Inside NYU’s Finances

February 5, 2018

As we all know, NYU has a large endowment. But what not many of us know is that some of those numbers are available to us, through its Form 990 and audits. WSN decided to take a look into the available information. Last year, we did a breakdown of the university’s tax return fiscal year 2015. Though NYU has not released its Internal Revenue Service Form 990 — the Return of Organization Exempt From Income Tax — for the fiscal year of 2016 or 2017, it did publicize an audit for 2016.

The 2016 audit was done by the British accounting company PricewaterhouseCoopers. The audit is available on ProPublica, a nonprofit journalistic organization, together with documents from previous years.

The 99-page document is an assessment of the university’s financial documents from Aug. 31 2015 to Aug. 31, 2016. By comparing the consolidated balance sheets from the two dates, the auditor is able to express an opinion. According to the audit, NYU presented fair documents and the cash flows “ended in accordance with accounting principles generally accepted in the United States of America.”

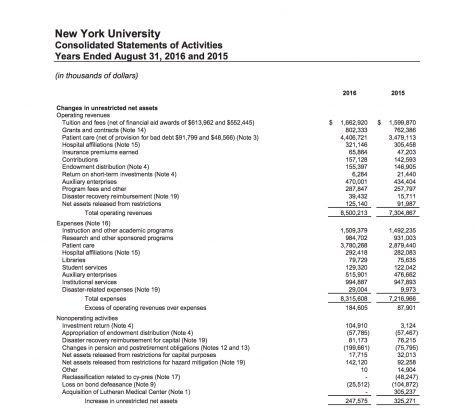

Financial Statements

Different from permanently or temporarily restricted net assets, the unrestricted net assets are “used to carry out its mission of education, research and patient care which are not subject to donor restrictions.”

In 2016, NYU had $8.5 billion in total operating revenues, a 16 percent increase when compared to 2015. Revenue from NYU Langone Health Operations was $4.4 billion, representing a little over 50 percent of that total, representing a 36.6 percent increase in 2016 compared to 2015.

Expenses went up $1.1 billion, and Patient Care was once again the biggest responsible for the change, which cost an extra $901 million in 2016. When considering total expenses, such as research, libraries and student services, total expenses went up by 15.2 percent.

The excess of operating revenues over expenses had a significant increase: almost $100 million, which is a fancy way of saying NYU made a lot of money.

Nonoperating activities — investment return, appropriation of endowment distribution and disaster recovery — added up to $246.6 million, compared to $325.2 million in 2015. This was mainly due to NYU’s merger of what was then the NYU Lutheran Medical Center, now called NYU Langone Hospital—Brooklyn which represented a change of a little over $300 million.

Screenshot by Sam Cheng

Screenshot by Sam Cheng

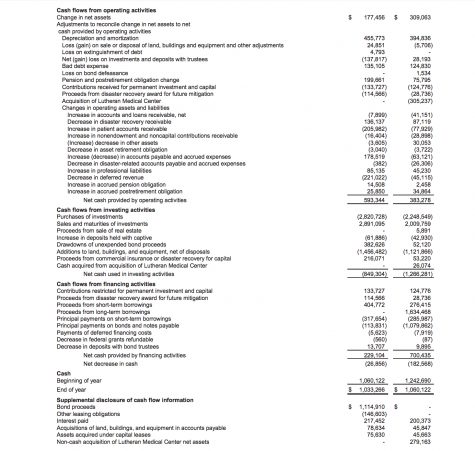

Consolidated Statements of Cash Flows

NYU had a $210 million increase in net cash provided by operating activities. In both years, the money was used in its totality — mainly toward the acquisition of land, buildings and equipment — leaving NYU at a loss and causing the university to use resources from disaster recovery for future mitigation (including payments from long and short term borrowings, among others and in both years, there was a net decrease in cash).

Screenshot by Sam Cheng

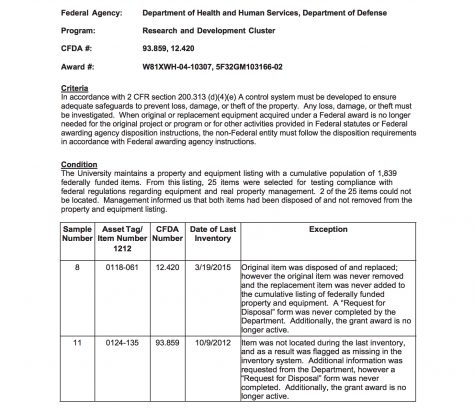

Findings and missing items

PwC selected 25 federally funded items for sampling, to check their compliance with federal regulations.

Two of those items, both related to medical research, presented problems. The first one was bought with funds from a military research grant: “Original item was disposed of and replaced; however the original item was never removed and the replacement item was never added to the cumulative listing of federally funded property and equipment.”

The second is part of a biomedical research and research training grant: “Item was not located during the last inventory, and as a result was flagged as missing in the inventory system.” The audit says both grants are not longer active, and that a Request for Disposal was never completed.

The audit does not express an opinion on the financial position, changes in net assets and cash flows of the individual companies, the effectiveness of NYU’s internal control or the internal control over financial reporting or on compliance.

Screenshot by Sam Cheng

Read more from Washington Square News’ Money feature.

Email Fernanda Nunes at [email protected].