Just Venmo Me

Venmo has become the go-to method for transactions between students.

October 18, 2017

Splitting the bill when you go out with friends is often an awkward hassle. The questionable silence that follows the check can be daunting, especially with pesky card minimums that follow. Luckily Venmo has taken it upon itself to help in such situations. “Just venmo me,” and the bill is sorted.

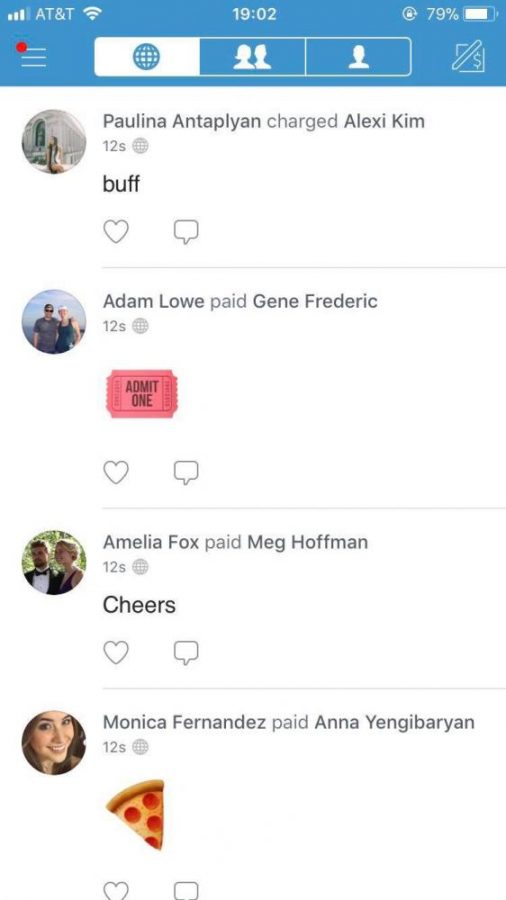

Venmo has transformed the way money moves among millennials. It’s easier, almost too easy now, to spend money with friends. The app, which was acquired by eBay in 2013 for $800 million, solves the rather touchy issue of splitting a check and paying for dinner bills. It’s an accountable system that directly pulls from a user’s bank account while also acting as a social application separating itself from many of the peer-to-peer payment apps pushed by competing banks. With each payment the use of emojis or short cheeky memos follow, making it a social media platform where likes or comments can follow on each transaction. Users can add friends and also see a feed of their transactions. It is essentially an uber simplified Facebook solely focused on how people are spending their time (and money).

As early as 2014, Fortune magazine called it “The payments app Millennials swear by” making it officially millennial-approved. Specifically, of the 65 percent of 20 to 30-year-old users using payment apps, 68 percent are using Venmo. Every college campus has students actively using it,and NYU is definitely no exception. Students seem to be in agreement, stating that with Venmo things become easier, especially when going out.

“I can see Venmo becoming ubiquitous as Uber,” LS sophomore Lily Kim said. “There are just too many instances where cab fares, restaurant bills, etc. have to be split between multiple people.”

Other students, like LS sophomore Anta Fily Gaye, said they enjoy Venmo because it is both convenient and fun.

“In some way it allows you to know what your friends are doing and with who,” Gaye said.

As for requesting money from people, it still is touchy and just as awkward through an app as it is in person.

“I find it kind of awkward,” Gaye said. “Usually I just wait for whoever borrowed money from me to pay.”

Other people work out a system with their friends.

“My friends and I have an unofficial agreement that if one pays, the other venmoes,” Kim said. “It takes away the hassle of using multiple cards of gathering crinkled dollar bills everywhere we go.”

With Venmo, last night’s escapades are recorded, adding a sentimental value to something that would have meant nothing more than the sad decrease in money in a bank account. When even the most mundane of activities such as splitting the bill and reimbursing a friend becomes a social interaction, what does it mean for the future of technology?

Email Liv Chai at [email protected].