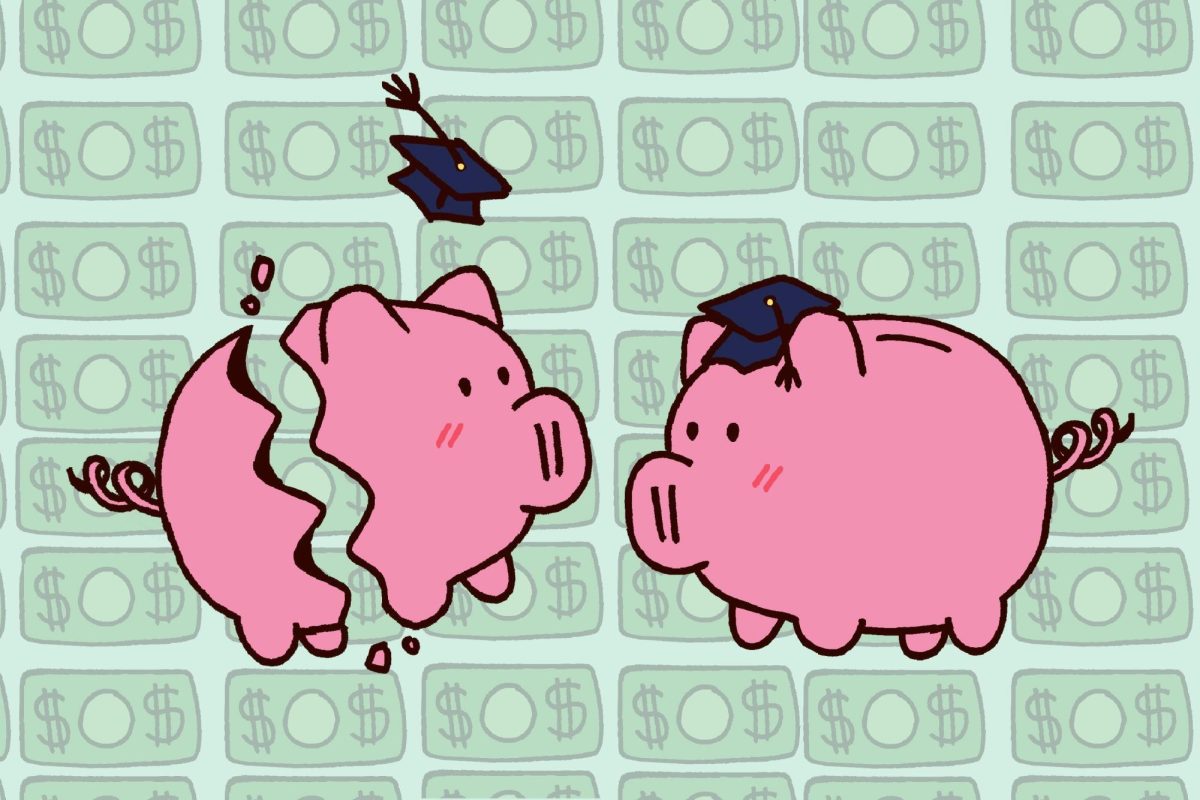

Live BlogA new study of wealth trends published by NYU economics professor Edward Wolff has found that American’s median net worth was at $57,000 per American — an inflation-adjusted 43-year low.

Median net worth is a calculation of household wealth — the number is the sum of an intermediate household’s assets minus their debts.

Wolff used the Federal Reserve Board’s Survey of Consumer Finances for his findings. The surveys are based on core representative samples of the American public that are taken every three years by the National Opinion Research Center.

In “Recent Trends in Wealth Ownership, from 1983 to 1998,” Wolff explained his choice to measure net worth as opposed to other economic measurements such as income.

“Family wealth is also an indicator of well-being, independent of the direct financial income it provides,” he wrote. “Wealth is [also] a source of consumption … because assets can be converted directly into cash and thus provide for immediate consumption needs.”

The report also highlighted the recent rise in wealth inequality that occurred during the recent economic recession.

“[Wealth inequality] remained virtually unchanged from 1989 to 2007,” he said in “The Asset Price Meltdown and the Wealth of the Middle Class.” “In contrast, the years of the Great Recession saw a very sharp elevation in wealth inequality … the share of wealth held by the top quintile climbed by almost four percentage points.”

Wolff also stated that some political context for his choosing to conduct his research.

“Since the election of Barack Obama in 2008, the fortunes of the middle class have generated a large amount of political interest and media interest as well,” he expressed in his paper.

Associate professor Howard Lune, director of the Graduate Social Research Program at Hunter College, applauded Wolff’s choice to measure net worth.

“The more significant departure for this study is that the author is measuring actual wealth, not just income,” Lune said. “This is … a more valid overall measure of economic status.

Jeff Stout, 42, had mixed feelings about using median net worth as a sole indicator of economic health and some of Wolff’s findings on income inequality.

“I think its a very good measure of wealth as a whole,” he said, “but I think factors like consumer spending and the ability to take risk are also pretty important, especially in a market economy.”

“Personally, I don’t feel like income inequality has changed very much … its been pretty much like this for about as far as I remember,” Stout added.

Hannah Cohen, a freshman in the Gallatin School of Individualized Study, also considered the wealth disparity numbers nothing new.

“We all know that the rich are always getting richer no matter what the economic circumstance. I can’t imagine the recession having made that any different,” Cohen said. “The root for all the wealth inequality is the system itself, and that’s not anything that’s going to change soon.”

Stern Finance professor Stijn Van Nieuwerburgh, however, noted that wealth inequality was a necessary evil of how markets motivated themselves.

“Each economy faces a fundamental insurance versus incentives trade-off,” Van Nieuwerburgh said. “Compared to other countries, [the United States] society has a high tolerance for inequality.”

Andrew Karpan is a staff writer. Email him at [email protected].