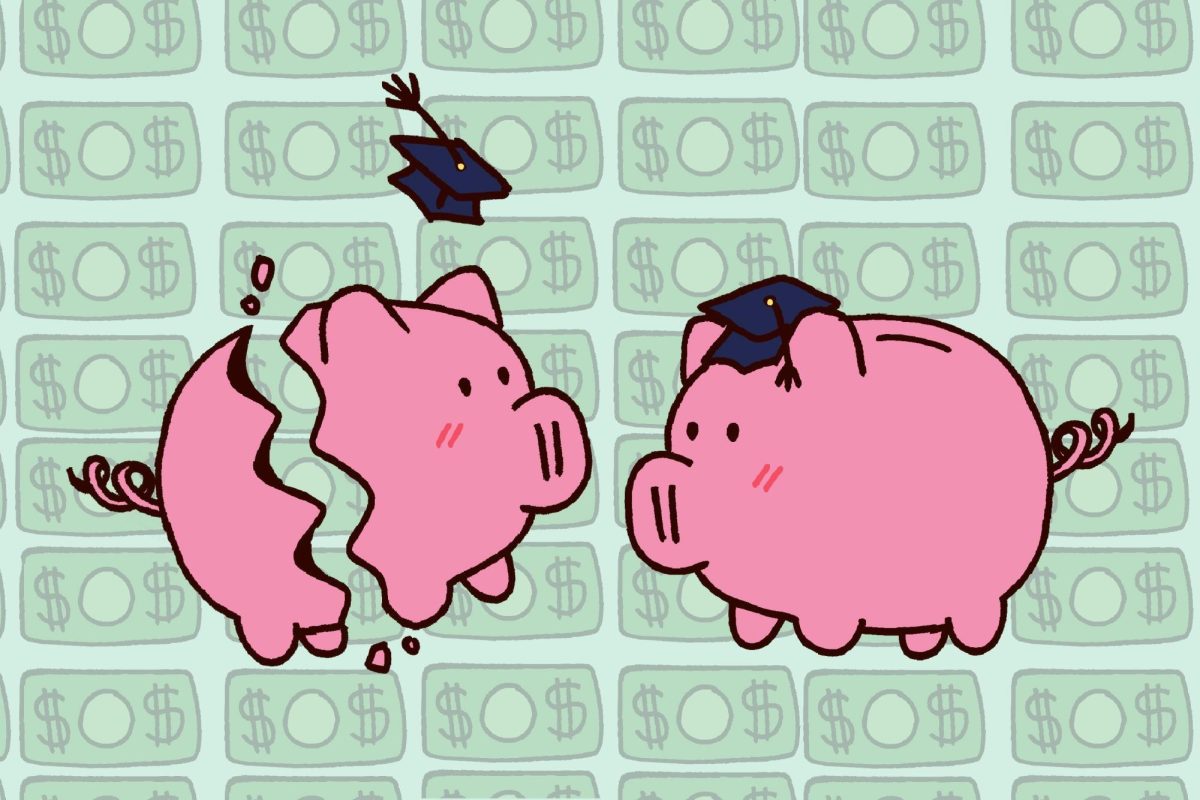

Affordability Steering Committee Partners With iGrad

iGrade is an online service developed to guide students and their families on personal and college-related finances. NYU’s Affordability Steering Committee announced a partnership with the service on March 29.

April 5, 2017

At a University Senate meeting on March 29, NYU’s Affordability Steering Committee announced its partnership with iGrad — an online educational service that provides university students and families with customized resources designed to help students manage personal and college-related finances.

iGrad offers access to articles, online courses and recommendations among other resources that inform students about financial aid to help them plan ahead and graduate early as a method of saving money.

Assistant Vice President for Financial Aid Lynn E. Higonbotham said that the university partnered with iGrad to provide informative, applicable financial education tools designed to benefit the NYU community.

“iGrad offers an expansive range of information,” Higonbotham said. “From budgeting, to investing, to job preparation, and financial information for specific populations such as veterans or borrowers of student loans and much more.”

Higonbotham said that many students have tried to find the type of information that iGrad provides. Higonbotham also thinks that iGrad is one example of how the university intends to partner with students and their families to provide fundamental financial education tools to assist with important financial decisions.

“iGrad provides an opportunity for NYU to engage in creating university specific information,” Higonbotham said. “So in the upcoming months the community will begin to see more features that are unique to the NYU experience, such as how to best engage in financial planning for our specific study away sites, and for prospective students and their parents, financial guidance to consider when determining if NYU is a sound educational investment for an individual family.”

She said there is great value in offering students and the NYU community information to increase their knowledge of the critical area of personal finance.

CAS senior and ASC member Caterina Dacey-Ariani said that she hopes iGrad will serve as a strong resource for students in developing their financial literacy.

“The partnership makes financial education more accessible to students, as well as faculty and alumni,” Dacey-Ariani said. “So the information and tools provided by iGrad cater to students’ needs both while they attend NYU and post-graduation.”

She said that iGrad isn’t replacing something specific, but instead is just an additional resource that centralizes financial education, and is accessible across the entire university.

LS freshman Tilly Holmes said that she is in favor of NYU joining hands with iGrad. As a student from England, Holmes said that it has been difficult learning about financial resources for students.

“This service will help students like me know more about how to spend less money in college, which is very important considering the costs of American universities these days,” Holmes said. “Especially universities like NYU.”

Besides iGrad, NYU already offers various resources designed to help students with college finances. Some of these resources include NYU’s Office of Financial Aid, Bursar and StudentLink.

Higonbotham said that even with the introduction of iGrad these resources will continue to serve NYU’s community.

“iGrad is an enhancement to services that are already provided,” Higonbotham said. “As we strive to strengthen our commitment to personal financial education, iGrad is just one additional tool, and we will continue to explore other possibilities.”

Email Lorenzo Gazzola at [email protected].