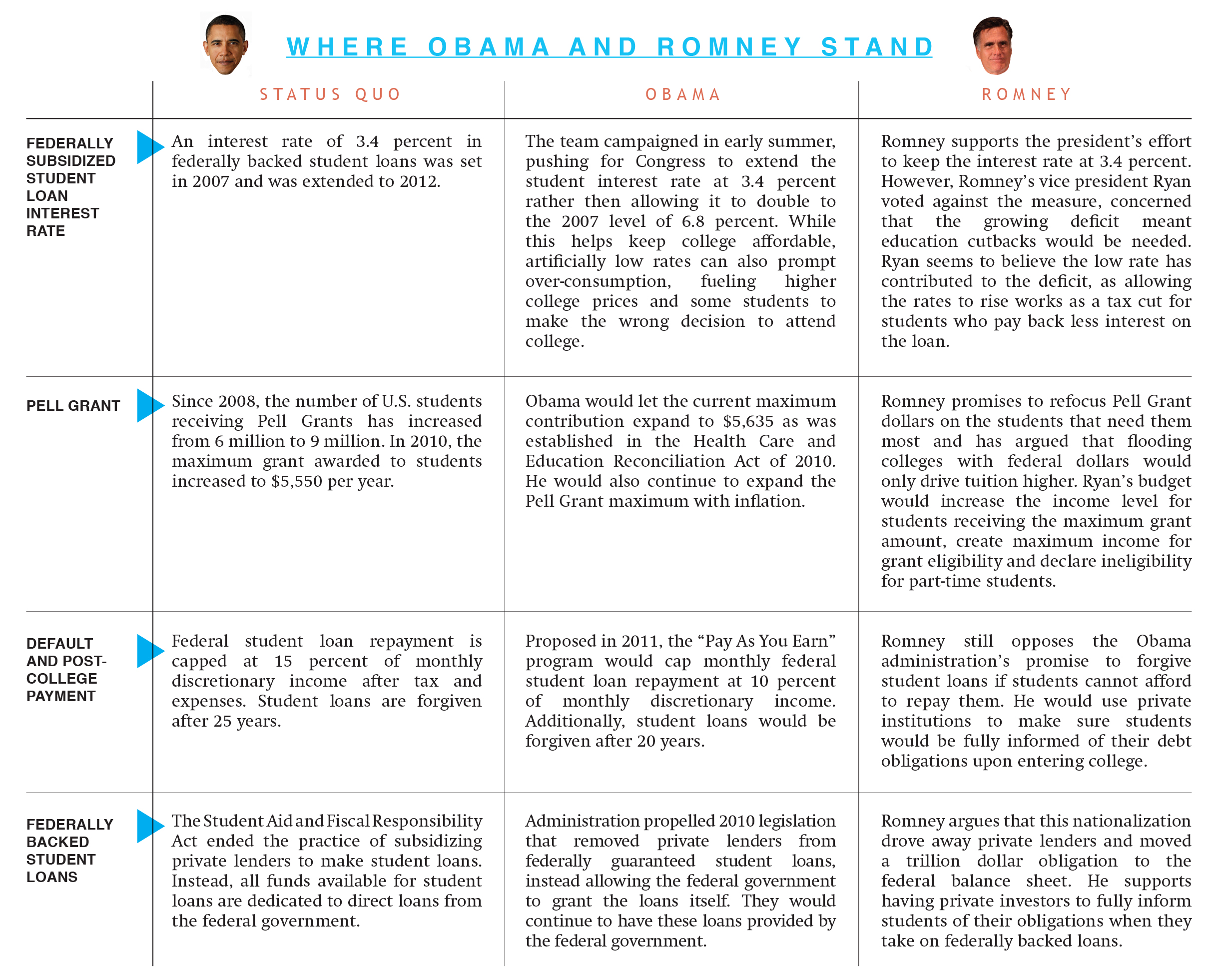

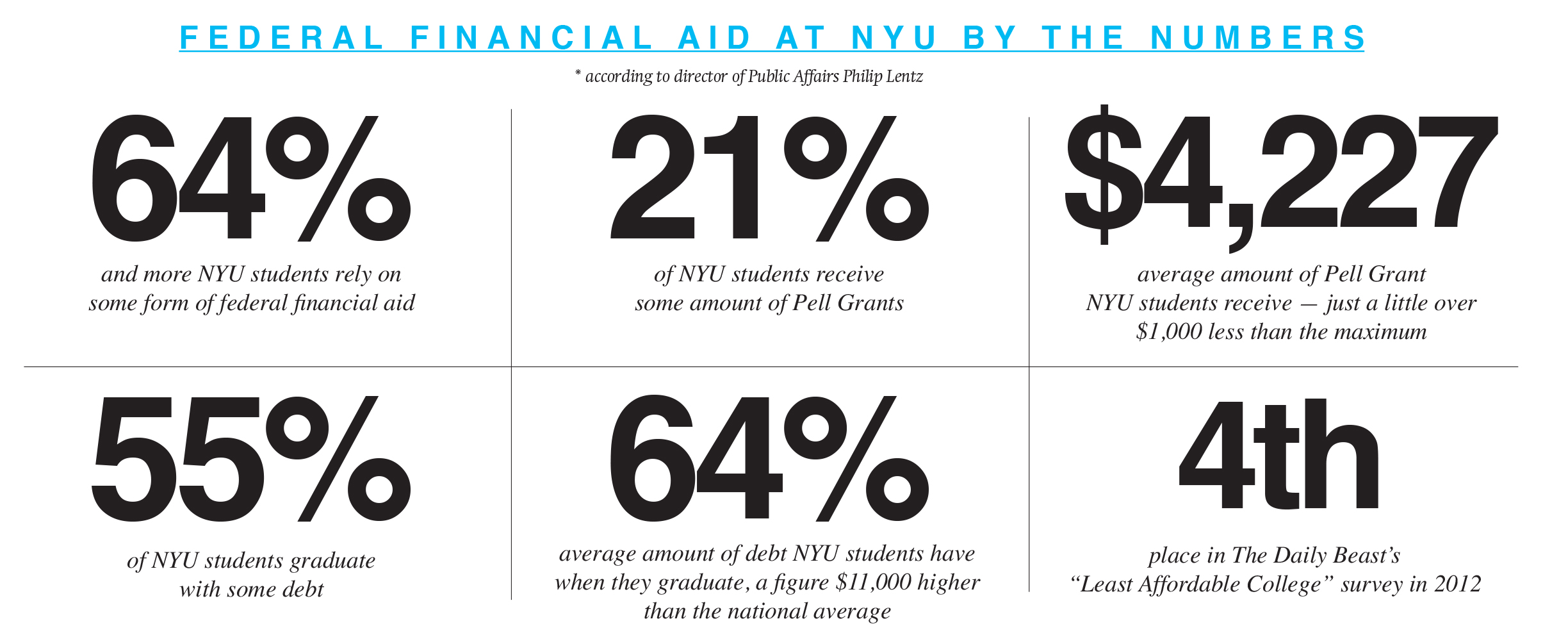

Considering the shaky job market, the continuing battle over health care and the skirmishes among social rights activists, federal student aid seems a minor issue to many voters. But for students, this issue decides their future. There is roughly $902 billion of outstanding student loan debt owed by Americans today, with about $846 billion of that owed to the federal government. The Obama administration has supported the infusion of the federal government into the student debt market, citing the need to continue to relieve students of their debt burdens. However, the Romney camp is concerned that the federal government is accruing more debt than it can pay for and is concurrently distorting the true cost of college.

Definitions:

Pell Grant: Financial aid provided by the federal government to college students based on financial need.

Federally subsidized student loan interest rate: Federal financial undergraduate students based on financial need. The U.S. Department of Education pays the interest for at least half the time a student is in school and the first six months after a student leaves school.

Federally backed student loans: Student loans that are guaranteed by the federal government. They have a lower interest rate than other types of loans, and can be subsidized or unsubsidized.

A version of this article appeared in the Friday, Oct. 26 print edition. Charles Mahoney is a senior editor. Email him at [email protected].