debtors’ prisons were neighborhoods where wealthy debtors could live in luxury, while at the same time avoid the payment of their debt and maintaining their rich assets.

Peebles discovered this dichotomy while conducting research in Iceland.

“This particular topic became more clear to me then in about 1999, when a very wealthy Swede was arrested for evading tax debts owed to the state, and they took his passport away from him, thereby imprisoning him within the nation-state of Sweden, so he could not flee his debts,” Peebles said.

Peebles explained the evolution of debtor’s prisons.

After the eradication of debtors’ prisons in the 18th century, the wealthiest debtors slowly developed more ways to flee their creditors, leading to the creation of modern day offshore bank accounts, which serve as a legal way for the wealthy to hide their assets.

During his talk, Peebles said in modern times most of the people using offshore bank accounts are those who are avoiding a debt, like spousal support or lofty tax bills.

Tisch junior Kerry McEnerey said she understood the social implications of the issue.

“I thought it was really interesting how behind all this legal and financial issues [are] a lot of social issues just about how people view other people,” McEnerey said. “It’s about how you live, it’s not about just numbers.”

Second-year GSAS student Frank Brancely said the topic of the lecture was perfect for an interdisciplinary audience.

“It is a topic I’m not very literate about so it seemed very informative to me,” Brancely said.

Peebles said he wants his research to change the way students see the world.

“I believe that many social scientists are aiming to bring to light things that are right before our very eyes,” Peebles said. “I’m hoping I can bring some basic facts about the world system for regulating credit and debt into the cognizance of my audience.”

A version of this article appeared in the Thursday, Feb. 13 print edition. Valentina Duque Bojanini is a contributing writer. Email her at [email protected].