NYU reiterated that it would avoid direct investments in fossil fuels and look to reduce indirect investments in a recent letter to student environmental group Sunrise NYU, after yearslong fossil fuel divestment efforts from the student group.

Over the last few years, the group has garnered thousands of signatures in support of its demands, which originally included that NYU end direct investments in the top 200 publicly-traded fossil fuel companies. Sunrise NYU co-founder Alicia Colomer said the letter showed progress in comparison to a letter penned in 2016, which said the university would be unable to divest from fossil fuels.

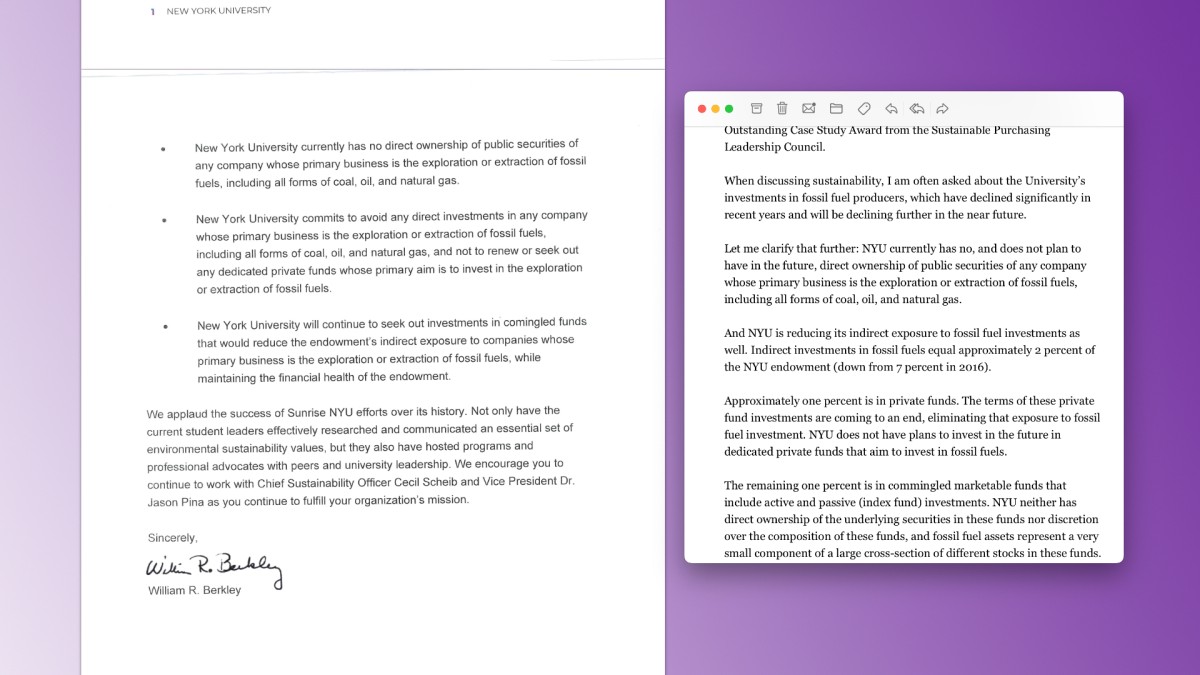

The Aug. 18 letter, written by Chair Emeritus of the NYU board of trustees William Berkley, reaffirmed several objectives announced in a February 2022 email from former university president Andrew Hamilton.

In the letter, Berkley said the university has “no direct ownership of public securities of any company whose primary business is the exploration or extraction of fossil fuels,” and “commits to avoid” direct investments in fossil fuels in the future. Berkley also said that NYU would “continue to seek out” investments that would reduce indirect exposure to companies primarily focused on fossil fuels in its endowment.

In the 2022 email, Hamilton used similar language, saying that NYU “has no, and does not plan to have in the future, direct ownership of public securities of any company whose primary business is the exploration or extraction of fossil fuels.” Hamilton also said the university was “reducing its indirect exposure to fossil fuel investments,” and that indirect investments in fossil fuels made up around 2% of the university’s endowment in 2022.

Berkley’s letter, similarly to Hamilton’s email, did not disclose any timeline on how the university planned to move forward with its divestment commitments. An NYU spokesperson referred WSN to the letter in response to a question about concrete plans for divestment.

According to Colomer, the primary differences between the two statements is that the university recognized the role Sunrise NYU played in pushing for change in the letter, while the role of student activists was not mentioned in the email. Colomer added that Sunrise NYU was content with the letter, and said it addressed all of the club’s demands.

“It doesn’t have an exact timeline, which would be great if they had included it. However, it’s so far ahead of many other schools that have announced divestment,” Colomer said. “NYU is telling us they already have no direct investment in the fossil fuel industry, which already puts them a step ahead in many of their peer schools. Additionally, they have a plan to reduce indirect exposure, whereas a lot of other schools when they announced divestment, they don’t even mention indirect exposure.”

In 2021, Columbia University announced a formal policy for divesting from fossil fuels, stating it does not hold direct investments in “publicly traded oil and gas companies.” In 2015, The New School also announced its decision to divest from fossil fuels.

David Bloomfield, a professor of education leadership, law and policy at Brooklyn College and The City University of New York Graduate Center, said that while he believes the university is taking a step in the right direction with the letter, NYU may also have less evident ties to fossil fuels through its abroad campuses.

“It appears that NYU has a good faith, dual commitment to reducing investments and use of fossil fuels while increasing investments and use of renewables,” Bloomfield wrote to WSN. “This intertwining of interests in the Middle East and China, as well as donors in the U.S. and abroad, does raise questions about conflicts and less obvious relations that may compromise NYU’s promotion of its more visible, positive efforts on climate change.”

Other climate activist groups have also criticized the university’s ties to fossil fuel investments, including through BlackRock CEO Laurence Fink’s position on its board of trustees. Last semester, climate activist group Climate Care Collective NYC gathered outside Bobst Library to demand Fink’s removal from the board due to his investment management firm’s investments in fossil fuels and private prisons. BlackRock is one of the world’s largest shareholders, at $8.5 trillion in assets under management, and is connected to hundreds of millions of tons of greenhouse gas emissions.

Sunrise NYU said while it has worked with clubs that were a part of the protest, removing Fink from the board was not a part of its demands.

Contact Bruna Horvath at [email protected].