Nearly 90 percent of first year graduate student Lisa Luo’s tuition is covered by student loans. It is a burden to be sure, but Luo, who is studying computer science at the Courant Institute of Mathematical Sciences, has carefully broken down her living expenses. She lives off campus to minimize room and board and works a part-time job.

“I took out loans according to a budget I calculated for the year that did not include wages earned from part-time work, so I might take out a smaller amount for the spring semester,” she said.

Luo might be a graduate student, but student debt is a concern of undergraduate and graduate students alike. In fact, it has become a problem with national ramifications, as the total amount of student debt soars to over a trillion dollars, which is even more than credit-card debt. Horror stories of college graduates struggling to pay rent while working multiple jobs have almost become commonplace.

Within NYU, 54 percent of the graduating class of 2011 took out loans — both federal and private — in the 2010-2011 school year, according to director for public affairs Philip Lentz. Nationwide, a U.S. News and World Report survey stated the percentage of students who took out federal loans for the 2011-2012 school year is approximately 34 percent, and only 10 percent took out private loans.

While the nationwide debt average of the graduating 2011 senior is around $26,600, NYU’s infamously high tuition is reflected in the average 2011 undergraduate debt, which was $36,351.

The reason for NYU’s pricey tuition is multi-faceted.

“For universities like NYU, with ambitious construction plans, student tuition becomes a key revenue stream to realize those ambitions,” said professor Randy Martin, art and public policy chair at the Tisch School of the Arts.

However, because NYU does not make public its fiscal affairs, exactly how its student tuition is spent remains unclear.

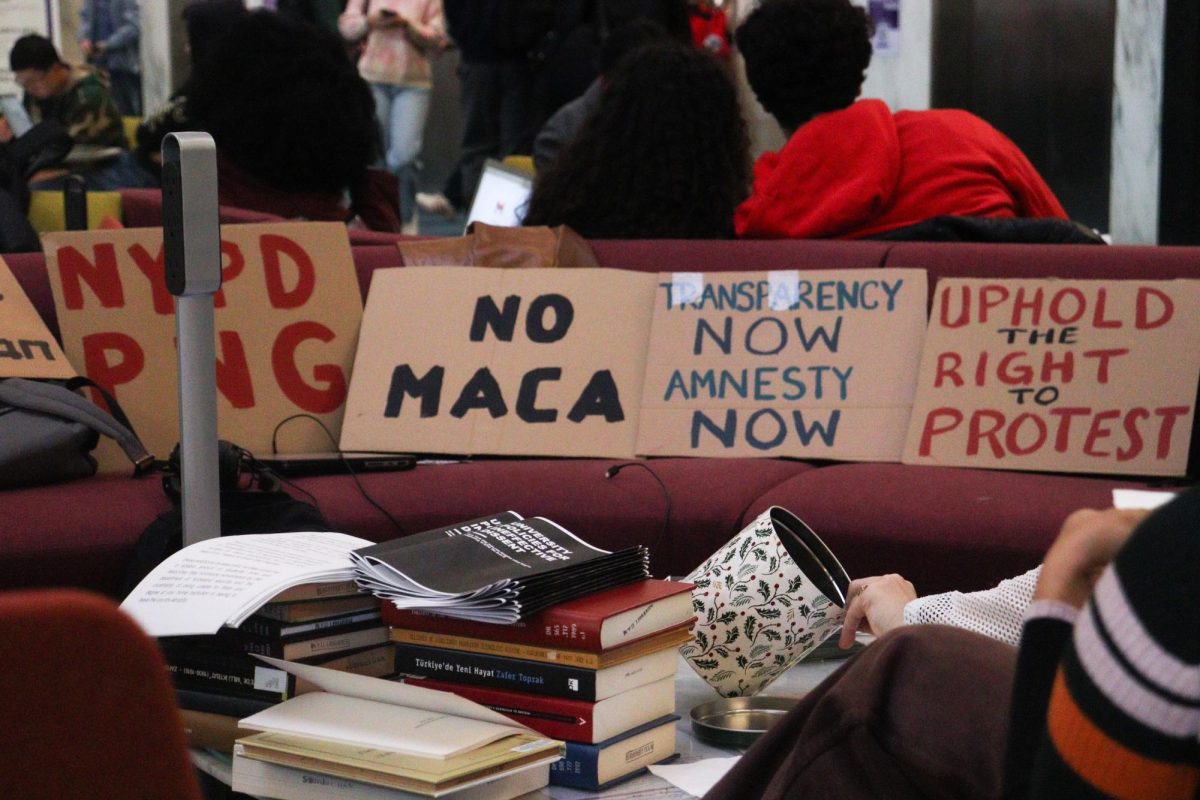

“I think students and parents should know what their tuition goes to,” said NYU social and cultural analysis professor Andrew Ross, who advocates greater transparency in universities’ fiscal matters.

Students acknowledge that NYU is expensive, but the fact that they are attending the school says something about how they view the price tag.

“People forget NYU’s high tuition is in line with those of private universities,” said Steinhardt senior Jameson Lee. “Also, New York City isn’t cheap. You also have access to affordable housing and world class professors.”

“And when you graduate you’re becoming part of a gigantic alumni network,” he said. “When you’re in school, you can take advantage of internships and student networking, and you leave with the maturity and identity of a New Yorker. These are things that you can’t put a price on, but they are worth making sacrifices for.”

The correct magnitude of those sacrifices is the question. There is an increasingly large group of protesters who believe that tertiary education in the United States has become extravagantly overpriced.

“I come from Scotland, where the government paid me to go to college,” said professor Ross, who is part of the Strike Debt campaign, an offshoot of the Occupy Wall Street movement. “It’s agonizing for me to walk into a classroom where the majority of students are struggling under the burden of student debt, and they don’t even know it.”

Part two of this article will appear in a later date.

A version of this article appeared in the Tuesday, Nov. 6 print edition. Wicy Wang is a contributing writer. Email her at [email protected].