Black and Latinx university students may receive worse rates on their loans due to the use of educational data by private companies to establish credit worthiness, according to a recent report from the Student Borrower Protection Center, a nonprofit focused on alleviating student debt.

Institutional practices that result in negative economic results for people from marginalized communities are referred to as educational redlining. The February report showed that the use of educational data in establishing credit rates is hitting Black and Latinx students with extra fees.

Students from community colleges, historically Black colleges or universities, or HCBUs, and Hispanic-serving institutions, or HSIs, are paying more for the same loans, the report indicated. The report compared the cost of loans for a hypothetical student from NYU, a non-minority serving institution, against the cost of loans for hypothetical students from an HCBU or HSI.

Katherine Welbeck — a civil rights counsel for the Student Borrower Protection Center — explained the importance of fair credit practices for allowing loan opportunities.

“Credit really determines so much of people’s economic outcomes and their mobility in our society, credit affects everything from your ability to own a home to your ability to buy a car,” Welbeck told WSN in an interview. “So it seems like when people are outside of mainstream credit markets they’re more prone to using predatory products.”

Credit is established to signal to a loaner the likelihood of the loan being paid back. Education data is thought of by some private companies as a means to provide a broader pool of people — like non-homeowners or people who don’t have credit cards — more options for loans, but the practice has backfired, Welbeck said.

“A lot of companies are thinking about ways to expand access to credit because we have millions of people in our country who don’t really have a credit profile or may not have the best of credit, so they’re not interacting in a mainstream credit market,” Welbeck said.

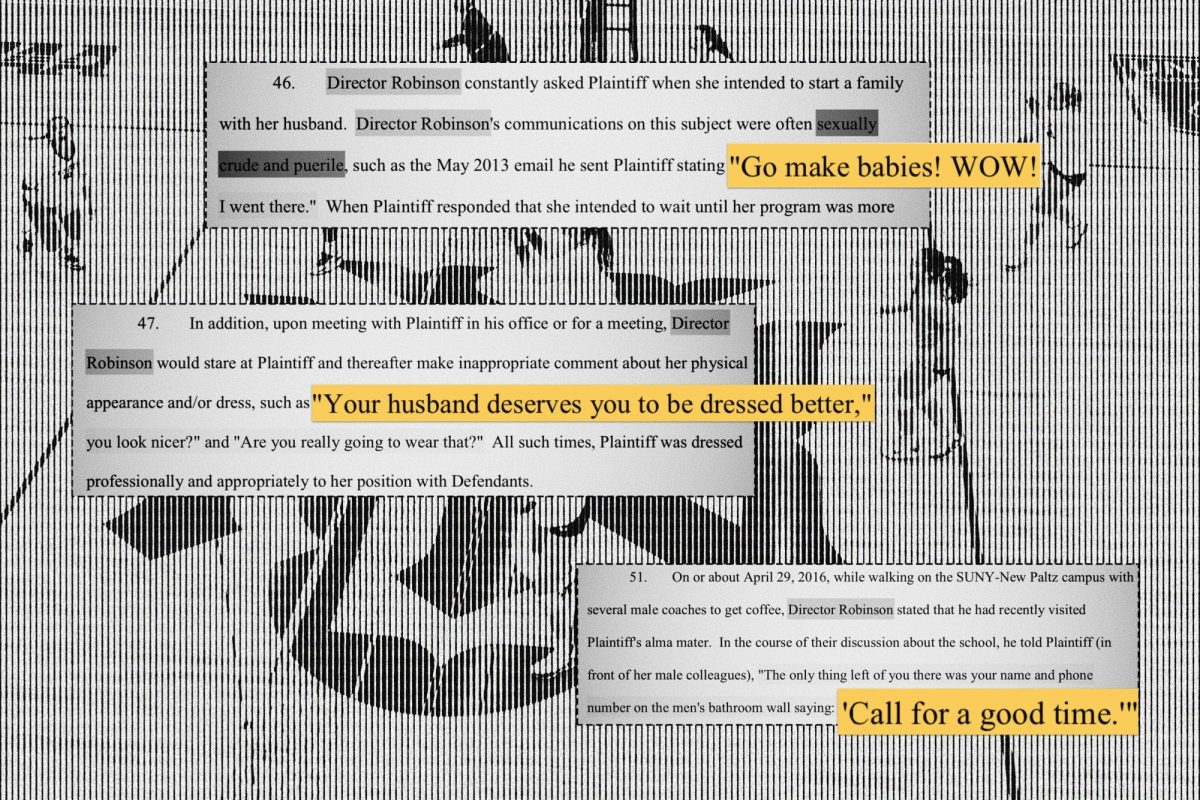

In a case study on Upstart — a private company that advertises themselves using non-traditional data to establish credit-worthiness — the report analyzed the costs of identical hypothetical borrowers seeking to refinance student loans who attended three different universities: NYU, Howard University (an HBCU) and New Mexico State University-Las Cruces (an HSI).

The report found that a hypothetical borrower seeking a $30,000 loan refinancing product with the same major, job and annual income would pay $3,499 more having attended Howard University and $1,724 more having attended New Mexico State University, compared to a borrower who had attended NYU.

The President of Howard University, Wayne A.I. Frederick, said these practices could cause students to enter the job market sooner to start paying off their loan debts rather than pursuing graduate or professional degrees.

“If you look at the comparisons, the endowment of Howard University is less than a billion dollars so our ability to provide institutional need to students is less robust than these other institutions,” Frederick told WSN in an interview. “So to then double down on that and leave them with greater debt is really not fair.”

In the wake of the report, U.S. Senate Democrats, including 2020 presidential candidate Elizabeth Warren, wrote an open letter to Upstart denouncing the use of non-individualized data to establish a person’s creditworthiness.

In response, Upstart outlined the study’s weaknesses in a blog post on their website, claiming the applications submitted were not identical and that out of 26 fabricated applications submitted by report conductors, only three who proved the center’s points were included in the report.

The company maintains that the use of alternative data, such as educational data, expands access to credit across all groups. In 2017, Upstart received a no-action letter from the Consumer Financial Protection Bureau, stating that the Bureau had no intentions of recommending an investigation into the company regarding violations of the Equal Credit Opportunity Act. The company’s independent testing found its credit appraisal process expands access to credit across race, ethnicity and genders by 23%-29%.

“Upstart has responded to the letter from Senator Brown, Senator Warren, Senator Menendez, Senator Booker and Senator Harris,” an Upstart spokesperson told WSN in an email. “We’re committed to demonstrating that Upstart’s use of alternative data, including education, improves credit outcomes for all disadvantaged groups.”

The practice of educational redlining fell into the public eye most notably in 2007, after New York Attorney General Andrew Cuomo spoke out against determining an individual’s credit rate based on their university’s loan default rate, the rate at which students from that university fail to pay back their loans.

Welbeck said that when looking for means to expand credit access, it has to be equitable.

“The user education data is really concerning in our minds because we worry that in trying to expand access to credit, they’re also potentially running a risk of discriminating against borrowers of color, exacerbating income inequality for marginalized communities,” Welbeck said. “Because we know educational access in our country has a history of being exclusionary and limited to people who are able to access education.”

A version of this article appeared in the Monday, March 2, 2020, print edition. Email Emily Mason at [email protected].