NYU Trustees Mentioned In Paradise Papers

December 6, 2017

NYU Trustee Joseph Landy and entities affiliated with Board Vice Chair Laurence Fink and Board Chair William Berkley were mentioned in the Paradise Papers for having offshore funds in Bermuda, a low-tax haven, according to documents released by the International Consortium of Investigative Journalists.

Landy and entities affiliated with Fink and Berkley were implicated in the Appleby leak of the Paradise Papers, which is current through the year 2014. This leak consists of millions of documents leaked to the ICIJ which belonged to the law firm Appleby, which specializes in “offshore legal services” for companies with offshore holdings.

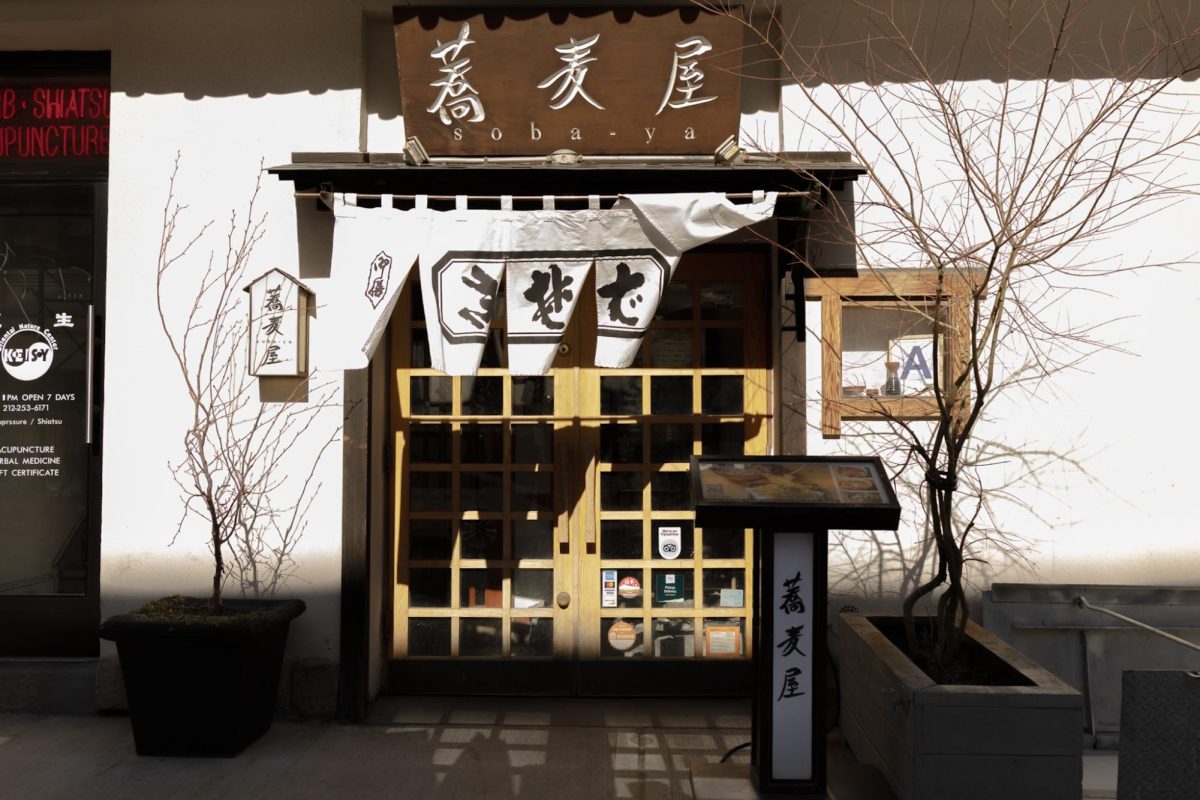

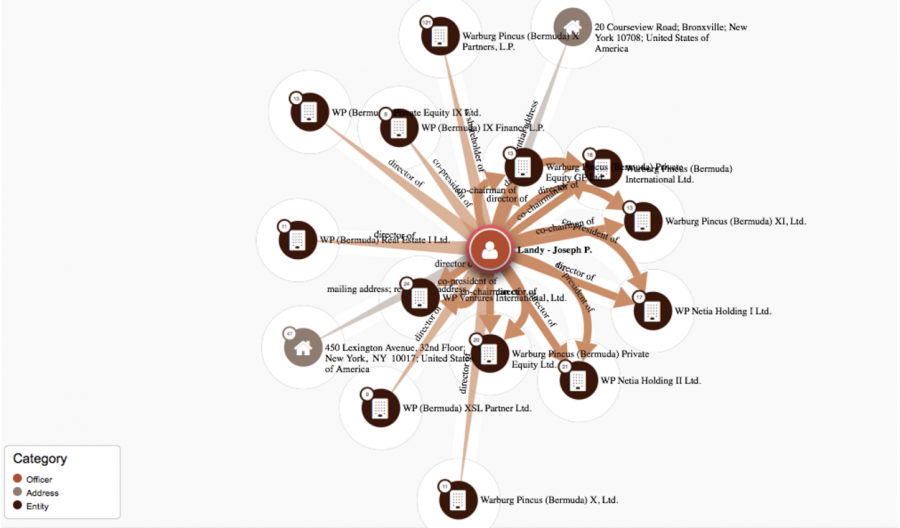

Landy, who graduated from the Stern School of Business in 1996, is the the co-CEO of the investment firm Warburg Pincus, LLC. Landy was connected to 13 offshore entities of Warburg Pincus, LLC in Bermuda. Bermuda does not have a direct income tax or capital gains tax, which targets profits made by investors, and this makes the country a common destination for companies looking to evade taxes.

Landy did not respond for comment.

Screenshot taken of the ICIJ Offshore Leaks Database taken by Caroline Haskins.

Screenshot taken of the ICIJ Offshore Leaks Database.

Fink is the chairman and CEO of BlackRock, an investment management corporation worth over $5 trillion. BlackRock was connected to 10 offshore entities in Bermuda.

According to the Financial Times, a BlackRock entity called BlackRock U.K. Property Fund, which was not in the Paradise Papers, operates as a tax haven for an investment fund by British Members of Parliament. Fink did not respond for comment.

Berkley is the executive chairman of the WIlliam R. Berkley Corporation. The W. R. Berkley Corporation insured Anadarko Petroleum Corporation as recently as 2012 and may still insure it. Anadarko Petroleum Corp. was connected to five offshore entities in Bermuda. Berkley did not respond for comment.

NYU currently invests an unknown amount of money in assets of Anadarko Petroleum Corp. through commingled funds, which are mixed investment funds with the assets of multiple companies.

NYU previously held direct investments in Anadarko Petroleum Corp., but withdrew these investments at an unknown time between 2014 and Dec. 1, when NYU Divest occupied the administrative elevator in the Elmer Holmes Bobst Library. NYU Divest was demanding the university to withdraw its direct investments in Anadarko Petroleum Corp. and Noble Energy, another oil company. A letter from NYU Executive Vice President Martin Dorph, delivered to NYU Divest during the occupation, announced that NYU withdrew direct investments from Anadarko Petroleum Corp. and Noble Energy at an unspecified date.

As reported by NYU Local, NYU was also in the Paradise Papers. As of 2014, NYU held investments in Genesis Limited and Arcadia Associates Ltd., which were implicated in the Paradise Papers for having offshore funds in Bermuda, a low-tax haven.

NYU did not respond for comment.

Correction: Dec. 7

A previous version of this article incorrectly affiliated Berkley Petroleum with William R. Berkley (who is affiliated with Berkley Oil & Gas) and used the phrase “offshore tax evasion” rather than “having offshore funds in Bermuda, a low-tax haven” to characterize the entities affiliated with Trustees Landy, Fink, and Berkley.

Email Caroline Haskins at [email protected].