Yesterday afternoon, journalists called from around the country to listen in on a special press call about student debt after death. The call, organized by online petition platform Change.org, featured Ella Edwards of Ypsilanti, Mich., and Angela Smith of Chesapeake, Va. Both started petitions for debt forgiveness after student deaths. ProPublica reporter Marian Wang also made an appearance during the call.

Change.org maintains dozens active petitions through their website.

“Change.org’s team of campaigners supports some petition creators by helping them connect their stories to audiences who’ll want to hear them,” said William Winters, senior organizer for the website. “And just like we connect petition creators to audiences, we also help connect her story to media outlets we think will be interested in telling it.”

Currently, federal student loans are excused after death but private student loans become the responsibilities of the students’ families.

As a result of their collaboration with Change.org, more than 430,000 people have signed petitions urging national and regional banks to forgive student debt in these circumstances.

Smith opened the call by relaying the story of the violent death of her son, Dante, on July 6, 2008.

“My son was shot and killed in a college town in West Virginia,” she said. “He was out with some friends celebrating the night before a holiday, and one of his friends also had a birthday on that day … He died … on his brother’s 16th birthday. Imagine having to deliver that news on his birthday.

“I don’t know if we’ll ever be whole again. He had a prominent career ahead of him and had a passion for football … He had plans for his life. He was a history major and coached. After Dante’s death, we started getting calls from First Marblehead [Bank] asking us to pay for his loans. He had a four-year scholarship for football but changed majors and had to add more time to school.”

According to Smith, a new football coach at Dante’s school did not allow Dante’s scholarship to be used for his extra semesters. As a result, Smith and her family were forced to take out private loans. First Marblehead Corporation of Boston, Mass. asked Smith to provide a death certificate and then declared that Smith’s husband was now responsible for the loans.

“We explained to [the bank] that we couldn’t afford the additional debt,” Smith said. “I’ve lost my business after my son’s death because I could no longer handle the things that I needed to do on a daily business … so we now only had one income.”

“This is just not the natural order of things,” she added. “Your child is not supposed to die before you. So we didn’t even think to ask a question about that situation when we borrowed the money.”

Smith is advocating for a clearer policy from First Marblehead Corp. about what happens in the event that a student dies.

Then Edwards told her story and gave her reasons for pushing the campaign.

Edwards’ son, Jermaine, died unexpectedly in 2009 of natural causes. Jermaine was 24 and had more than $10,000 of student loan debt. Edwards was forced to retire early due to illness and depression, and cannot afford to pay off the debt.

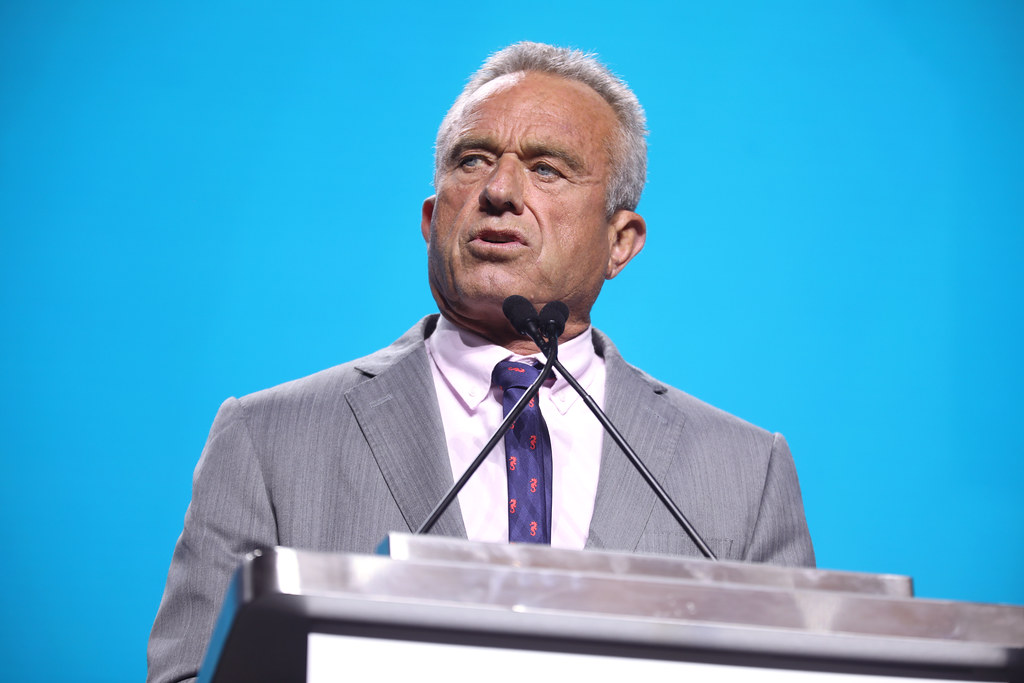

Andrew Ross, an NYU professor who works with the group Strike Debt, an offshoot of the Occupy Wall Street movement, does not support the practice.

“It’s a highly immoral practice and would be outlawed in a humane society,” Ross said. “All the evidence shows that our legislators are too beholden to the interest of the finance industry to do anything to resolve the crisis. People will have to seek debt relief for themselves by any means necessary.”

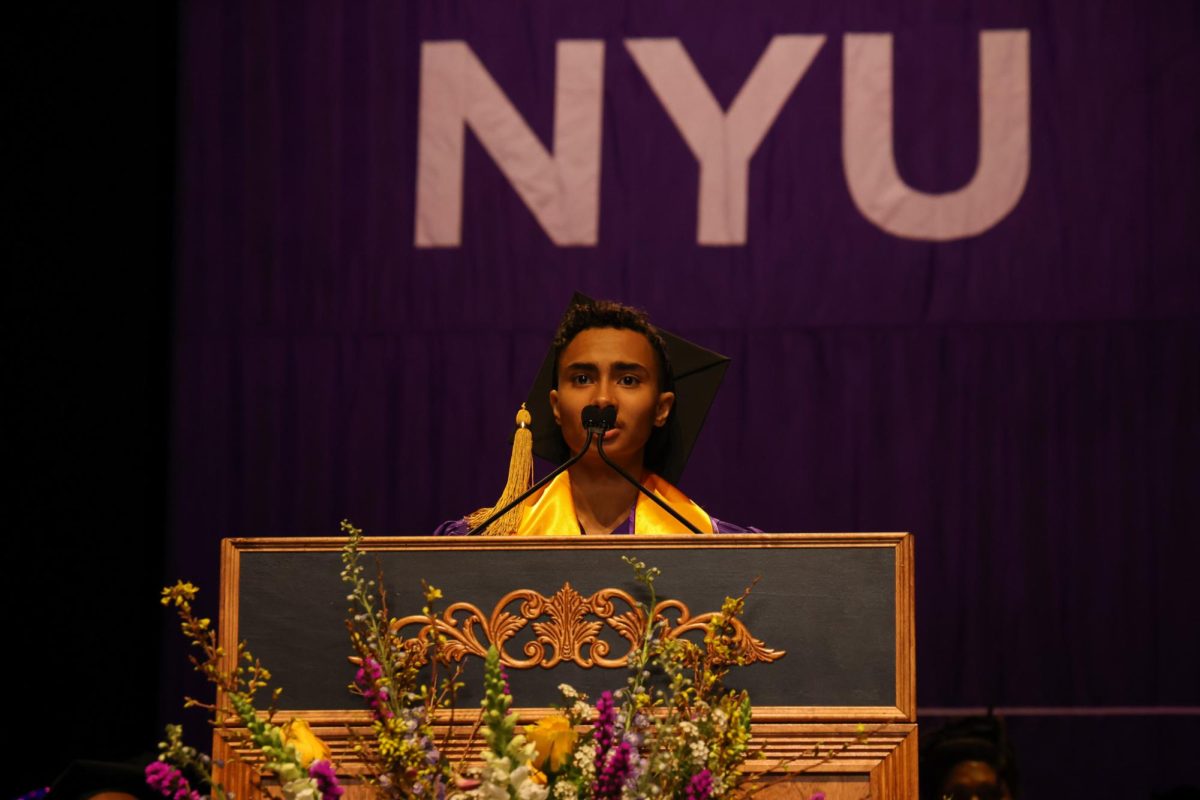

Eric Ives, a CAS sophomore, agrees that lenders do not always have the public interest at heart.

“When we take out loans to finance our education, we’re making an investment in our future,” Ives said. “But if a student dies and the potential for that education to be used to pay back the loan is lost, we see a key difference in the way a government and a corporation operate.”

“A government forgives the debt because they lend to invest in the future of the country, a corporation doesn’t because they are interested in profit,” he added. “It’s short-sighted for a bank, but underscores that corporations don’t necessarily have a national allegiance to goodwill.”