The government shutdown that has resulted from political brinkmanship may hopefully end soon, as Senate leaders are nearing a bipartisan deal to raise the nation’s borrowing limit and fund the federal government. House Republicans, pressured by the Tea Party, have been unclear about supporting the Senate plan despite the looming Thursday deadline to raise the debt ceiling or risk default of the world’s largest economy. Now that House leaders have failed to pass their own plans with deadline less than 24 hours away, they must act swiftly and responsibly to support the Senate’s proposal.

As the Senate moves forward with attempts of compromise, the House is stagnating. Its most recent proposal has been postponed, evidence that Speaker John Boehner lacked the required votes. Both sides agreed that the shutdown should end and the debt ceiling be raised, but they differ as to the degree of concessions which are necessary and appropriate. Unfortunately for the House, enough GOP members didn’t think the proposal was sufficiently critical on Obamacare for it to warrant support.

Though determined to reject the Senate bill for its insufficient curbing of Obamacare, House Republicans should reevaluate their obstinance. Drafted with bipartisan collaboration, the Senate plan would tighten verification requirements and delay the act’s medical device tax for two years. While minor, the Senate’s concession is generous, especially considering that Republicans never had the electoral standing to make such ultimatums. The House lacked the votes to defund Obamacare, yet lawmakers stubbornly demanded its repeal, instigating the ill-conceived government shutdown. Resorting to the Senate deal, which would both reopen the government and prevent default on Thursday, seems a small price to pay for the Republicans’ misplaced pride.

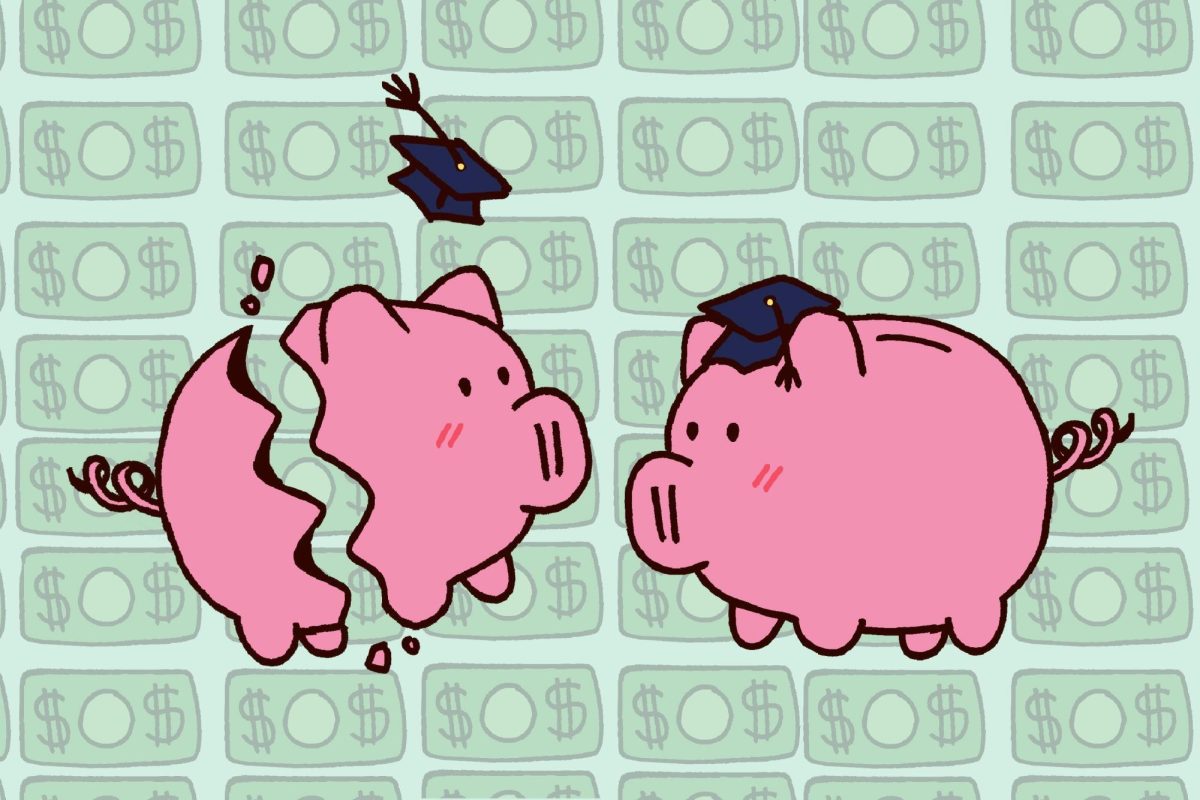

The consequences of a default can be catastrophic, both domestically and worldwide.

First, the U.S. Treasury would be about 30 percent short of the funds it needs to pay next month’s bills, which include $3 billion in federal employee salaries, $25 billion in Social Security benefits, and $29 billion in interest on debt. But even more critically, the U.S. wouldn’t be able to pay all its Treasury bondholders — such as the Chinese government — causing the bonds to be perceived as a riskier investment, which could ultimately prompt interest rates around the world to rise. Goldman Sachs estimates that, upon default, $175 billion would be immediately withdrawn from the U.S. economy, possibly leading to a severe recession. Given these dire consequences, the Republicans should act sensibly and accept the Senate proposal.

A version of this article appeared in the Oct. 16 print edition. Email the Editorial Board at [email protected].