The Internal Revenue Service is most often associated with collecting taxpayer money, not doling it out. But yesterday, the I.R.S. paid its largest award — a staggering $104 million — to Bradley Birkenfeld, a former banker-turned-white-collar-criminal-turned-whistle-blower from UBS. Because of the crucial information Birkenfeld provided, the I.R.S. was able to recover billions in unpaid taxes.

The I.R.S. revamped its whistle-blower program in 2006 to reward individuals who report tax evaders. However, due to delays in the system, fewer whistle-blowers came forward and less money was collected by the program in 2011 compared to previous years. Birkenfeld’s huge payoff is a promising step towards changing the amount of money the program acquires, as potential whistle-blowers see the concrete benefits of reporting the gross negligence of their companies or clients.

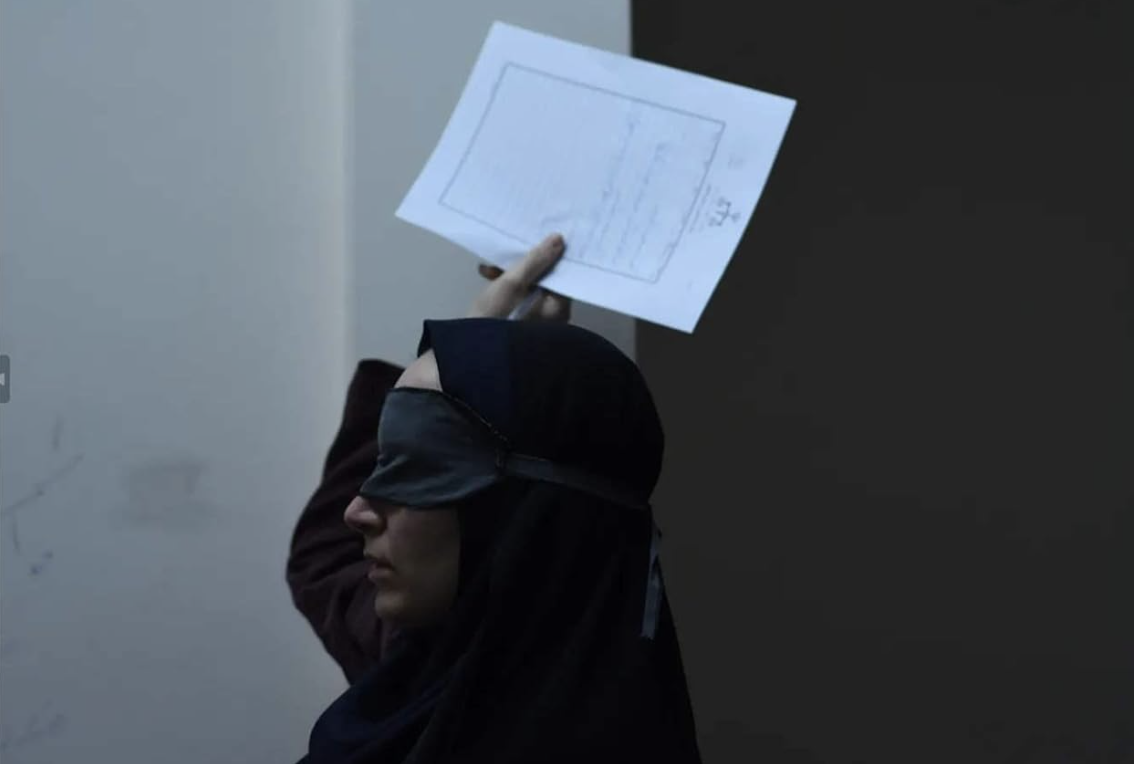

There has been a move by those in power to silence would-be whistle-blowers with financial penalties or even prosecution. The I.R.S.’s action in this case provides an optimistic glimpse for those who report evidence of grave abuse or misconduct. Furthermore, by shining a light into the crevices that banks like UBS use to secure financial windfalls, tax laws already flex their muscular one-size-fits-all policies in an attempt to leave no culprits unpunished.

The program sends a strong message to tax-dodgers: Tax evasion is intolerable and the I.R.S. will use all means necessary to catch those who try to cheat the system. Although awarding informants who sound the alarm on their own illegal activities may seem unjustified, these actions encourage informants to help uncover dirty deals and recollect stolen money. It incentivises truth over power.

The I.R.S.’s move resonates beyond the fight against tax evasion. The program fixes a spotlight on an entire global financial system forced into a paradigm shift towards responsibility and transparency. Concealed trades that over-leverage bank assets and scandals like the LIBOR manipulation are coming out of the woodwork, and this encouragement of whistle-blowing will accelerate the process. Better late than never.

A version of this article appeared in the Sept. 12 print edition. Email the WSN editorial board at [email protected].