Continued from Student loan debt continues to soar (Part 1)

Robert Wosnitzer, a doctoral candidate in Media, Culture and Communication, said that nowadays students are choosing between getting loans or not getting an education.

“I believe there should be a state response to the problem,” Wosnitzer said.

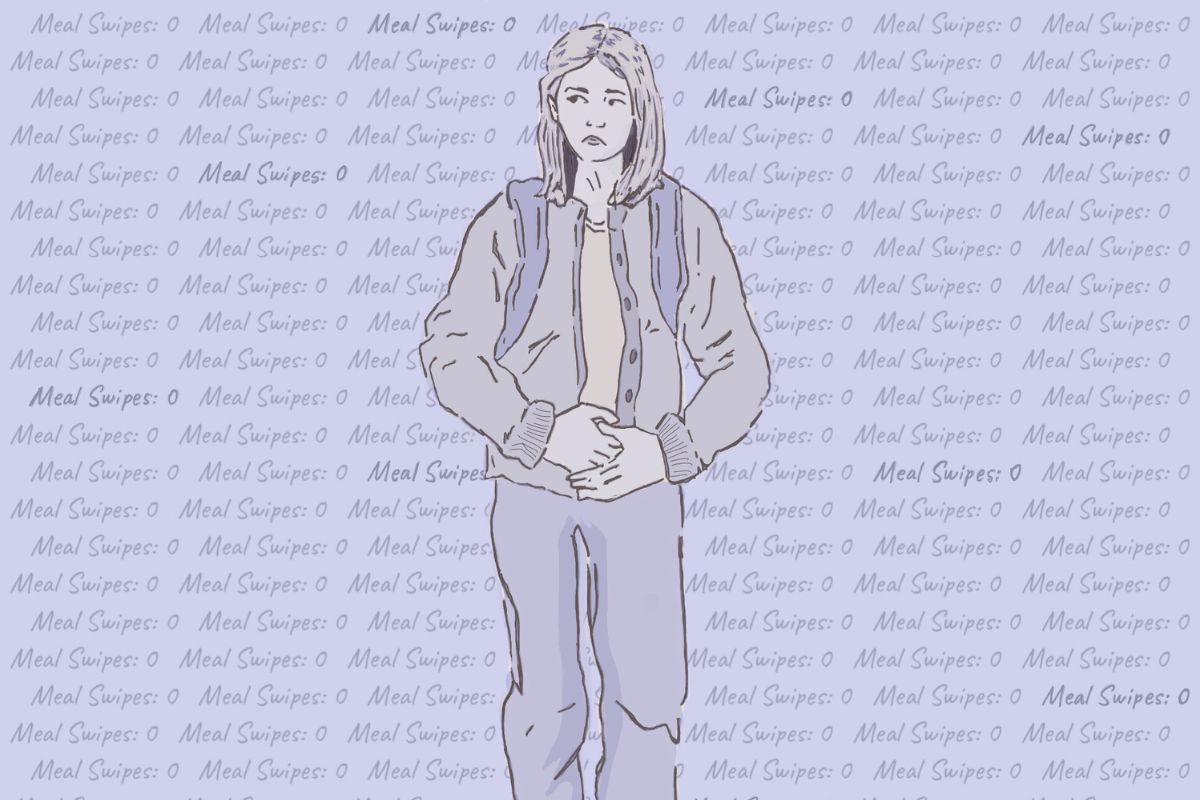

Randy Martin, a Tisch professor, said there is also the social impact of a high student debt.

“When we look at the overall capacity of an economy that generates over 14 trillion [dollars] a year, forgiving debt that is roughly one half of one percent of that total certainly seems possible,” Martin said. “The larger question, perhaps, is the cost to society of living with an increasingly indentured population.”

What can student borrowers do? Although there may come a day when the federal government will take college students under its wing, student debtors are still bound by law to pay off their loans, no matter how grueling the process might be.

“I think it’s impossible to [save up] if one is in a position to take out student loans,” Wosnitzer said. “And many people forget that unemployment is at a record high for people under the age of 25.”

For now, saving could be the good old-fashioned way of preparing for a rainy day.

“I do think that it’s important to build personal savings in order to prevent the need to take out more loans in the future or at least reduce the size of those loans,