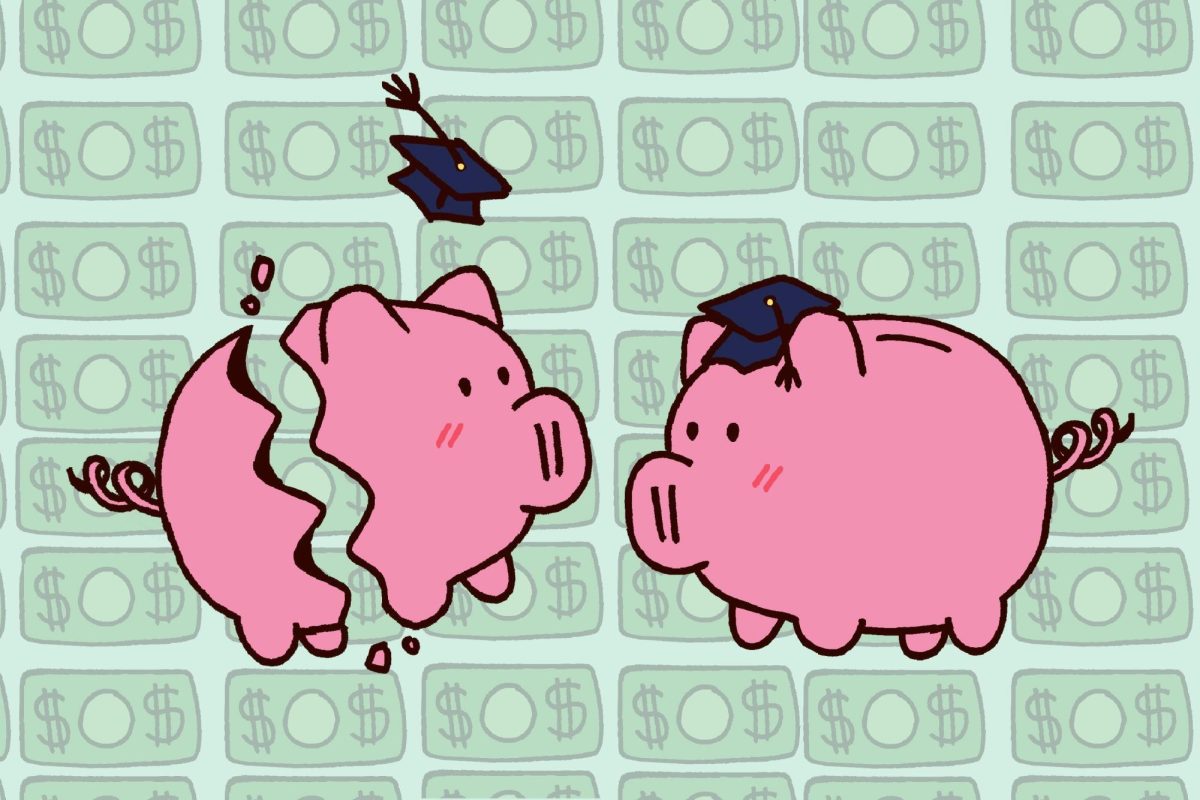

On Sept. 17, 1967, The New York Times reported that NYU’s annual tuition topped $2,000 for the first time in school history.

The antiquated Times’ report attests that American households’ battle with mounting costs of post-secondary education was as ferocious half a century ago as it is today.

A trend of continuous increases, particularly during the 1980s and 1990s, have made tuition costs deviate significantly from the general rate of inflation measured by the Consumer Price Index.

The estimated price for the 2012-2013 academic year as an NYU undergraduate, including tuition and fees but excluding room and board, is $43,204 according to NYU’s Financial Facts pamphlet. If the cost would have followed the CPI since 1967, a year in the classroom would cost $11,525 — close to a 275 percent difference net of inflation.

The seemingly stunning increase is by no means unusual. According to a 2011 report published by the non-profit College Board, NYU’s costs have risen largely at par with the national average for four-year private non-profit institutions over the past three decades, and the underlying reasons are many.

Like most other service firms, schools cannot rely on increased productivity year after year — the time required to teach a student algebra has not changed significantly over time — so higher education outpacing CPI for 52 of the past 64 years is no surprise, according to Robert Archibald and David Feldman of the American Council on Education.

Their report “Anatomy of College Tuition,” published in April 2012, also points out that universities are more or less required to keep up with technological advancements, a cost that has accelerated significantly in recent decades.

Another reason for boosted list prices is the extensive use of scholarships and grants that often are tailored to attract students with certain qualities or backgrounds.

In the book “Best 377 Colleges, 2013 Edition,” the Princeton Review presented results from surveys conducted with 122,000 students across the nation showing that NYU students are very discontent with the school’s financial aid availability, placing NYU in the bottom five percent in the category.

The statistical significance of the survey can be debated since only an average 324 students per institution were interviewed, but a closer look at the schools’ actual numbers gathers some support for the claim.

Sixty-five percent of all incoming NYU freshman receive on average of $18,754 directly from the university in form of scholarships and grants that do not have to be paid back. Averaged out across the entire incoming student body, they correspond to $12,190 per person — a 21 percent discount from the estimated 2012-2013 cost

of attendance.

At Columbia University, roughly half of the incoming freshmen are awarded, on average, $40,441 in scholarships and grants, resulting in the average student being awarded $20,000, or a 32 percent discount on the $62,000 sticker price for one year of undergraduate attendance.

Much of the difference can be attributd to each school’s respective endowment, financing roughly four percent of NYU’s annual expenses compared with 10 to 13 percent at Columbia.

“Fundraising for financial aid is the single most important priority of NYU’s development efforts,” NYU director of public affairs Philip Lentz said in an email. “Financial aid has increased by 55.3 percent from 2009 to 2013, more than double the increase in gross tuition and fees during the same period.”

Despite these efforts, the average NYU undergraduate student racks up $36,351 in debt by the day of graduation, compared with the $26,600 national average recorded in 2011. Even in the light of increasing student debt, experts almost unanimously advise young Americans to pursue a college degree rather than relying on a high school diploma.

“For most students … access to high-quality postsecondary education remains the single most important investment they can make,” Archibald and Feldman write in their report, supported by research from Georgetown’s Center of Education.

The research indicates that people with a bachelor’s degree out-earn their peers possessing only a high school diploma by roughly $1,000,000 over the span of their careers, corresponding to an 84 percent premium, up from 75 percent in 1999.

Ken Goldstein, senior researcher at the New York Conference Board, stated that companies now more than ever struggle with finding educated people to employ and strongly advised young students to put down the beer and pick up the book.

“If you try to get out in the workforce in 2012 with only a high school diploma, you’re playing economic Russian roulette,” Goldstein said.

A version of this article appeared in the Tuesday, Nov. 13 print edition. Anders Melin is a contributing writer. Email him at [email protected].