NYC Area Median Income Figures Must Discount Suburbs

February 8, 2016

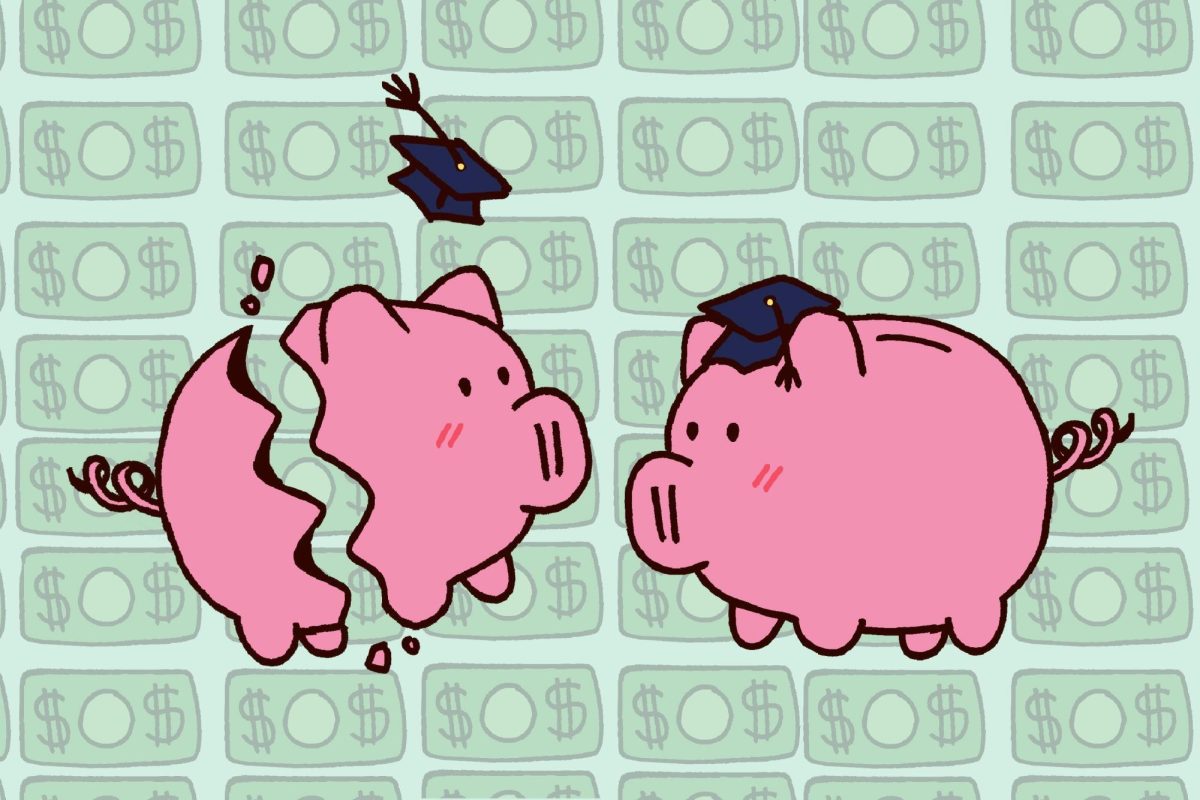

Living in New York City is becoming increasingly difficult for low and middle income New Yorkers. Luxury developments and rich transplants are driving up rents and pushing out local residents. To combat this, Mayor Bill de Blasio has championed his Mandatory Inclusionary Housing program. The MIH program requires that about a quarter of units meet affordability benchmarks based of the Area Median Income. Yet these AMI benchmarks still remain out of reach for many New Yorkers.

The AMI is the annually-released figure representing the average household income for an area. For New York City, the U.S. Department of Housing and Development calculates AMI using household incomes of the five boroughs plus Westchester, Rockland and Putnam counties, three of the five richest counties in New York state. Consequently, the AMI is $60,500 for single person and $86,300 for a family of four, well above New York City’s median household income of $52,737. The MIH program uses 60 percent of the AMI as the lowest affordability benchmark, yet because of the AMI’s suburban inflation this benchmark amounts to about $51,800 — more than the median household incomes of Brooklyn and the Bronx. Under the current affordability guidelines, if Brooklyn and the Bronx were people, they would fall into the very low income category, the 40 percent and 50 percent of AMI range, a category which is not served currently by the MIH program.

The inflation of the AMI means rezoning under de Blasio’s MIH program will do little to help those who need it most. As it stands, over 43 percent of New Yorkers fall beneath the 60 percent of AMI affordability benchmark. Within neighborhoods such as Harlem and East New York, the inflated AMI figure could push out residents whose median incomes are about $33,000. When two-thirds of New Yorkers are in one of the three AMI based low income categories, it is time to question the legitimacy of the city’s AMI figure. The U.S. Department of Housing and Urban Development justified its inclusion of the three suburban counties by claiming it makes building units viable to developers. Yet, New York is one of the most lucrative real estate markets in country. It is already viable for developers. However, inflating the AMI makes it easier for developers to overcharge struggling New Yorkers.

A rationally calculated city AMI that only used the data from the five boroughs could lay the groundwork for substantive improvements to the city’s livability. This more reasonable AMI, about $60,000 for a four-person household, would make the MIH’s 60 percent AMI benchmark actually affordable to residents in neighborhoods such as East Harlem and the Lower East Side. A proper city-wide AMI would be relevant and useful figure for evaluating and not just a guise for gentrification.

Opinions expressed on the editorial pages are not necessarily those of WSN, and our publication of opinions is not an endorsement of them.

A version of this article appeared in the Monday, Feb. 8 print edition. Email Shiva Darshan at [email protected].