How to find housing as an international student

Under the Arch

How to find housing as an international student

The NYC housing market expects international students to be rich — here’s a guide to offsetting some of the costs.

By Andrea Lui, Staff Writer | March 11, 2025

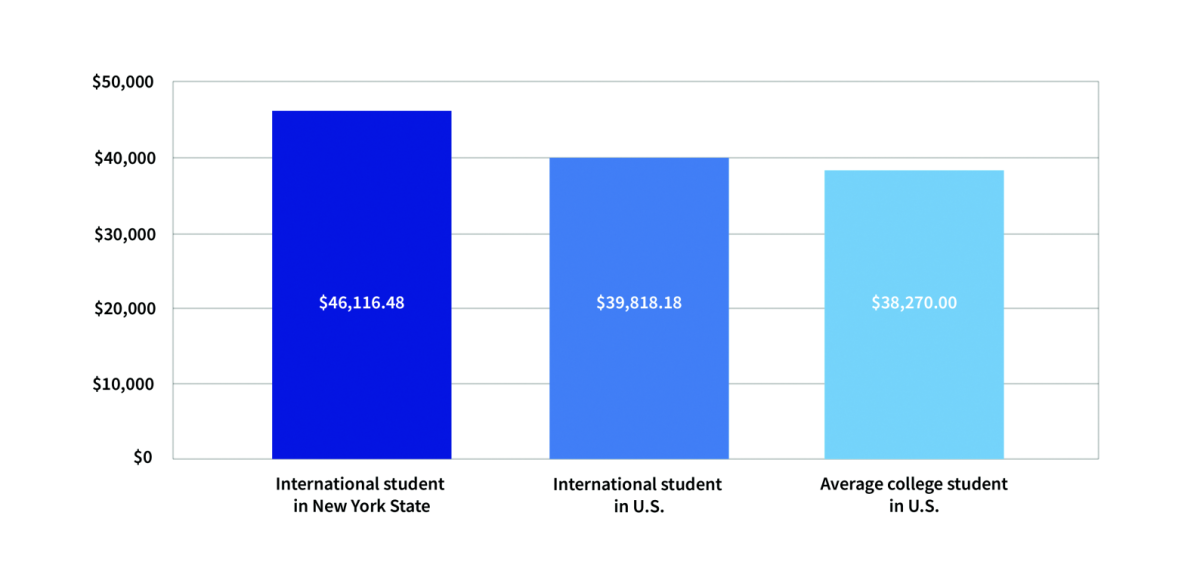

NYU’s international student body — the largest and most diverse among United States colleges — has always been a hot clientele for New York City’s competitive housing market. After all, the combination of deep foreign pockets and a strong demand for student housing often presents attractive marketing opportunities for landlords. However, this isn’t the case for all international students. In fact, their posh reputation makes them prime targets for inflated rental pricing. As a result of the widespread misconception that every international student is reliably affluent, many brokers mark up listings targeted at this demographic. International students tend to pay a roughly 20% premium on annual housing costs compared to their counterparts, as well as spend 14% more than the national average on tuition, accommodation and living expenses if they study in New York state.

The average rent in New York’s international student housing market is $2,075, the highest in the country alongside California. Rents in neighborhoods popular among NYU international students such as Long Island City, Midtown South and the Financial District, have slightly climbed or remained stagnant over the past year, instead of returning to pre- and early pandemic levels.

On top of headwinds from market fluctuations, international students may also have trouble navigating the city’s housing market due to language barriers and a gap in knowledge of required paperwork and payment options. If you’re an international student looking to rent for the first time, it’s important to consult upperclassmen or fellow students from your home country about their apartment hunting experiences.

But if you’re not sure where to start, here are a few tips that could save you some money in the process.

Average annual expenditures of college students in the United States 2023-24

* Each figure includes the cost of tuition, accommodation and basic living expenses

(Andrea Lui for WSN)

Be picky when finding listings

Given how competitive New York City housing is, there are probably just as many search websites as there are prospective tenants. Diversify your search across a few different sources, like StreetEasy and Zillow, but beware of rental scams that seem too good to be true — listers love to prey on international students new to apartment hunting. If a listing asks you to put down a deposit before you even get to tour or apply for the apartment, do not proceed. Never pay for anything without seeing it in person first or having someone see it for you.

International students typically don’t qualify for public housing programs since they require candidates to have citizenship or eligible immigration status. However, rent-stabilized units are a great alternative for those seeking definitively cheaper options with fewer prerequisites. These units — which make up almost half of the city’s housing market — are regulated to a maximum 2.75% renewal increase after a one-year lease and 5.25% after a two-year lease. You can find rent-stabilized units by using a keyword filter on StreetEasy or checking a street address on Am I Rent Stabilized?, available in English, Spanish and Chinese.

For those heading home for a break or about to study abroad, look for a sublease via Ohana — a search website widely used among NYU students in need of temporary or semester-long tenants.

Reduce or wait out broker’s fees

With two federal interest rate cuts predicted for 2025, mortgage rates are expected to have a couple of dips throughout the year, which means rents will ideally decrease, or at least flatline. However, rents may see a small spike this summer because the New York City Council recently passed the FARE Act, a law that mandates landlords cover broker’s fees instead of prospective tenants. While this is a win for renters, the law could cause landlords to roll over broker’s fees into new leases, potentially raising rents, but the overall increase is still unlikely to exceed the standard 12% broker’s fee.

The law takes effect mid-June, so it’s best to pause apartment hunting until then — just in time to secure a place for the 2025-26 academic year. If you need to start a lease before June, try negotiating broker’s fees. Many brokers are now under pressure to close deals before the FARE Act begins, giving you extra bargaining power.

Alleviate guarantor requirements

Unless you have an American roommate willing to guarantee your lease, you’ll almost always encounter issues when applying for an apartment. This is because foreign bank accounts are not usually accepted on rental applications, no matter how wealthy the guarantor is. Landlords primarily look for U.S.-based guarantors from the tri-state area with a strong credit score and annual income of at least 80 times the monthly rent, though high-income Canadians are sometimes an exception. If you don’t have a connection to someone that meets these requirements, you can leverage institutional guarantors like Insurent which is accepted in over 9,000 buildings across the city. You still need to prove to an institutional guarantor that your personal guarantor’s income or total assets are 80 times the rent — but as long as everything is in order, you could get representation in less than an hour from your initial inquiry.

Institutional guarantors charge fees for their services, only adding more to your plate, so it’s always best to turn to as many other friends and family as possible first so you can have a guarantor you know and trust.

Contact Andrea Lui at [email protected].

About the Contributor

Andrea Lui, Culture Editor

Andrea Lui is a junior at the Stern School of Business majoring in Business with concentrations in finance and computing and data science and is minoring...