What to expect with your off-campus apartment search

Under the Arch

What to expect from your off-campus apartment search

Finding an apartment in New York City may feel impossible, but here are some how-tos and tips to relieve any stress.

The WSN Management Team | April, 25, 2024

Securing an apartment in New York City can be a burdensome and daunting task. Finding your way through a competitive — and expensive — real estate market can be intimidating, especially after living in a college dorm. This guide will equip you with the knowledge and strategies to navigate the labyrinth of apartment hunting in New York City, from filtering online listings to understanding the intricacies of broker fees and guarantors.

Navigating the initial search

Finding an apartment is the obvious first step when moving off campus, and can often be the most time-consuming. Sometimes, the best way to go about finding a place is putting out or answering a call for a roommate — you’ve all seen the Instagram stories. But if you want to live alone, you’ll need to approach it a bit differently.

Websites like StreetEasy or even Zillow can filter for preferences to give you a general idea of the space. This can at least help you avoid spending an afternoon at an open house, only to learn the listing is not what you expected.

The filters on these websites are far more specific than what you might expect. You can filter by listing and building amenities, proximity to subway lines or even move-in dates. There’s a feature that allows you to categorize certain amenities as necessities, and others as wants. You can legitimately curate your search, which will save time and money.

One month ‘free’ rent policy

If you scroll through any New York City rental website, you’ll probably be overwhelmed by a barrage of listings offering a month of free rent, typically in the last month of your lease. So, if by some miracle you are able to find a place in the West Village for $1,500 a month, the landlord might offer one month for free to “sweeten the deal” or act as what they might call a “concession.”

While this offer may present itself as an appealing no-brainer, it’s just another one of those gimmicks landlords and websites like to dangle in front of prospective renters like gift cards and negotiable broker’s fees. You’re going to be told you’ll be paying $1,500 per month over your lease, but what that really means is that you’re paying 1,625 a month for every other month except for the free month.

Someone to back you up

Minimum income requirement is a barrier for renters in New York City. To rent an apartment, the renter themselves need to show proof that their annual income exceeds 40 times the monthly rent. If the monthly rent is $2,500 per month, then the renter needs to make at least $100,000 a year to satisfy the requirement. In the case of most undergraduate students who do not have a full-time job that would generate enough income, renting with a personal or institutional guarantor becomes another available options.

A guarantor is a person who can ensure that they will pay your rent in the case that you do not. The minimum income requirement for a guarantor is 80 times the monthly rent — double that of what the renter would need by themselves. If the monthly rent is $2,500 per month, a guarantor needs to make at least $200,000 a year to qualify. For undergraduate students, their guarantors are often older family members or family friends. Sometimes, landlords prefer guarantors who reside in the tri-state area — that is, in New York, New Jersey or Connecticut.

For international students or students without a family connection around school, an institutional guarantor is also an option. The most commonly used institutional guarantor services in New York City are Insurent and TheGuarantors. Institutional guarantors usually provide services for the equivalent of about a month’s rent, with some requiring pre-paying along with security deposits.

All that said, it is better to ask family, friends and trusted acquaintances to see who could potentially qualify as your guarantor. Ask them if they would be willing to share their pay stubs if they are an employee and tax returns if they are retired or self-employed. Double-check with landlords and real estate agents to see whether they have preferences on using guarantors in general, the type of document to prove income or using institutional guarantors.

On the other hand, renting with suitemates or roommates can drive down the monthly rent, which makes it easier to find a guarantor who can qualify for the requirement. Most landlords renting multiple bedroom apartments are willing to take different guarantors for each of the renters in the unit.

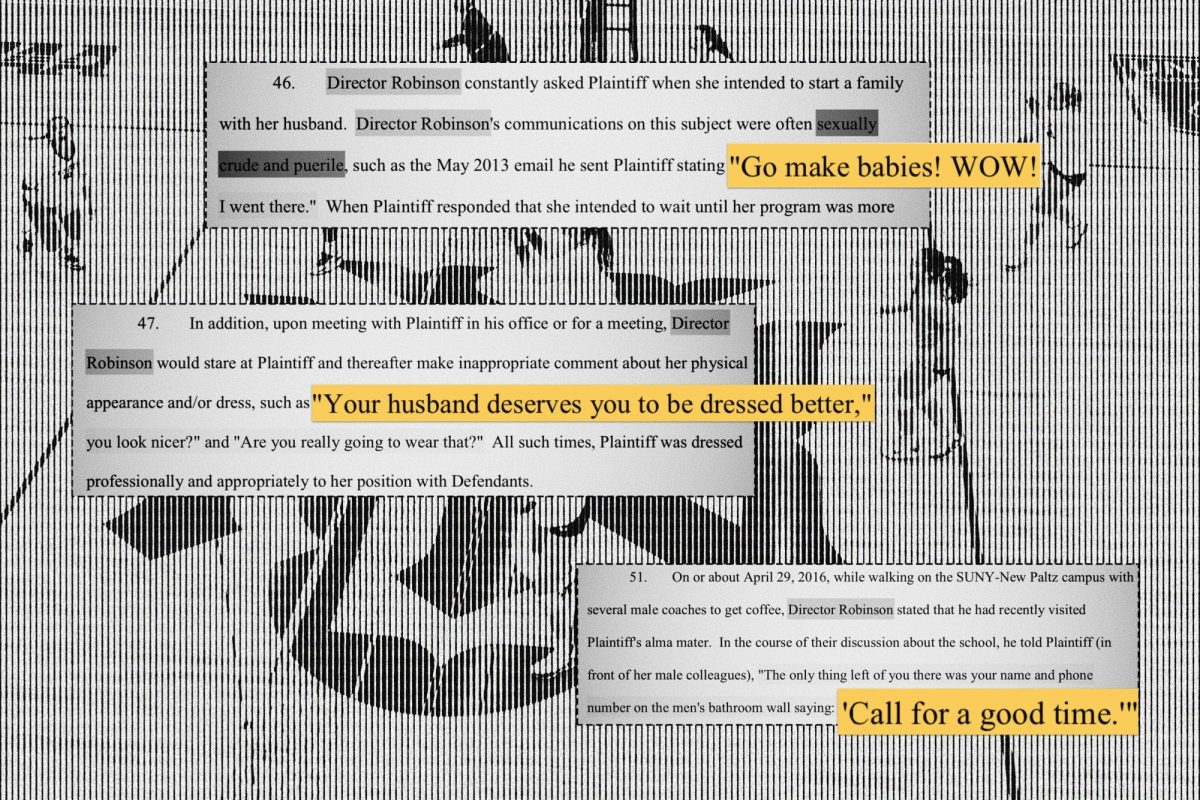

The sneaky broker’s fee

Renting in New York is expensive. But when you first rent an apartment, there’s more to your first payment than the first month’s rent and security deposit. The broker’s fee — which is around 10-15% of the annual rent, or around two months rent — is paid to the agent, or broker.

Broker’s fees are negotiable, though it’s worth noting that if it’s a popular listing, you may lose out on the apartment to someone who is willing to pay the agent’s desired amount. There are also no-fee apartments, where the landlord pays the fee for their broker, but if you find that apartment through a separate agent, then you would still need to pay them their fee. If there are two brokers between the seller and the buyer, then they split the costs between themselves — it isn’t double the fee.

More than a roof and walls

Utilities are an important aspect to consider when budgeting for your new apartment. By understanding what’s typically included in the rent and what you’ll be responsible for, you can avoid surprise costs. In most New York City apartments, landlords are required to provide heat and hot water. It’s always a good idea to double-check your lease agreement to confirm what’s covered. You’ll likely be responsible for setting up and paying for your own electricity bill, and possibly gas if your apartment has a gas stove or oven. Wi-Fi is a separate expense altogether and is usually a fixed monthly rate. Be sure to ask your landlord or building manager which utility providers service the building so you can set up accounts in your name.

Electricity bills can fluctuate depending on the season and your usage. Research average costs for your desired neighborhood to get a ballpark figure. Factor in the cost of cooking with gas, if applicable, and Wi-Fi to get a more accurate picture of your monthly utility expenses. This will help you determine how much to allocate in your overall budget for a comfortable off-campus living experience in New York City.

Making sure you don’t pay even more

When you first choose to move into an apartment, there will be a lot of things you don’t think about ahead of time. You won’t know how to move all of your things to a different borough, how much exactly your utilities bill will cost, how to fix your ever-dysfunctional fan or what to do when a part of your kitchen counter is mysteriously missing when you move in.

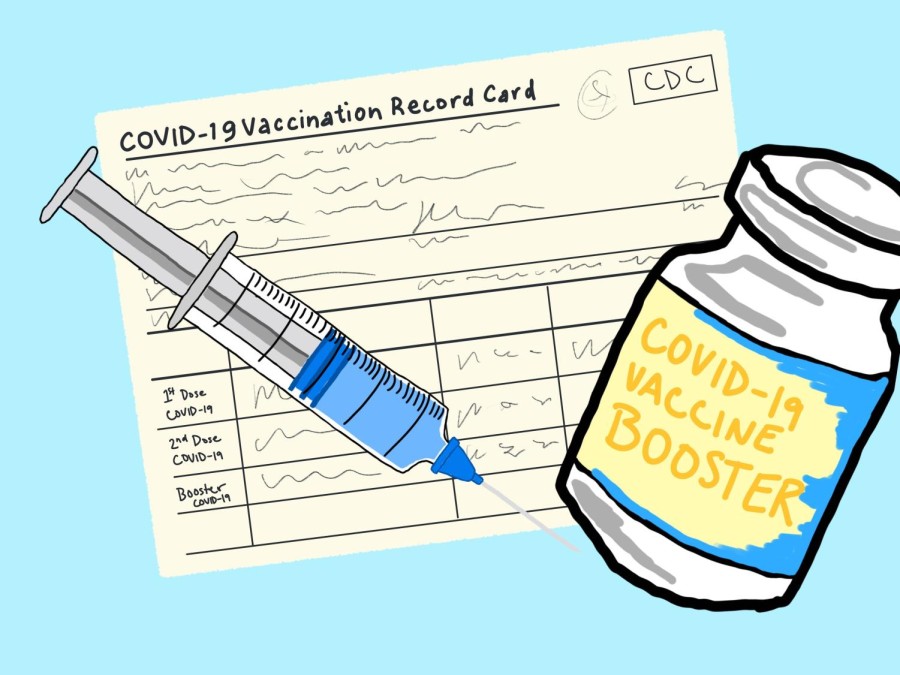

One thing you can get ahead on is purchasing renter’s insurance as soon as possible, preferably before you even open your apartment’s front door. You might think you’re invincible and that you have no need for renter’s insurance; surely you must be impervious to fires, injuries, leaks, flooding, theft and any other apartment-related maladies you can think of.

Even if you think the odds of something happening to you or someone else in your apartment are low, renter’s insurance is a good enough deal that it is definitely still worth getting. While monthly costs and total coverage varies by carrier and insurance plan, you can usually get around $50,000 in coverage for a monthly fee of around $18. With renter’s insurance, if disaster strikes in your apartment, it won’t be on you to pay for the damages.

To anyone out there roaming the world without renter’s insurance: Please make the investment, it might just save you from having to pay a nightmarishly large bill.

New York City is one of the most unaffordable places to live. Adding all the aforementioned costs together — along with the time and effort you would spend in seeking and securing the apartment — you should consider if the cost of renting in New York City is a worthy endeavor for you. Renting an apartment allows you to tailor your living situation to your needs, but it does come at a price. Explore options in different neighborhoods at different times of the year to maximize your chances of finding a good place at a good price. Remain diligent and vigilant at apartment-hunting and, hopefully, you can find your ideal New York City apartment.

Contact WSN Management at [email protected]

Alisia Houghtaling is a first-year in Applied Psychology in Steinhardt and one of WSN's Illustration Editors. In her freetime, you can find Alisia drawing,...