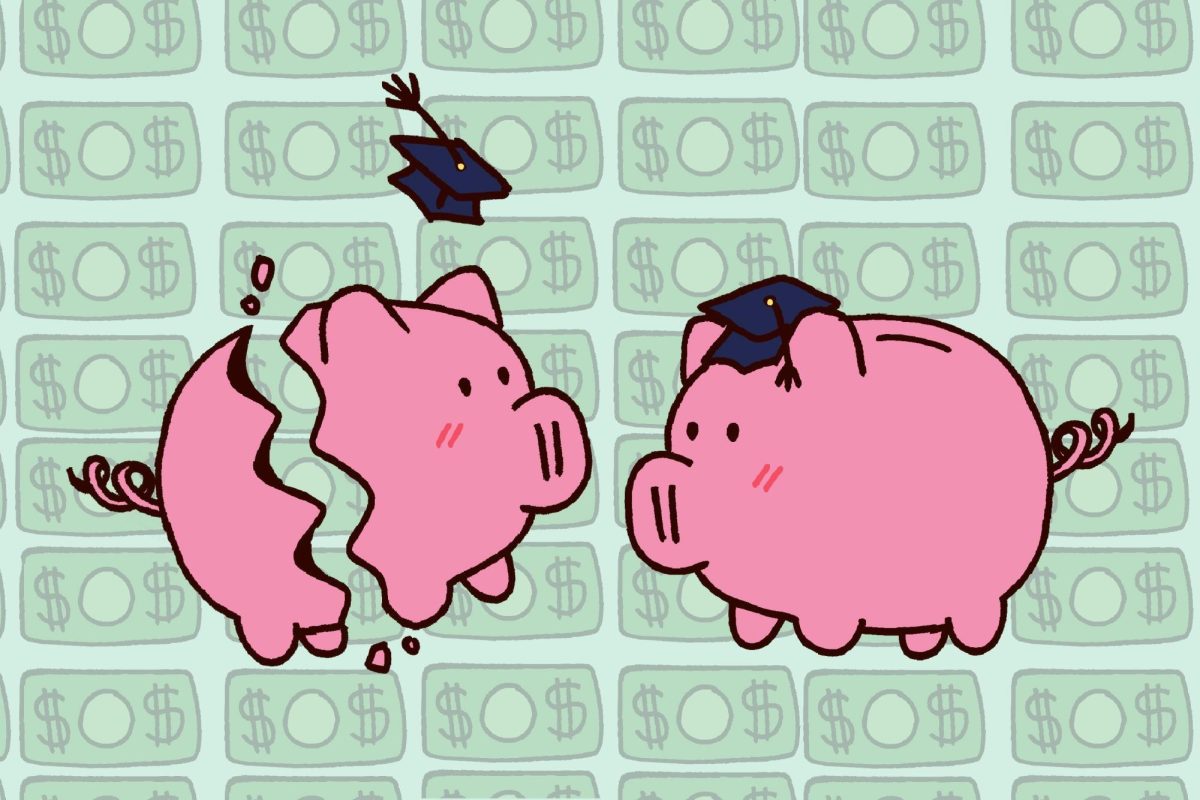

In 2025, rising costs and student debt challenge Gen Z’s approach to money in the U.S. Born between 1997 and 2012, these young adults must adapt to a dynamic financial landscape shaped by evolving lending trends. High costs strain budgets, while traditional banks often fail to meet their needs and have quite strict requirements. We’ve analyzed how Zoomers handle their finances, given today’s economic issues, changing loan rules and new banking habits.

Gen Z Economy: High Costs and Unstable Income

The economy for Generation Z is expected to remain challenging this year. Students often spend nearly half their income on rent, which doesn’t leave much for basics like food, transport or healthcare. As a result, nearly 45% of Gen Z expats had left the country because of high living costs.

Side gigs offer flexibility for young workers, but the inconsistent pay messes up their budgets. Gig platforms often take weeks to pay, which complicates financial planning.

Because income can be unpredictable, many young adults have to work multiple gigs, which can make their financial situation worse. According to a 2025 survey, 41% of Gen Z run out of money each month, and only 22% consider themselves financially stable. These challenges highlight the difficulties of managing personal finance in a volatile economy.

How Gen Z Builds Financial Habits

To handle financial issues, students are improving their financial management. Budgeting apps like YNAB, EveryDollar and PocketGuard are commonly used by Gen Z as they are quite helpful when it comes to changing paychecks from freelance jobs. Social media also affects the way young people manage their finances, with influencers giving tips on budgeting and investing.

When it comes to savings, young people find it difficult to set money aside when income changes, especially with complex taxes on side jobs. Gen Z often directs gig earnings toward bills or debt, but the unstable cash flow makes planning difficult. Many now rely on saving money tools like Mint and Acorns to stay mindful of their finances.

Speaking about extra financing, Zoomers often seek innovative financial products with flexible payment structures to match unsteady income. However, many loans have strict requirements misaligned with variable earnings. Gen Z’s financial habits demonstrate resilience, but systemic barriers remain. By going to online groups and getting advice, young people are learning to handle their finances so they can be independent later in life.

Ways Gen Z Manage Their Debt and Savings

In 2025, student loan debt averages $39,075, a 20% increase from 2022. At least 56% of young adults have credit card debts, with an average outstanding balance of $3,456 in 2024. However, Zoomers show the lowest credit card debt among generations.

High rent strains Gen Z’s income, while unexpected costs, including medical bills or car repairs, drain reserves. Social pressures to spend on dining or travel further limit funds for emergencies. Growing debt results in stress, shifting focus from long-term planning to immediate survival.

Rising borrowing balances delay major milestones, such as homeownership or starting a family. All this also results in savings challenges. Building a nest egg becomes an inconsistent practice for Gen Z, regardless of their proactive and tech-driven approach. Surveys show that only 15% of young people put a set percentage of their income toward savings.

Gen Z Credit Cards and Banking Trends

Young adults prefer digital banking for its low fees, rapid transfers and convenient bill-splitting features. They rely on online reviews to select user-friendly apps. Many opt for credit cards tailored to their age group to establish a good credit history that will improve their financial lives down the road. Among generations, Gen Z holds one of the lowest credit ratings, though still within the good range.

Establishing a robust credit history requires years, and limited credit profiles often holds Gen Z back from obtaining traditional loans, housing or employment in competitive markets. This gap frequently drives young adults to alternative online lenders for additional financing to address personal finance needs.

“While our company assists young adults with loans for urgent needs, we prioritize educating them on responsible borrowing and debt management to foster sound financial habits and underscore the importance of meeting obligations,” says Latoria Williams, CEO of 1F Cash Advance, emphasizing accountable use of online lending solutions. “Everyone thinks it’s so simple to reach goals with other people’s help. But if you want to be indeed satisfied with the final results, you have to shoulder your own responsibility in this process and do your best to achieve the desired goals,” she adds.

Evolving Lending Trends: SAVE, RAP, and Beyond

Gen Z is facing more challenges with tougher loan rules. The SAVE plan, impacting 8 million borrowers, paused payments for six months from October 2024 due to legal disputes. Interest resumed in August 2025, adding hundreds annually to balances. By July 2026, SAVE will transition to the Repayment Assistance Plan (RAP), potentially requiring 30 years for debt forgiveness. This shift burdens young borrowers with decades of payments amid rising costs. Federal financing caps, such as $20,500 annually for graduate students, drive many to private lenders with rates up to 15%.

Private borrowing options carry risks due to variable rates and unclear terms. Aggressive online ads targeting young people add complexity. Banks now check credit using factors like credit mix, payment history, credit utilization and length of credit, which means people with limited credit profiles find it difficult to access financing. All this can make it harder for students to manage their money.

Yet, even with financial stress, young adults are doing well. They keep track of their loans, focus on what they need and use free education from schools or charities. Online resources, including podcasts and guides, help students build Gen Z money habits for smarter budgeting and debt management. By picking the right loans and avoiding bad ones, young adults can build a secure future. Planning, saving smart and making good choices help this generation overcome financial difficulties and become independent in the long run.